All figures in Canadian dollars unless otherwise noted.

Third-Quarter Performance1:

- Net assets increase by $14.6 billion

- 10-year annualized net return of 9.3%

TORONTO, ON (February 15, 2024): Canada Pension Plan Investment Board (CPP Investments) ended its third quarter of fiscal 2024 on December 31, 2023 with net assets of $590.8 billion compared to

$576.1 billion at the end of the previous quarter.

The $14.6 billion increase in net assets for the quarter consisted of $19.3 billion in net income less $4.7 billion in net Canada Pension Plan (CPP) outflows. CPP Investments routinely receives more CPP contributions than required to pay benefits during the first part of the calendar year, partially offset by benefit payments exceeding contributions in the final months of the year.

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved a 10-year annualized net return of 9.3%. For the quarter, the Fund’s net return was 3.4%. In the 10-year period up to and including the third quarter of fiscal 2024, CPP Investments has contributed $319.4 billion in cumulative net income to the Fund.

For the nine-month fiscal year-to-date period, the Fund increased by $20.7 billion consisting of $15.3 billion in net income and $5.4 billion in net CPP contributions. The Fund’s net return was 2.6% for that same period.

“Strong performance of global equity and fixed income markets during the final months of calendar 2023 contributed to the Fund’s continued growth,” said John Graham, President & CEO. “We remain focused on applying our investment capabilities to prudently manage the Fund to deliver long-term value for CPP contributors and beneficiaries.”

Gains in public equity, fixed income, credit, private equity, energy and infrastructure assets contributed positively to results, partially offset by the impact of foreign exchange losses due to a stronger Canadian dollar relative to the U.S. dollar.

Performance of the Base and Additional CPP Accounts

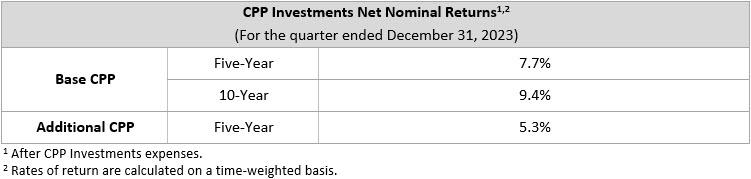

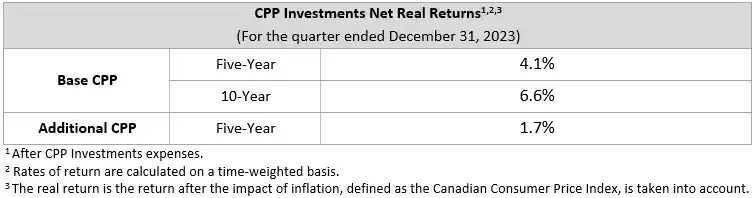

The base CPP account ended its third quarter of fiscal 2024 on December 31, 2023, with net assets of $557.7 billion, compared to $546.3 billion at the end of the previous quarter. The $11.4 billion increase in assets consisted of $17.8 billion in net income, less $6.4 billion in net base CPP outflows. The base CPP account achieved a 3.3% net return for the quarter, and a five-year annualized net return of 7.7%.

The additional CPP account ended its third quarter of fiscal 2024 on December 31, 2023, with net assets of $33.1 billion, compared to $29.8 billion at the end of the previous quarter. The $3.3 billion increase in assets consisted of $1.6 billion in net income and $1.7 billion in net additional CPP contributions. The additional CPP account achieved a 5.0% net return for the quarter, and a five-year annualized net return of 5.3%.

The additional CPP was designed with a different legislative funding profile and contribution rate compared to the base CPP. Given the differences in their design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in their net contribution profiles, the assets in the additional CPP account are also expected to grow at a much faster rate than those in the base CPP account.

Long-Term Financial Sustainability

Every three years, the Office of the Chief Actuary of Canada (OCA), an independent federal body that provides checks and balances on the future costs of the CPP, evaluates the financial sustainability of the CPP over a long period. In the most recent triennial review published in December 2022, the Chief Actuary reaffirmed that, as at December 31, 2021, both the base and additional CPP continue to be sustainable over the long term at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2021, the base CPP account will earn an average annual rate of return of 3.69% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.27%.

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, while considering the factors that may affect the funding of the CPP and its ability to pay current benefits. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance and plan sustainability.

Operational Highlights

Corporate developments

- Ranked first among the world’s leading public pension funds by Global SWF when measuring annualized returns between fiscal years 2013 and 2022 (Global SWF Data Platform, December 2023).

- Completed a review of our business activities in Europe resulting in the planned closure of our Luxembourg office in fiscal 2025. This decision was a result of thorough analysis of business activities that best serve our global operations. Established in January 2015, the Luxembourg office has supported our investment activities in Europe.

- Received the Australian-market Kangaroo Issuer of the Year award by Sydney-based KangaNews for their annual institutions and transactions awards in 2023. The KangaNews Awards consider factors such as the volume of issuance, breadth of distribution, deal performance and commitment to the Australian Dollar Bond market as an issuer. In 2023, CPP Investments issued A$3.75 billion (C$3.4 billion) of bonds in the Australian market.

Third-Quarter Investment Highlights

Credit Investments

- Participated in the financing of a subsidiary of Pattern Energy Group, a U.S.-based renewable energy and transmission company, through a US$83 million investment in a holding company debt facility, which will support initial equity capital for the construction of SunZia Transmission and SunZia Wind, a clean energy infrastructure project in the U.S.

- Agreed to invest up to €118 million in a forward-flow mezzanine loan facility for Enpal. Based in Germany, the company offers financing solutions for solar panels, electric vehicle chargers, heat pumps and batteries as well as installation and maintenance services.

- Entered into a newly formed venture with Blackstone Real Estate Debt Strategies, Blackstone Real Estate Income Trust, Inc., and funds affiliated with Rialto Capital and acquired a 20% equity stake for US$1.2 billion in a venture that holds a US$16.8 billion senior commercial mortgage loan portfolio, primarily located in the New York metropolitan area.

- Invested A$300 million (C$268 million) in a first-lien term loan to TEG, a leading integrated live entertainment and ticketing service provider in Australia.

- Invested €75 million in a senior secured loan to Curtis Biomass Plant, a 49-megawatt woody biomass plant using certified forestry waste located in northwest Spain.

- Invested in the financing package to support New Mountain Capital’s investment in the merger of HealthComp, a U.S.-based benefits and analytics platform, with Virgin Pulse, a global digital-first health, wellbeing and navigation company.

- Committed to invest C$197 million in financing to support CapVest Partners in its acquisition of Recochem. Headquartered in Canada, Recochem is a global manufacturer and distributor of aftermarket transportation and household fluids.

- Agreed to provide financing to support a consortium of investors led by Sixth Street in its acquisition of the GreenSky platform and its associated loan assets. GreenSky is a leader in point-of-sale home improvement financing based in the U.S.

- Committed up to US$90 million in junior financing to fund up to US$820 million of loans originated by Service Finance Company, a U.S. home improvement financial services company.

Private Equity

- Invested €398 million to acquire interests in three funds managed by Hayfin Capital Management. The transaction represents a diversified portfolio of European mid-market, single- company secondary investments, direct co-investments and funds.

- Invested US$50 million in the carve-out of Forcepoint’s Global Governments and Critical Infrastructure (G2CI) cybersecurity business, alongside TPG. Based in the U.S., Forcepoint G2CI is a leading provider of cybersecurity solutions.

- Committed US$175 million to MBK Partners Fund VI, which focuses on control buyouts investments in South Korea, Japan and Greater China.

- Committed US$240 million to TPG Partners IX, L.P., which focuses primarily on healthcare, software and digital media & communications, and US$60 million to TPG Healthcare Partners II, L.P., which focuses solely on healthcare. The funds target upper middle-market and large growth buyouts in North America and Western Europe.

- Committed US$90 million to acquire ownership interests in a diversified portfolio of 25 private equity funds with investments distributed across Europe, North America and Australia.

- Agreed to the partial realization of our investment in Visma, a leading provider of mission-critical cloud software in Europe, retaining an approximate 2% stake in the company. Net proceeds from the sale are expected to be approximately C$700 million. Our original investment was made in 2019.

- Completed the sale of a diversified portfolio of 20 limited partnership fund interests in mostly North American and European buyout funds. Net proceeds from the sale were approximately C$2 billion. The portfolio of fund interests represents various commitments made over the course of approximately 20 years.

Real Assets

- Completed a follow-on investment of US$905 million into Pattern Energy Group to support the company’s ongoing development projects and future growth opportunities. Pattern Energy is a leading U.S.-based renewable energy and transmission company. We completed our initial investment in 2020.

- Committed an additional £300 million to Octopus Energy to support the company’s continued global growth. Octopus Energy is a global clean energy technology pioneer based in the U.K. Our partnership was established in 2021.

- Sold the Midland Gate Shopping Centre in Perth, Australia, held through the Vicinity Retail Partnership (VRP). Gross proceeds from the sale total A$97 million (C$85 million). The transaction marks the final asset disposition from VRP, a joint venture vehicle established in 2010 to invest in shopping centres across Australia.

- Sold our 24.5% stake in two operating German offshore wind projects, Hohe See and Albatros, which have been fully operational for nearly three years and produce a combined 2.5-million-megawatt hours of electricity. Net proceeds from the sale were C$374 million. Our initial investment was made in 2018 while the projects were still under construction.

Transaction Highlights Following the Quarter

- Signed a definitive agreement in support of the proposed merger between Aera Energy, one of California’s major energy producers, and California Resources Corporation, an independent energy and carbon management company in the U.S. Through this transaction, we will receive newly issued shares of common stock upon close of the transaction, expected to represent approximately 11.2% of the combined company.

- Completed a C$100M Freddie Mac-compliant preferred equity investment in Panorama Tower, an 85-story, Class-A luxury multifamily high-rise tower in Miami, Florida.

- Committed to provide an additional US$75 million in financing to Global Lending Services (GLS) through a term loan, bringing the total size of the loan to US$150 million. Based in the U.S., GLS provides automotive financing solutions offered through franchise and independent automobile dealers.

- Invested £40 million for an approximate 1% stake in Dechra Pharmaceuticals alongside EQT. Dechra Pharmaceuticals is a U.K.-based developer and manufacturer of specialty animal pharmaceuticals.

- Participated in the financing of BridgeBio Pharma Inc., a U.S.-based commercial-stage biopharmaceutical company focused on genetic diseases and cancers, through a US$200 million synthetic royalty financing commitment and a US$150 million term loan that refinances an existing senior secured credit facility, alongside Blue Owl Capital. The financing will support the commercial launch of acoramidis, a pre-approval drug candidate designed to treat a rare and potentially fatal heart condition known as transthyretin amyloid cardiomyopathy (ATTR-CM).

- Invested US$75 million in a secured credit facility issued by Altus Power, a commercial-scale provider of clean electric power that develops, owns and operates locally sited solar generation, energy storage and charging infrastructure across the U.S.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 22 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At December 31, 2023, the Fund totalled C$590.8 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Instagram or on X @CPPInvestments.

Disclaimer

Certain statements included in this press release constitute “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable United States safe harbors. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United States securities laws. Forward-looking information and statements include all information and statements regarding CPP Investments’ intentions, plans, expectations, beliefs, objectives, future performance, and strategy, as well as any other information or statements that relate to future events or circumstances and which do not directly and exclusively relate to historical facts. Forward-looking information and statements often but not always use words such as “trend,” “potential,” “opportunity,” “believe,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions. The forward-looking information and statements are not historical facts but reflect CPP Investments’ current expectations regarding future results or events. The forward-looking information and statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, including available investment income, intended acquisitions, regulatory and other approvals and general investment conditions. Although CPP Investments believes that the assumptions inherent in the forward-looking information and statements are reasonable, such statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. CPP Investments does not undertake to publicly update such statements to reflect new information, future events, and changes in circumstances or for any other reason. The information contained on CPP Investments’ website, LinkedIn, Facebook and Twitter are not a part of this press release. CPP INVESTMENTS, INVESTISSEMENTS RPC, Canada Pension Plan Investment Board, L’OFFICE D’INVESTISSEMENT DU RPC, CPPIB and other names, phrases, logos, icons, graphics, images, designs or other content used throughout the press release may be trade names, registered trademarks, unregistered trademarks, or other intellectual property of Canada Pension Plan Investment Board, and are used by Canada Pension Plan Investment Board and/or its affiliates under license. All rights reserved.

1 Certain figures in the news release may not add up due to rounding.

Article Contacts

For More Information:

Frank Switzer

Public Affairs & Communications

Tel: +1 416 523 8039

fswitzer@cppib.com