We are living in uncertain times, but there’s one thing Canadians can be certain about: the strong and steady performance of CPP Investments. The investment manager for Canada’s largest pension fund has been recognized by industry experts for having among the highest returns over the past decade when compared to global peers.

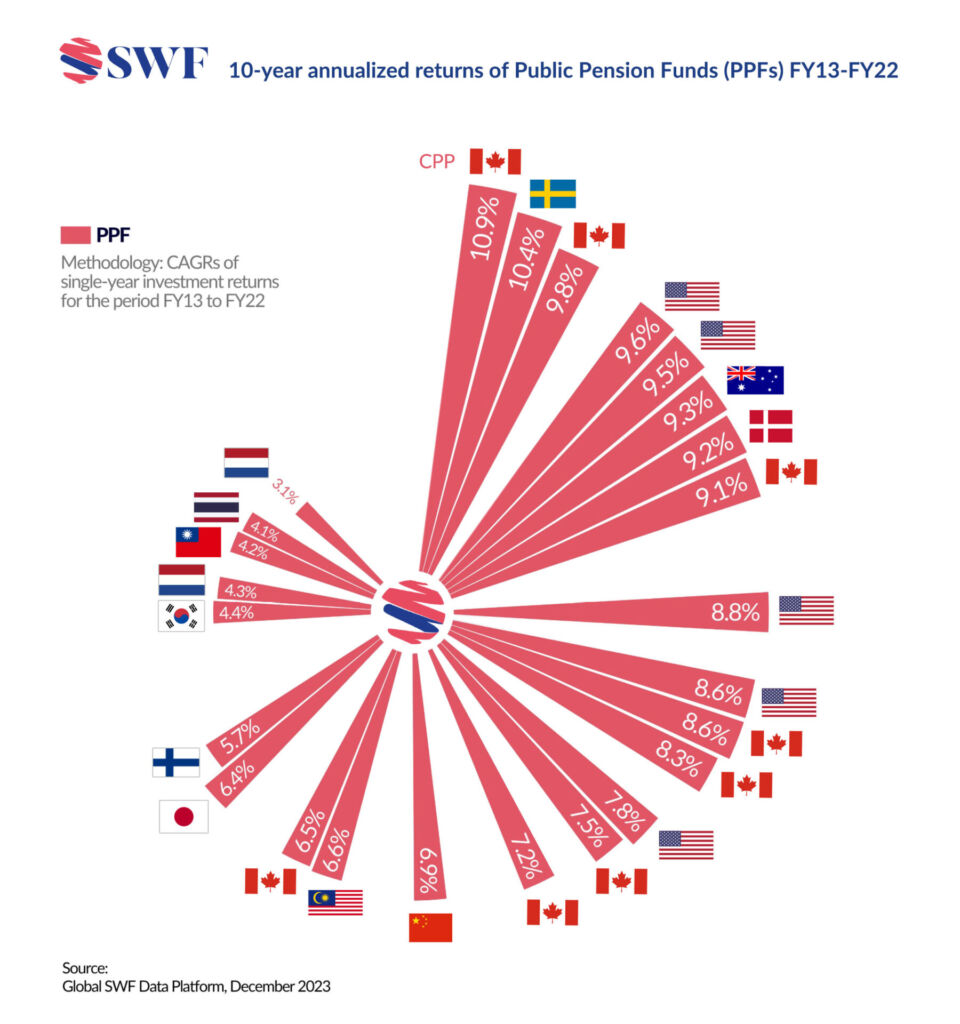

Global SWF, a New York-based pension industry specialist recently released its 2024 Annual Report, which measured 10-year returns for sovereign wealth funds and public pension funds. With a 10-year annualized rate of return of 10.9% from fiscal 2013 to 2022, CPP Investments ranked first among national pension funds, and second only to New Zealand Superannuation Fund and national institutional investors.

The report highlights various fund dynamics and industry trends, including how Canadian funds – such as CPP Investments – are highly focused on investing in their home market of North America. In addition, CPP Investments was lauded in the report for participating in co-investments, an investment style well-known to Canadian funds, as a way of gaining direct exposure. “CPP [Investments] is by far the most active, but others are catching up rapidly.”

Learn more about how CPP Investments has been recognized among leading global pension funds.