Happy 50th Birthday CPP!

January 1, 2016 marked the New Year and also a special milestone for Canadians: the 50th anniversary of the establishment of the Canada Pension Plan (CPP).

Created in 1966 during a period of increasing focus on social security, the underlying goal of the CPP was to help ensure all workers in Canada would have a minimum level of financial security in retirement. The CPP also provides income support through disability, death, survivor, children’s and post-retirement benefits for eligible contributors and their families. In the most recent reporting period, 5.2 million people in Canada received $37.3 billion in benefits from the CPP.

The CPP is highly praised in Canada as one of our strongest national federal-provincial programs, and is widely credited for helping to reduce seniors’ poverty. Statistics Canada data shows a dramatic 25% decrease in the poverty rate among Canadian seniors over the past four decades, from 36.9 % in 1976 to 12.3 % in 2010 – a decrease largely attributable to the establishment of the CPP and, in Québec, the Québec Pension Plan, according to a report by the Conference Board of Canada.*

The Plan is also admired around the world. Few countries with comparable programs can expect the same level of public confidence today on what is arguably the most critical criterion for any such program – that it is sustainable over the longer term.

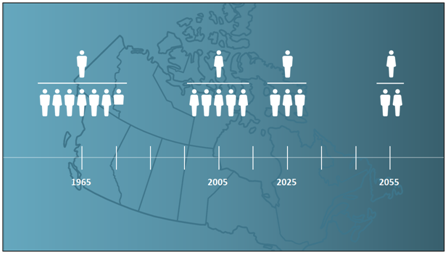

Since it began in 1966, the CPP has continually adapted to social and economic changes in order to respond to the evolving needs of Canadians. Established as a ‘pay-as-you-go’ plan where current workers would pay for current retirees, the approach worked well initially, with more than enough contributors at the time to fund pension payments to beneficiaries. But by the late ’60s and onward, certain important demographic changes began to challenge the CPP’s ability to continue paying pensions in the long run.

Most important among these changes was the advent of the birth control pill which led to declining fertility rates and smaller families, a trend that continues today. People were living longer, as life expectancy in Canada continued increasing by three months every year. Other changes included more women joining the workforce and immigration levels increasing over time. When taken together, these changes had significant impacts on the expected ratio of inflows to and payments from the CPP fund. The demographic facts confirmed it: with a significant decrease in the number of CPP contributors relative to beneficiaries (referred to as the dependency ratio) the CPP would not be able to continue paying pension benefits in the long term unless changes were made.

As a result, in 1997, the federal and provincial governments took two important steps—they increased CPP contribution rates and they created the Canada Pension Plan Investment Board (CPPIB).

Operating independently of the CPP and at arm’s length from the government, CPPIB invests the CPP fund to help ensure its long-term sustainability. To date, CPPIB has added more than $160 billion in net investment income to the CPP fund. At almost $273 billion, more than half of today’s CPP fund is composed of investment income.

Canada’s Chief Actuary releases a report every three years on the sustainability of the CPP. The latest report filed in December 2012 confirms that the CPP will be able to continue paying pensions to Canadians for at least the next 75 years.

Fifty years after its creation and as a result of the 1997 reforms, the CPP continues to stand the test of time, supporting the retirement security of 19 million contributors and beneficiaries in Canada today and those in the generations to come.

* “Elderly Poverty”. How Canada Performs: A Report Card on Canada. The Conference Board of Canada, 2016. (Accessed January 2016).

http://www.conferenceboard.ca/hcp/details/society/elderly-poverty.aspx

Article Contacts

FOR MORE INFORMATION CONTACT:

CPPIB

Dan Madge

Senior Manager, Media Relations

T: +1 416 868 8629

dmadge@cppib.com