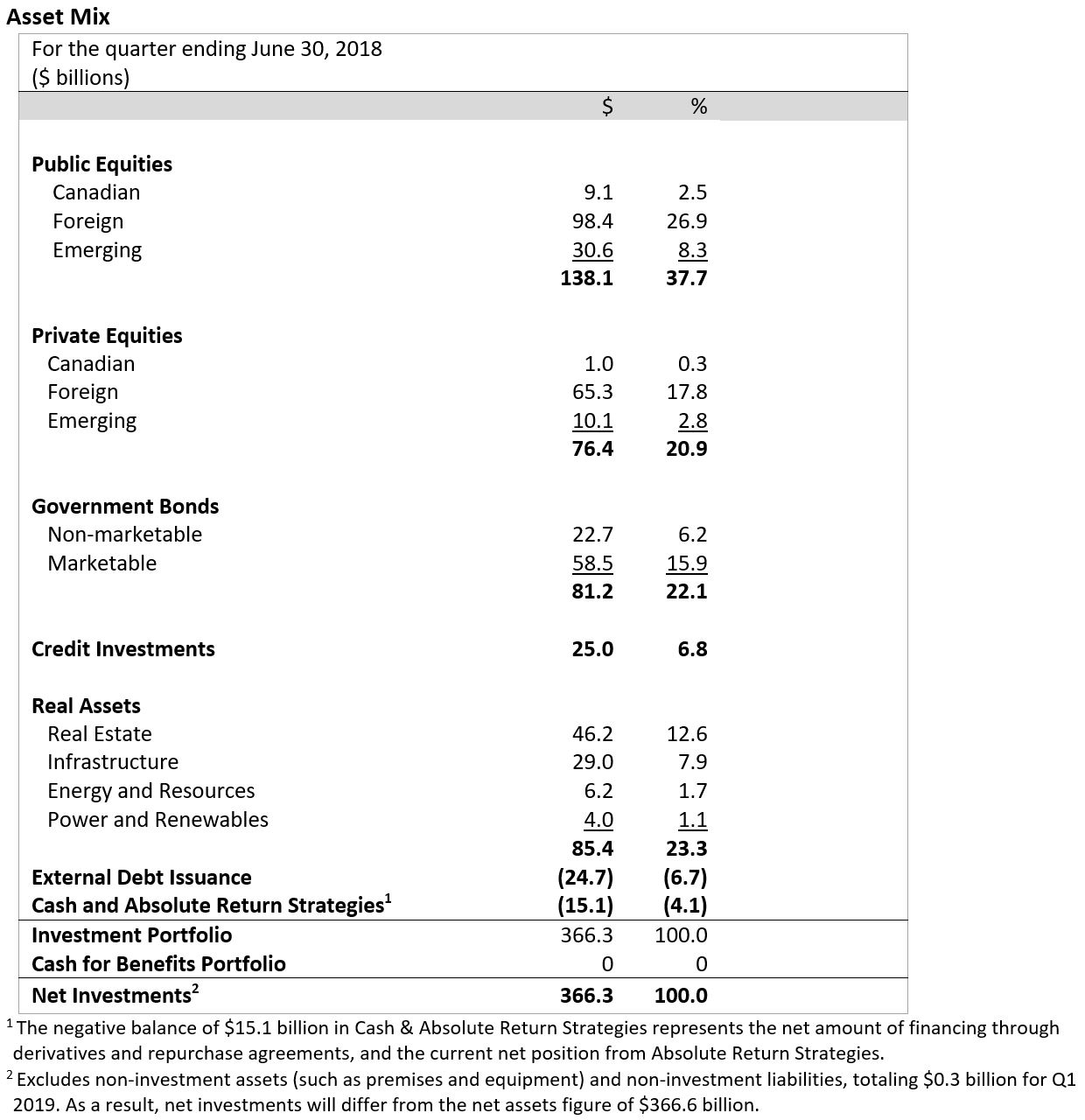

TORONTO, ON (August 10, 2018): The CPP Fund ended its first quarter of fiscal 2019 on June 30, 2018, with net assets of $366.6 billion, compared to $356.1 billion at the end of fiscal 2018. The $10.5 billion increase in assets for the quarter consisted of $6.6 billion in net income after all CPPIB costs and $3.9 billion in net Canada Pension Plan (CPP) contributions.

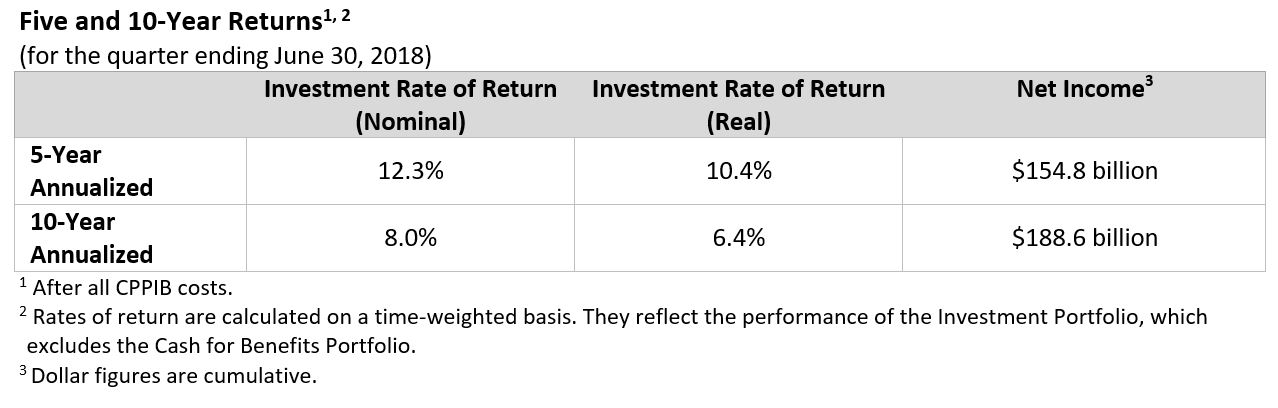

The Investment Portfolio achieved 10-year and five-year annualized net nominal returns of 8.0% and 12.3%, respectively, and 1.8% for the quarter. These returns are net of all CPPIB costs.

“While performance was solid across our investment departments, our private assets did particularly well. Global equity markets maintained positive performance this quarter, contributing to Fund growth,” says Mark Machin, President & Chief Executive Officer, Canada Pension Plan Investment Board (CPPIB). “While we focus on strong average returns stretching well beyond five and 10 years, solid performance today cushions the Fund for an inevitable future market downturn. We are confident that our investment strategy will continue to serve the Fund through multiple economic cycles.”

CPPIB continues to build a portfolio designed to achieve a maximum rate of return at an appropriate risk level, having regard to our exceptionally long investment horizon. Accordingly, long-term results are a more appropriate measure of CPPIB’s investment performance than returns in any given quarter or single fiscal year.

Long-Term Sustainability

CPPIB’s 10-year annualized net nominal rate of return of 8.0%, or 6.4% on a net real rate of return basis, was above the Chief Actuary’s assumption of an average 3.9% return over the 75-year projection period of his report. The real rate of return is reported net of all CPPIB costs to be consistent with the Chief Actuary’s approach.

Every three years, the Office of the Chief Actuary of Canada conducts an independent review of the sustainability of the CPP over the next 75 years. In the most recent triennial review released in September 2016, the Chief Actuary of Canada reaffirmed that, as at December 31, 2015, the CPP remains sustainable at the current contribution rate of 9.9% throughout the forward-looking 75-year period covered by the actuarial report. The Chief Actuary’s projections are based on the assumption that the Fund’s prospective real rate of return, which takes into account the impact of inflation, is expected to average 3.9% over the 75-year period.

The Chief Actuary’s report confirmed that the Fund’s performance was ahead of projections for the 2013-2015 period as investment income was 248%, or $70 billion, higher than anticipated.

Q1 Investment Highlights:

Real Assets

- Announced an R$ 500 million (C$175 million) equity target for a 20% interest in the newly established Goodman Brazil Logistics Partnership to invest in prime logistics and industrial assets in the key gateway cities of São Paulo and Rio de Janeiro. Launched by Goodman Group, the R$ 2.5 billion (C$880 million) joint venture also includes global investors APG, First State Super and GIC.

- Completed a transaction with Enbridge Inc. and its related entities (Enbridge) under which CPPIB acquired 49% of Enbridge’s interests in select North American onshore renewable power assets, as well as 49% of Enbridge’s interests in two German in-construction offshore wind projects, for approximately C$2.25 billion, including funding of future construction expenditures. In addition, CPPIB and Enbridge agreed to form a partnership to pursue future European offshore wind investment opportunities.

- Acted as an anchor investor in the first private infrastructure investment trust in India, known as IndInfravit Trust (IndInfravit), alongside Allianz Capital Partners, on behalf of Allianz insurance companies. Sponsored by L&T Infrastructure Development Projects Limited, IndInfravit will initially own five operational toll roads in India. CPPIB invested approximately C$200 million for 30% of IndInfravit units.

- Entered into a joint venture partnership with GIC to acquire Kumho Asiana Main Tower, a Grade A office building in Seoul, South Korea, from Kumho Asiana Group, parent of Asiana Airlines, for KRW418 billion (C$510 million). CPPIB and GIC will each own a 50% stake in this landmark property, which is located in Seoul’s Central Business District.

- Invested an additional INR 9.38 billion (C$185 million) into the Island Star Malls Developers Pvt. Ltd. (ISMDPL), the strategic investment venture co-owned with The Phoenix Mills Limited (PML). Through this second tranche, CPPIB’s total investment in ISMDPL is now INR 16.62 billion (C$328 million), representing a 49% ownership stake.

- Acquired a 396 megawatt portfolio of contracted renewable energy projects in Canada for C$740 million through CPPIB’s wholly owned subsidiary, Cordelio Power.

Credit Investments

- Acquired a US$400 million interest in a US$3.3 billion A-note secured by a Class-A office building located in the Central Business District of Hong Kong.

Active Equities

- Invested approximately US$600 million in Ant International Co., Limited, a subsidiary of Ant Small and Micro Financial Services Group Co., Ltd. (Ant Financial). Ant Financial is a tech company dedicated to bringing more secure, transparent, cost-effective and inclusive financial services to individuals and small and medium enterprises globally.

Investment highlights following the quarter end include:

Private Equity

- Signed an agreement to acquire a stake in Sportradar alongside TCV at an enterprise value of €2.1 billion. Sportradar is the global leader in analyzing and leveraging the power of sports data and serves as the official partner of the NBA, NFL, NHL and NASCAR as well as FIFA and UEFA.

Real Assets

- Partnered with ESR and its Seoul-based subsidiary Kendall Square Asset Management to invest up to US$500 million in a newly established investment vehicle targeting modern logistics facilities in South Korea. The portfolio will be comprised of Grade-A facilities in key locations servicing diverse tenant demands. The vehicle will initially invest in a seed portfolio of six logistics facilities with an aggregate gross floor area of 270,000 square metres, which are already managed by Kendall Square Asset Management.

- Acquired a prime logistics asset in Northern New Jersey for US$150 million through the Goodman North American Partnership with Goodman Group. CPPIB invested approximately US$70 million for a 45% interest. The 617,000 square-foot logistics warehouse is fully leased to an investment-grade, e-commerce tenant as its primary last-mile distribution point for New York City.

- Committed to invest up to C$305 million in Wolf Midstream Inc. (Wolf) to support the construction of the Alberta Carbon Trunk Line (ACTL). Wolf and Enhance Energy entered into a project development and coordination agreement related to the construction and operation of the ACTL, a 240-kilometre carbon dioxide capture and pipeline transportation asset in Alberta. Wolf will construct, own and operate the ACTL.

- Formed a joint venture with WPT Industrial Real Estate Investment Trust and Alberta Investment Management Corporation to aggregate a portfolio of industrial properties in strategic U.S. logistics markets through a value-add and development investment strategy. The joint venture will target investing up to US$1 billion of combined equity. CPPIB will own a 45% interest in the joint venture.

- Committed to invest approximately US$1.0 billion in Encino Acquisition Partners (EAP) to support EAP’s acquisition of Chesapeake Energy’s Utica Shale oil and gas assets in Ohio for a total consideration of US$2.0 billion in cash. CPPIB and Encino Energy formed EAP in 2017 to acquire large, high-quality oil and gas production and development assets in the U.S. lower 48 states. CPPIB owns approximately 98% of EAP.

- Formed a joint venture with Boston Properties, Inc., one of the largest public owners and developers of office buildings in the United States, and completed the acquisition of Santa Monica Business Park in the Ocean Park neighborhood of Santa Monica, California, for a purchase price of approximately US$627.5 million. As part of the joint venture, CPPIB will invest US$147.4 million for a 45% ownership in the Business Park.

- Launched a new investment cooperation with Longfor Group Holdings Limited to invest in rental housing programs in China with an initial targeted investment of approximately US$817 million.

Credit Investments

- Signed an agreement to acquire a portfolio of Spanish non-performing loans with a gross book value of approximately €1,000 million from Banco Bilbao Vizcaya Argentaria, S.A.

- Invested US$260 million in the first lien term loan for Getronics, a leading European provider of digital transformation solutions. The financing supported Getronics’ acquisition of Pomeroy, a leading U.S. provider of digital workplace transformation services, creating a global IT services platform company.

Active Equities

- Invested US$50 million in the Series B Preferred Share financing of Zoox, a U.S. technology company focused on developing a fully integrated autonomous vehicle mobility solution including building and operating a fleet of specially designed robo-taxis.

Corporate Highlights:

- Dr. Heather Munroe-Blum was reappointed as Chairperson for a term expiring October 2020. Dr. Munroe-Blum first became a Director of CPPIB in 2010 and assumed the role of Chairperson in 2014. She also sits on the boards of the Royal Bank of Canada, CGI Group and the Gairdner Foundation, and was the Principal and Vice-Chancellor (President) of McGill University from 2003-2013.

- We welcomed the appointment of Chuck Magro to CPPIB’s Board of Directors. Appointed in July 2018, Mr. Magro is President and Chief Executive Officer of Nutrien Ltd. He serves on the boards of the International Fertilizer Association and the International Plant Nutrition Institute and serves as chair of Canpotex Limited, The Fertilizer Institute and the Nutrients for Life Foundation.

- Mark Machin, President and CEO, was named one of Canada’s Top 10 CEOs by Glassdoor, one of the world’s leading job and recruitment websites. Among CEOs in Canada, Mark received a 98% approval rating. The rating is based on anonymous and voluntary CPPIB employee reviews on Glassdoor throughout the year. Among the 770,000 companies reviewed on Glassdoor, the average CEO approval rating is 69%.

- CPPIB Capital Inc. (CPPIB Capital), a wholly owned subsidiary of CPPIB, issued its inaugural green bond valued at $1.5 billion. This financing provides additional funding for CPPIB as it increases its holdings in renewables and energy efficient buildings as world demand gradually transitions in favour of such investible assets. This is the largest Canadian green bond issuance to date and marks a pioneering moment for CPPIB, as the first pension fund to issue a Green Bond.

About Canada Pension Plan Investment Board

Canada Pension Plan Investment Board (CPPIB) is a professional investment management organization that invests the funds not needed by the Canada Pension Plan (CPP) to pay current benefits on behalf of 20 million contributors and beneficiaries. In order to build a diversified portfolio of CPP assets, CPPIB invests in public equities, private equities, real estate, infrastructure and fixed income instruments. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, São Paulo and Sydney, CPPIB is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At June 30, 2018, the CPP Fund totalled $366.6 billion. For more information about CPPIB, please visit www.cppib.com or follow us on LinkedIn, Facebook or Twitter.

Disclaimer

Certain statements included in this press release constitute forward-looking statements with respect to CPPIB’s future financial or business performance, strategies or expectations. Forward-looking statements are typically identified by words or phrases such as “trend,” “potential,” “opportunity,” “believe,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions. The forward-looking statements are not historical facts but reflect CPPIB’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, including available investment income, intended acquisitions, regulatory and other approvals and general investment conditions. Although CPPIB believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. CPPIB does not undertake to publicly update such statements to reflect new information, future events, and changes in circumstances or for any other reason. The information contained on CPPIB’s website is not a part of this press release.

Article Contacts

For Further Information:

Darryl Konynenbelt

Director, Global Media Relations

dkonynenbelt@cppib.com

T: +1 416 972 8389