Investing in the Potential of Carbon Credits

By CPP Investments Insights Institute on March 14, 2022

Climate change entails a whole economy transition. Navigating consequent risks and opportunities requires a mix of innovative tools – including carbon credits.

The pricing of carbon emissions is affecting financial markets globally. Impact will intensify in coming years as more regions advance efforts to decarbonize by expanding carbon rules—pushing carbon prices higher.

Demand for carbon credits will grow significantly in the coming decades. Our partnership with Conservation International serves as a prototype to help scale nascent carbon markets and create enduring value by safeguarding unique forest ecosystems and communities.

Read why we’re deploying this tool to meet the challenge of climate change.

Investing in the Potential of Carbon Credits

CPP Investments is partnering with Conservation International on a prototype for joint ventures between private capital and non-profit organizations to help scale nascent carbon markets and create enduring value by safeguarding unique forest ecosystems and communities. This partnership is indicative of the innovative tools being increasingly sought by investors as we pursue attractive returns from climate change-related opportunities.

This paper shares the data, analysis and convictions that helped inform CPP Investments’ decision to partner with Conservation International.

At CPP Investments, we are putting considerable effort and capital into capturing attractive investment opportunities that arise as world economies ramp up efforts to decarbonize in response to climate change. The market for high-quality, additional, verifiable, and permanent carbon credits is one of those opportunities. Carbon credits are generated from projects around the world that pull greenhouse gases out of the atmosphere or keep emissions from being released, such as by reducing deforestation. Companies looking to reduce emissions that cannot yet be abated, can balance out today’s emissions by purchasing carbon credits. These credits help meet the urgent need to reduce global carbon emissions, and voluntary or compliance targets. We support efforts to strengthen carbon credit markets as we see them as a mechanism for delivering strong returns while diminishing risk.

In 2021, we established “Accelerate Nature”, a unique partnership with Conservation International, a nonprofit, non-governmental organization and globally recognized leader in nature-based climate solutions. These solutions conserve, restore or improve the use or management of ecosystems while maintaining their capacity to absorb and store carbon from the atmosphere.

As an investor pursuing attractive returns through investments in nature-based climate solutions, we sought to partner with Conservation International because of its proven expertise and experience in this space. Conservation International focuses on establishing enduring partnerships with Indigenous communities to keep carbon-rich tropical forests healthy; support the development of high-quality projects that reduce and remove carbon emissions; preserve biodiversity; enable the private sector to purchase certified carbon credits generated by each project; and provide a return to investors. Carbon credits generated via the partnership will be verified to the highest quality standards such as those developed and managed by Verra, a global non-profit that provides quality assurance in voluntary carbon markets.

As an investor pursuing attractive returns through investments in nature-based climate solutions, we sought to partner with Conservation International because of its proven expertise and experience in this space.

Demand for carbon credits is rising faster than supply, and will continue to expand for decades to come, driven by fast-multiplying regulatory standards and corporate commitments to reach net zero (see sidebar Demand for carbon credits is growing quickly). With the adoption of Article 6 of the 2015 Paris Agreement in November 2021, nearly 200 countries agreed to allow countries to partially meet their climate targets by buying offset credits representing emission cuts by others. The ultimate global goal is to eliminate or replace industrial processes that release carbon into the atmosphere. While working toward that goal, however, carbon credits will be necessary to offset emissions that cannot yet be abated, even as the world works to develop and deploy effective mitigation strategies.

As demand for credits rises, protecting the world’s forests offers an excellent opportunity to fill that need. Based on Conservation International’s on-the-ground experience, we recognize that deforestation is driven by a mix of factors, including a lack of income-generating options for residents who live in and near the forests. Absent better options, communities may opt to fell trees for timber or to clear land for farming or mining. According to World Resources Institute, if tropical deforestation were a country, it would rank third in carbon dioxide-equivalent emissions, only behind China and the U.S. Yet to date, there has been a lack of effective large-scale incentive schemes to protect forests and avoid additional carbon emissions.

Through Accelerate Nature, Conservation International partners with Indigenous communities to support their prosperity, and in turn, the health of the forests. By utilizing carbon markets in this process, we can be conservation allies while staying true to our mandate – maximizing investment returns without undue risk for the Canada Pension Plan’s contributors and beneficiaries.

Sign up for our latest news, insights, reports and other information about CPP Investments

FIGURE 1

McKinsey Global Energy Perspective 2021 Reference Case

Holding the rise in the earth’s temperature to no more than 1.5 degrees — the target agreed to by 195 countries as part of the Paris Climate Agreement — could require a large quantity of “negative” emissions, including some from projects, like Accelerate Nature, that generate nature-based carbon credits.

Efforts like Accelerate Nature are part of a broader global imperative to address climate change while also creating attractive investment opportunities and righting long-standing disparities in development. As the world moves towards limiting and tolling GHG emissions, monetizing the global benefits of carbon stores in forests and other natural carbon sinks, which absorb more carbon from the atmosphere than they release, not only helps to address climate change, but also more fairly balances the costs and benefits of formerly unpriced externalities stemming from industrialization and global trade.

After centuries of releasing emissions into the environment, industrial nations are advancing regional, national and cross-border regimes to price such emissions and using those funds to reward programs that reduce and remove emissions. For communities that host unique carbon-absorbing ecosystems, such as tropical forests, these regimes offer a potentially powerful and enduring economic incentive to protect and nurture these important resources. Just as emitters are being pushed to recognize the cost of their carbon emissions, there is another push to compensate communities for maintaining natural carbon sinks, which provide an essential “service” that benefits all people. By monetizing the benefits of tropical forests, such programs can help support Indigenous communities to transform their economies.

Demand for carbon credits is growing quickly

The promise of carbon markets

The pricing of carbon emissions is affecting financial markets globally and the impact will only expand in coming years as more regions advance efforts to decarbonize. Emissions regulations, carbon pricing and climate policies are likely to drive a shift towards renewables, investments in energy efficiency, and – for many – carbon credit purchases to offset emissions that cannot be avoided otherwise. Already, the majority of emissions generated by our portfolio companies occur in markets with carbon rules and carbon pricing. As carbon rules expand and carbon prices increase, their impact on markets and corporate strategy is likely to grow.

Though carbon credits have been traded for decades, today’s markets are fragmented and complex. There are currently 64 carbon pricing markets globally, with another 30+ under development. These markets are multifaceted, with a mix of compliance (set by law) and voluntary (evolved via collaborative standard setting) regimes growing in scope and scale around the world. We expect that as carbon prices rise, these markets will mature and strengthen. Long term, the success of a wider market for carbon credits depends on developing rigorous standards and methods to ensure the quality of carbon credit projects (see Validation and assurance).

At the same time, the global push to quantify, offset, abate and value carbon emissions is creating new industries and companies focused on carbon removal, some of which are also supported by voluntary carbon markets. These offer an increasing range of growth opportunities for consideration. As a long-term investor with positions spanning sectors and geographies, we see our deepening understanding of, and involvement in, carbon markets as a source of competitive edge.

The debut project in our partnership with Conservation International is taking shape in Peru’s Amarakaeri Communal Reserve (ACR), a National Protected Area that is co-managed by Indigenous communities and Servicio Nacional de Áreas Naturales Protegidas por el Estado (SERNANP), a specialized public agency in charge of directing and establishing the technical and administrative criteria for the conservation of Natural Protected Areas in Peru. The ACR was chosen for this inaugural project because it includes over half a million hectares of forest and is home to some of the world’s richest ecosystems. Additionally, Conservation International has been working in Peru for over 30 years and as a result is acutely familiar with the region and communities taking part in the Accelerate Nature partnership.

In addition to providing a return to investors like CPP Investments, the goals of the project are to:

- mitigate climate change risk by preserving a critically scarce ecosystem;

- economically support Indigenous communities;

- nurture the overall scale and quality of voluntary carbon markets by standardizing practices;

- support the development of high-quality carbon credits that reduce global carbon emissions; and

- enable the private sector to purchase certified carbon credits generated by each project

On the ground, Conservation International will work alongside Indigenous communities to implement the project, which includes training and education programs to develop skills and capacities. Together, Conservation International and communities will identify opportunities to create jobs that provide sustainable revenue streams to Indigenous communities.

Drawing on its corporate partnerships, Conservation International will also help find market access for the sustainable products that may result. The goal is to create incentives and systems that enable Indigenous people to continue to flourish while protecting their natural resources, and ensuring they are fairly compensated for the positive externalities of their work. The project is expected to generate average annual emissions reductions of 220,000 to 330,000 metric tons of CO2 — the equivalent of preventing up to 72,000 new cars from being commissioned, annually.

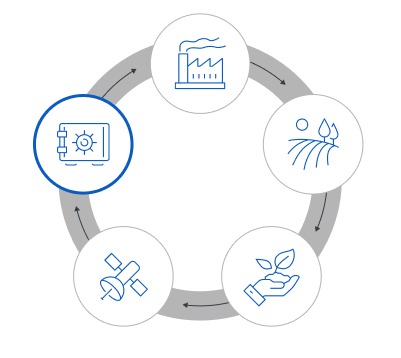

As we mentioned at the launch of Accelerate Nature, carbon credits generated by the ACR project will be marketed on the voluntary carbon market. Key market participants, including buyers, project developers and intermediaries, will adhere to established practices to ensure the structure is mutually beneficial. For more, see Fig. 2.

On-the-ground

benefits

On-the-ground benefits

The Indigenous communities of Amarakaeri have traditionally depended on the forests for their livelihoods. But the introduction of illegal mining, informal logging, illicit crops, and small-scale agriculture, have driven deforestation in the region. The rising price of locally mined metals, a growing flow of migrants from the Andes in search of economic opportunities, and the construction of illegal roads into the forest further contribute to deforestation.

The program aims to create economic opportunities for local citizens in ways that make protecting the ecosystem from the consequences of climate change the superior economic choice. If Indigenous communities receive equitable access to the tools and partnerships required to capture the tangible economic benefits from protecting and caring for their forests, they are more likely to invest in forest conservation and management, restore degraded soils and bring rivers and streams back to life.

Protecting critical

ecosystems

Protecting critical ecosystems

By connecting Indigenous communities to economic incentives to pursue livelihoods focused on sustainability, the program will help protect the ACR region, which includes 600,000 hectares of forest that are home to some of the world’s richest ecosystems. Flanking the Andes Mountain range, the rugged terrain varies from 300 metres above sea level to over 2,700 metres.

Variations in altitude, rainfall and temperature create six distinct ecological systems, ranging from lowland tropical forests to montane cloud forests. Climatic diversity supports a rich menagerie of at-risk plants and animals including giant otters, black spider monkeys and military macaws.

Variations in altitude, rainfall and temperature create six distinct ecological systems, ranging from lowland tropical forests to montane cloud forests. Climatic diversity supports a rich menagerie of at-risk plants and animals, including giant otters, black spider monkeys and military macaws.

Protecting the region’s unique flora and fauna can only succeed by supporting the communities that live near and depend on the forest for their livelihoods. The ACR’s communities include Indigenous peoples whose ancestors predate the arrival of modern economic and political systems. Supporting their legacy is part of the project’s mission.

There are precedents for this work. In Peru’s Alto Mayo Protected Forest — a swath of Amazonian rainforest adjacent to our project area — Conservation International has used funds to pay for training, equipment, and to establish a new trading cooperative to help farmers shift away from clear cutting rain forest to growing open-field coffee plantations, providing incentives to instead plant shade-grown coffee varieties.

These coffee bushes grow under the shelter of the forest, so can thrive with minimal disturbance to existing ecosystems. What’s more, shade grown beans command a premium in global markets. The project has cut deforestation in the protected area by more than half, while also boosting exports and diversifying the local economy.

The Amarakaeri Communal Reserve project will occur in phases and have an expected lifespan of 30 years. The first phase will begin at the end of 2022 and span approximately 400,000 hectares of the core communal reserve area.

CPP Investments and Conservation International are building a long-term collaboration that is focused on enduring value creation. We recognize that we can only do so if projects are equitable with Indigenous community stakeholders; hence, at least 50% of project revenues will go back to Indigenous communities to make further investments in sustainable practices that can support both the forest and the communities living within them. Projects will be audited by third-party agencies to ensure standardization and validate the climate, community and biodiversity impacts we have set out to achieve.

At least 50% of project revenues will go back to Indigenous communities

Validation and

assurance

Validation and assurance

Without rigorous standards and methods to ensure the quality of carbon credit projects, concerns about the integrity of credits could impede the market’s emergence as an effective mechanism in the fight against climate change.

For example, the sheer variety of carbon credits can lead to questions about quality, and thus, price of a credit. Is a ton of carbon absorbed by a tree, with a lifespan of hundreds of years, of the same value as a ton of carbon injected back underground, which can be locked in for thousands of years or more?

Validation of credits poses an additional set of challenges, as does potential abuse, for example, when a landowner claims a carbon removal credit for planting trees that are later felled. These and other uncertainties are fueling industry efforts to advance and standardize measures, establish consensus practice, and improve the ability to validate and track claimed emissions.

CPP Investments has helped advance these standards as a participant in the Taskforce on Scaling Voluntary Carbon Markets. We support the consolidation and unification of these standards to ensure comparability, completeness, timely reporting and assurance of data around carbon credits.

Verification

Additionality

Permanence

Opportunities

on the horizon

Opportunities on the horizon

We believe the ACR project will mark the first of a series of projects globally to further advance the development of REDD+ carbon credits and other nature-based carbon removal methods. We aim to use the platform created for this project to fund additional projects over the next two years.

Stepping back, it’s important to remember that limiting the rise of global temperatures to 1.5°C will require a reduction in net GHG emissions that is both drastic and rapid. While many companies will be able to make the necessary emissions cuts by switching to low-carbon energy sources or upgrading equipment and practices, a large share of companies will have to complement these efforts with the use of carbon credits.

A credible, large-scale voluntary market for carbon credits will be an essential element of the transition to net zero. For now, the carbon credit market is too immature to meet rising expectations: volumes are too small, standards too varied and pricing too illiquid. We see an opportunity both to cultivate new, trustworthy sources of carbon credits and to help the market grow in depth and scale, opening new avenues for our investment activities.

The opportunity we see is based on three emerging trends:

Credible markets will develop.

Demand will outstrip supply.

Prices will rise.

Rising prices, which are a result of increased demand and inadequate supply, are a boon to extend forest protection. The growing gap between supply and demand for carbon credits underscores both the dire urgency to increase the supply of carbon credits, as well as the growing financial opportunity they represent.

Put plainly, carbon credit markets are poised to grow — indeed, they must. By enabling more partnerships like Accelerate Nature, we believe we can help expand both the supply and market infrastructure necessary to progress toward a net-zero future. Doing so will help protect ecosystems and their communities, and enable us to earn attractive risk-adjusted returns for generations of contributors and beneficiaries.

Facts and figures are proprietary to CPP Investments unless otherwise stated.

Refer to pdf version for full citations.

How Standard Chartered is mapping skills for an AI-driven economy

Resilience, critical thinking—and an ability to manage ambiguity.

Your Pension, Our Promise: A Message to Canadians

Our commitment to Canadians has never been stronger. The CPP Fund isn’t just an investment portfolio; it’s a promise to provide

CPP Investments: Making AI governance, education and skills a priority

The rapid rise of artificial intelligence is opening exciting possibilities for workforce productivity—and value creation.