All figures in Canadian dollars unless otherwise noted.

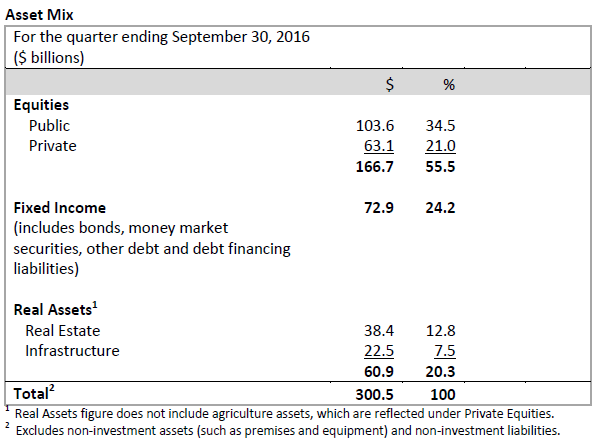

TORONTO, ON (November 10, 2016): The CPP Fund ended its second quarter of fiscal 2017 on September 30, 2016 with net assets of $300.5 billion, compared with $287.3 billion at the end of the previous quarter. The $13.2 billion increase in assets for the quarter consisted of $13.6 billion in net investment income after all CPPIB costs, less $0.4 billion in Canada Pension Plan (CPP) cash outflows. The CPP Fund routinely receives more CPP contributions than required to pay benefits during the first part of the calendar year, partially offset by payments exceeding contributions in the final months. The portfolio delivered a gross investment return of 4.83% for the quarter, or 4.75% net of all costs.

For the six-month fiscal year-to-date period, the CPP Fund increased by $21.6 billion from $278.9 billion at March 31, 2016. This included $17.7 billion in net investment income after all CPPIB costs and $3.9 billion in net CPP contributions. The portfolio delivered a gross investment return of 6.4% for this period, or 6.3% net of all costs.

“All investment departments contributed to the Fund’s overall performance this quarter with solid gains across public and private markets,” said Mark Machin, President & Chief Executive Officer, Canada Pension Plan Investment Board (CPPIB). “Longer-term returns demonstrate the prudence of our disciplined investment strategy to help sustain the Fund over multiple generations.”

Long-Term Sustainability

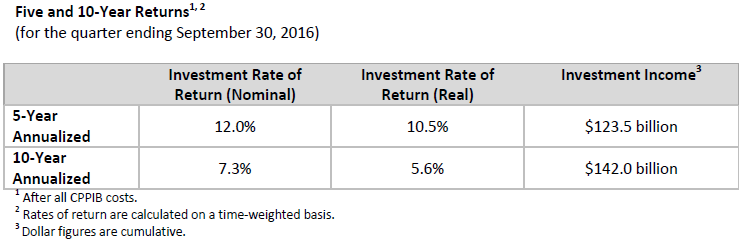

The CPP’s multi-generational funding and liabilities give rise to an exceptionally long investment horizon. To meet long-term investment objectives, CPPIB continues to build a portfolio and to invest in assets designed to generate and maximize long-term, risk-adjusted returns. Accordingly, long-term investment returns are a more appropriate measure of CPPIB’s performance than returns in any given quarter or single fiscal year.

In the most recent triennial review released in September 2016, the Chief Actuary of Canada reaffirmed that, as at December 31, 2015, the CPP remains sustainable at the current contribution rate of 9.9% throughout the forward-looking 75-year period covered by his report. The Chief Actuary’s projections are based on the assumption that the Fund’s prospective real rate of return, which takes into account the impact of inflation, will average 3.9% over 75 years. CPPIB’s 10-year annualized net nominal rate of return of 7.3%, or 5.6% on a net real rate of return basis, was comfortably above the Chief Actuary’s assumption over this same period. These figures are reported net of all CPPIB costs to be consistent with the Chief Actuary’s approach.

The Chief Actuary’s report also indicates that CPP contributions are expected to exceed annual benefit payments until 2021, after which a small portion of the investment income from CPPIB will be needed to help pay pensions.

“Over the period of his latest report, the Chief Actuary confirmed that the Fund’s performance is well ahead of projections as investment income was 248% higher than anticipated. The Fund’s investment returns have made a favourable impact and contributed to the lowering of the minimum contribution rate required to help keep the CPP sustainable over the long term,” added Mr. Machin.

Q2 Investment Highlights:

Public Market Investments

· Completed a follow-on investment of $250 million in Kotak Mahindra Bank (Kotak) for an additional 0.9% stake. Kotak is a leading private-sector bank holding company in India, with additional lines of business in life insurance, brokerage and asset management. To date, CPPIB has invested $1.0 billion representing a 5.8% ownership stake in the company.

· Invested US$280 million in convertible preferred equity securities of a parent company of Advanced Disposal Services, Inc. (Advanced Disposal), which converted to common equity of Advanced Disposal upon its initial public offering subsequent to the quarter end. This represents an approximate 20% ownership stake in the company. Based in Ponte Vedra, Florida, Advanced Disposal is the fourth largest solid waste company in the U.S., providing integrated, non-hazardous solid waste collection, transfer, disposal and recycling services to residential, commercial, industrial and municipal customers across 16 U.S. states and the Bahamas.

Investment Partnerships

· Announced a combined investment of US$500 million with TPG Capital for a minority stake of 17% in MISA Investments Limited, the parent company of Viking Cruises. TPG Capital and CPPIB each invested US$250 million to support and accelerate Viking Cruises’ growth initiatives and strengthen the company’s balance sheet. Viking Cruises is a leading provider of worldwide river and ocean cruises, operating more than 60 cruise vessels based in 44 countries.

Private Investments

· Signed an agreement with American International Group to acquire 100% of Ascot Underwriting Holdings Ltd. and certain related entities (Ascot), together with Ascot’s management, for a total consideration of US$1.1 billion. Based in London, England, Ascot is a Lloyd’s of London syndicate and a global specialty insurance underwriter with expertise spanning multiple lines of businesses, including property, energy, cargo, casualty and reinsurance. The transaction is subject to customary regulatory approvals and closing conditions.

· CPPIB Credit Europe S.à r.l., a wholly owned subsidiary of CPPIB, acquired a portion of Dana-Farber Cancer Institute’s royalty interests related to its Programmed Death Ligand-1 (PD-L1) intellectual property for US$100 million. PD-L1 inhibitors are immuno-oncology drugs used for the treatment of various types of metastatic cancer.

· Crestone Peak Resources LLC, an entity 95% owned by CPPIB, completed the acquisition of the Denver Julesberg Basin oil and gas assets in Colorado from Encana Oil & Gas (USA) Inc., a wholly owned subsidiary of Encana Corporation, for US$609 million.

· Invested equity into Wolf Midstream Inc. (Wolf) to support Wolf’s acquisition of a 50% ownership interest in Access Pipeline (Access) from Devon Energy Corp. Access includes pipelines that transport blended bitumen and diluent between the Christina Lake area of Northeastern Alberta and Edmonton. The transaction was funded by Wolf through an investment by CPPIB of $683 million and third-party debt financing.

Real Assets

· Acquired a 50% interest in a portfolio of high-quality office properties in downtown Toronto and Calgary at a gross purchase price of $1.175 billion from Oxford Properties Group. The 4.2 million-square-foot portfolio includes seven office buildings with a broad mix of tenants in financial services, technology, accounting, legal and commodities businesses. The transaction brings the total size of the jointly owned Oxford-CPPIB office portfolio to over 12 million square feet.

· Completed the acquisition of a 33% stake in Pacific National for approximately A$1.7 billion, as part of the consortium that acquired Asciano Limited. Pacific National is one of the largest providers of rail freight services in Australia. In addition, the Relationship Investments group invested approximately A$300 million in equity for a 9.9% ownership stake in Qube Holdings Limited (Qube) to support Qube’s acquisition of the ports business of Asciano Limited. Qube is Australia’s largest integrated provider of import and export logistics services.

· Completed follow-on investments totalling R$470 million (C$190 million) in Aliansce Shopping Centers S.A. (Aliansce), one of the largest owners, operators and developers of shopping centres in Brazil. With these transactions, CPPIB’s interest in Aliansce has increased to 38%.

Investment highlights following the quarter end include:

· Invested US$162 million to acquire a 40% interest in the Pavilion Dalian shopping mall from the Pavilion Group. Pavilion Dalian is a prime shopping centre in Dalian, a major economic hub in northeast China.

· Invested US$375 million in Raffles City China Investment Partners III, CapitaLand’s third integrated development private investment vehicle in China. CPPIB’s investment represents a 25% stake in the investment vehicle.

· Entered into a second joint venture with Longfor Properties Co. Ltd to invest in Chongqing West Paradise Walk shopping centre in China. CPPIB will commit approximately $193 million for a 49% interest in the property. West Paradise Walk is a six-level shopping mall built in 2008, located in the heart of one of Chongqing’s most established commercial areas.

· Signed an agreement to acquire an additional 5.1% stake in Transportadora de Gas del Peru (TgP) for approximately US$110 million. TgP is the largest transporter of natural gas and natural gas liquids in Peru. With this acquisition, CPPIB’s ownership stake will increase from 44.8% to 49.9%.

· Formed a joint venture with Hudson Pacific Properties (Hudson Pacific) to acquire a 285,680-square-foot, Class-A office tower, known as “Hill7,” for approximately US$180 million (after closing adjustments). CPPIB will own a 45% interest in the joint venture and Hudson Pacific will own 55%. Located in Seattle, the newly constructed, 11-storey office building offers large floorplates, city and water views, modern on-site amenities and convenient access to the regional transportation system.

Asset Dispositions:

· Sold our 50% interest in four retail properties, Grandview Corners (Surrey, BC), RioCan Meadows (Edmonton, AB), RioCan Beacon Hill (Calgary, AB) and RioCan Centre Burloak (Oakville, ON) to our joint venture partner, RioCan Real Estate Investment Trust. Proceeds to CPPIB from the sale were approximately $352 million. The properties were acquired between 2006 and 2009.

Corporate Highlights:

· Signed a Memorandum of Understanding with the National Development and Reform Commission of the People’s Republic of China to offer CPPIB’s expertise in assisting Chinese policy-makers as they address the challenges of China’s aging population, including pension reform and the promotion of investment in the domestic senior care industry by global investors.

· Established a Real Assets investment department that brings together the Real Estate Investments department with the existing Infrastructure and Agriculture groups. This change creates a better alignment with our Strategic Portfolio. The Private Investments department continues to invest in a wide range of private equity and credit assets, comprising four groups: Direct Private Equity, Natural Resources, Principal Credit Investments and Portfolio Value Creation.

· Announced new senior management appointments:

o Graeme Eadie appointed as Senior Managing Director & Global Head of Real Assets. Graeme has been with CPPIB since 2005, and was most recently Senior Managing Director & Global Head of Real Estate Investments.

o Shane Feeney appointed as Senior Managing Director & Global Head of Private Investments and joined the Senior Management Team. Shane is responsible for CPPIB’s private investment activities. Shane joined CPPIB in 2010 and was most recently Managing Director, Head of Direct Private Equity.

o Ryan Selwood appointed as Managing Director, Head of Direct Private Equity and is responsible for overseeing co-sponsorships and other direct private equity transactions. Ryan joined CPPIB in 2006 and was most recently Managing Director in the Direct Private Equity group and led CPPIB’s financial institutions investing initiative.

CPPIB Capital Inc. (CPPIB Capital), a wholly owned subsidiary of CPPIB, completed its first international debt offering of three-year term notes totalling US$2 billion. CPPIB utilizes a conservative amount of short- and medium-term debt as one of several tools to manage our investment operations. Debt issuance gives CPPIB flexibility to fund investments that may not match our contribution cycle. Net proceeds from the private placement will be used by CPPIB for general corporate purposes.

About Canada Pension Plan Investment Board

Canada Pension Plan Investment Board (CPPIB) is a professional investment management organization that invests the funds not needed by the Canada Pension Plan (CPP) to pay current benefits on behalf of 19 million contributors and beneficiaries. In order to build a diversified portfolio of CPP assets, CPPIB invests in public equities, private equities, real estate, infrastructure and fixed income instruments. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City and São Paulo, CPPIB is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At September 30, 2016, the CPP Fund totalled $300.5 billion. For more information about CPPIB, please visit www.cppib.com or follow us on LinkedIn or Twitter.

Article Contacts

FOR MORE INFORMATION CONTACT:

Dan Madge

Senior Manager, Media Relations

T: +1 416 868 8629

dmadge@cppib.com

Mei Mavin

Director, Corporate Communications

T: +1 646 564 4920

mmavin@cppib.com