Second-Quarter Highlights:

- $21.6 billion in net income generated for the Fund

- 10-year net return of 10.5%

TORONTO, ON (November 16, 2020): Canada Pension Plan Investment Board (CPP Investments) ended its second quarter of fiscal 2021 on September 30, 2020, with net assets of $456.7 billion, compared to $434.4 billion at the end of the previous quarter.

The $22.3 billion increase in net assets for the quarter consisted of $21.6 billion in net income after all CPP Investments costs and $0.7 billion in net Canada Pension Plan (CPP) contributions.

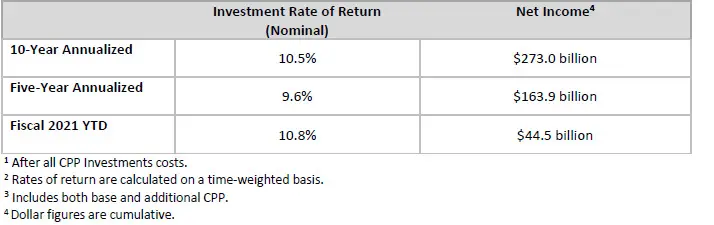

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved 10-year and five-year annualized net nominal returns of 10.5% and 9.6%, respectively. For the quarter, the Fund returned 5.0% net of all CPP Investments costs.

For the six-month fiscal year-to-date period, the Fund increased by $47.1 billion consisting of $44.5 billion in net income after all CPP Investments costs, plus $2.6 billion in net CPP contributions. For the period, the Fund returned 10.8% net of all CPP Investments costs.

“CPP Investments’ diversified Fund performed well this quarter, generating strong returns. However, we continue to be cautious about the months ahead given the highly uncertain economic fallout of COVID-19 and its effect on markets,” said Mark Machin, President & Chief Executive Officer, CPP Investments. “All of our investment departments generated positive returns this quarter. Our investment professionals continue to pursue opportunities that will bring value to the Fund over the long term.”

The Fund’s growth is primarily attributed to the continued recovery of global public equity markets in the first two months of the quarter, reflected in gains in both the Fund’s public and private holdings. Stock markets retracted in September driven by concerns over new COVID-19 lockdown measures and uncertainty related to monetary stimulus, tempering these gains.

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, taking into account the factors that may affect the funding of the CPP and the CPP’s ability to meet its financial obligations. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance compared to quarterly or annual cycles.

Fund 10- and Five-Year Returns1, 2, 3

(for the period ending September 30, 2020)

Performance of the Base and Additional CPP Accounts

The base CPP account ended its second quarter of fiscal 2021 on September 30, 2020, with net assets of $452.6 billion, compared to $431.1 billion at the end of the previous quarter. The $21.5 billion increase in assets consisted of $21.5 billion in net income after all costs, less $54 million in net base CPP outflows. The base CPP account achieved a 5.0% net return for the quarter.

The additional CPP account ended its second quarter of fiscal 2021 on September 30, 2020, with net assets of $4.1 billion, compared to $3.3 billion at the end of the previous quarter. The $0.8 billion increase in assets consisted of $0.1 billion in net income and $0.7 billion in net additional CPP contributions. The additional CPP account achieved a 3.0% net return for the quarter.

The base and additional CPP differ in contributions, investment incomes and risk targets. We expect the investment performance of each account to be different.

Long-Term Sustainability

Every three years, the Office of the Chief Actuary of Canada conducts an independent review of the sustainability of the CPP over the next 75 years. In the most recent triennial review published in December 2019, the Chief Actuary reaffirmed that, as at December 31, 2018, both the base and additional CPP continue to be sustainable over the 75-year projection period at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2018, the base CPP investments will earn an average annual rate of return of 3.95% above the rate of Canadian consumer price inflation, after all costs. The corresponding assumption is that the additional CPP investments will earn an average annual real rate of return of 3.38%.

The Fund, combining both the base CPP and additional CPP accounts, achieved 10-year and five-year annualized net real returns of 8.8% and 8.0%, respectively.

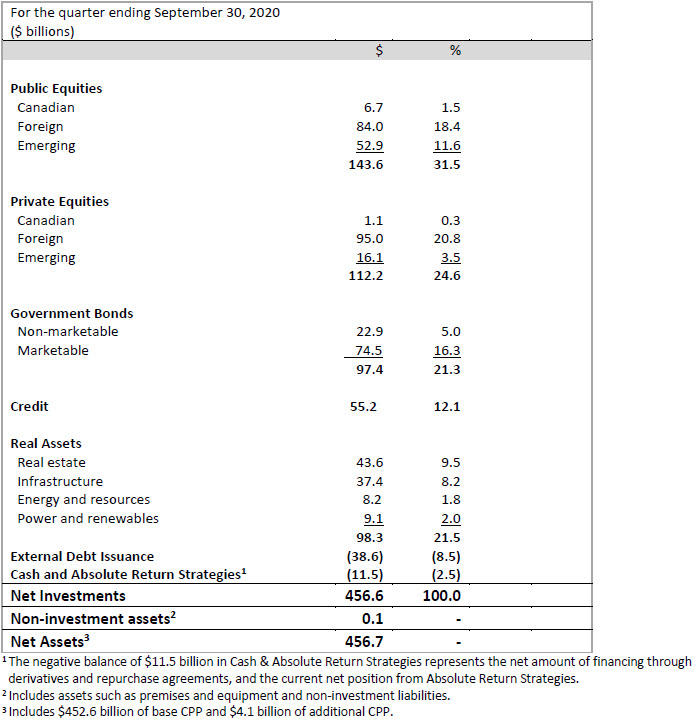

Diversified Asset Mix

Operational Highlights:

Corporate developments

- Hosted 10 public meetings, one for each of the nine provinces that participate in the CPP and one meeting for the three territories, to inform Canadians about the Fund’s financial performance and our investment strategy.

- Published the 2020 annual Report on Sustainable Investing, which outlines CPP Investments’ approach to environmental, social and governance factors. The report shows that our investments in global renewable energy companies more than doubled to $6.6 billion in the one-year period of the report.

- Thinking Ahead, the thought leadership lab at CPP Investments, issued research on How COVID-19 is shaping the landscape for long-term investors. In this latest report, professionals at CPP Investments analyzed the breadth of change expected following the global pandemic, as well as emerging opportunities.

Executive announcements

- Appointed Ed Cass as CPP Investments’ first dedicated Chief Investment Officer (CIO) and Head of Total Fund Management. The CIO role was created to effectively address the anticipated size and scale of CPP Investments by 2025 and beyond. Total Fund Management comprises the former Total Portfolio Management department and the Balancing & Collateral team formerly residing in the Capital Markets and Factor Investing department. Ed was most recently Global Head of Real Assets.

- Appointed Deborah Orida as Senior Managing Director & Global Head of Real Assets, where she will be responsible for the global Real Assets program, which encompasses Energy & Resources, Infrastructure, Power & Renewables, Real Estate and Portfolio Value Creation. Deborah was most recently Senior Managing Director & Global Head of Active Equities.

Board announcements

- Dr. Heather Munroe-Blum was reappointed as Chairperson of the Board for a term of three years ending in October 2023. Dr. Munroe-Blum first became a Director of CPP Investments in 2010 and assumed the role of Chairperson in 2014. She also serves on the board of the Royal Bank of Canada and is Chairperson of the Gairdner Foundation. Dr. Munroe-Blum served as the Principal and Vice-Chancellor (President) of McGill University from 2003-2013.

- Mary Phibbs was reappointed to the Board of Directors for a term ending in May 2023. Ms. Phibbs was first appointed a CPP Investments Director in May 2017. She also serves as Chairperson of Virgin Money Unit Trust Managers Limited and is a non-executive Director of Morgan Stanley International Limited, Morgan Stanley & Co International plc and Morgan Stanley Bank International Limited. Ms. Phibbs previously had a 40-year, multidisciplinary career in international banking and finance, both in executive and non-executive roles.

- The National Association of Corporate Directors (NACD) named the CPP Investments Board of Directors as a winner of this year’s NACD NXT® awards. NACD NXT showcases boards that are leveraging innovation and diversity to elevate company performance, and this is the first time the recognition has been awarded to a Canada-based organization.

- Board Chairperson Heather Munroe-Blum was appointed to The Committee on the Future of Corporate Governance in Canada, a joint initiative established by TMX Group and the Institute of Corporate Directors to provide updated guidance on corporate governance for Toronto Stock Exchange-listed companies.

Bond issuance

- Completed two international debt offerings: GBP one-year term notes totalling £200 million and USD five-year term notes totalling US$1 billion. CPP Investments uses a conservative amount of short- and medium-term debt as one of several tools to manage our investment operations. Debt issuance gives CPP Investments flexibility to fund investments that may not match our contribution cycle. Net proceeds from the issuances will be used by CPP Investments for general corporate purposes.

Second-Quarter Investment Highlights:

Active Equities

- Invested an additional C$309 million in a rights offering by Cellnex Telecom S.A., a leading mobile-tower owner and operator based in Spain, holding total ownership in the company at 4.95%.

- Invested US$50 million in Perfect Day, Inc., an animal-free dairy maker, the first investment in our Climate Change Opportunities strategy.

Credit Investments

- Invested US$75 million in a senior secured term loan issued by Global Lending Services LLC, an auto financing solutions provider.

- Invested US$175 million in the first lien term loan, senior secured notes and second lien term loans of LogMeIn, Inc., a provider of remote working, collaboration and customer engagement software-as-a-service solutions.

- Committed to acquire up to US$1 billion of home improvement focused consumer loans from Service Finance Company, LLC, a sales finance business owned by ECN Capital Corp. Under the agreement, the purchases will be made through 2020 and 2021.

Private Equity

- Committed US$300 million in equity to the proposed acquisition of Virtusa Corporation (Virtusa) for an approximate 24% stake, alongside Baring Private Equity Asia. Virtusa is a global provider of a full spectrum of IT services.

- Increased our investment in Visma, the software-as-a-service provider headquartered in Norway, to an approximate 6% stake.

- Completed the acquisition of Galileo Global Education, a leading international provider of higher education and Europe’s largest higher education group, as part of a consortium of investors, with an investment of €550 million for a significant minority stake.

Real Assets

- Extended our partnership with GLP through the launch of the GLP Japan Income Fund (GLP JIF), the largest private open-ended logistics fund in Japan. The partnership with GLP was first established in 2011, and at the end of August 2020, CPP Investments successfully exited the investment in GLP JDV I, receiving approximately JPY 48 billion (C$590 million) of net proceeds. Following the disposition, CPP Investments recommitted JPY 25 billion (C$307 million) of the proceeds into the newly established GLP JIF.

- Expanded the existing multifamily joint venture alongside Cyrela Brazil Realty to include new partner, Greystar Real Estate Partners, LLC, the global leader in rental housing. Together, the joint venture partners will develop a portfolio of world-class rental housing assets across São Paulo and continue to target an investment of up to R$1 billion in combined equity. We will maintain majority interest in the joint venture.

Asset Dispositions:

- Sold our ownership interest in Zoox, a U.S. technology company focused on developing a fully integrated autonomous vehicle mobility solution, as part of Amazon.com, Inc.’s acquisition of the company. Our ownership interest was initially acquired in 2018.

- Sold our 45% stakes in AMLI 900, AMLI Lofts, AMLI Campion Trail, and AMLI Arts Center, multifamily properties in the U.S. Combined net proceeds from the sales were approximately US$224 million. Our ownership interests were initially acquired in 2012 and 2013.

- Exited the investment in luxury retailer Neiman Marcus Group LTD LLC through Chapter 11 proceedings in U.S. Bankruptcy Court and, as a result, did not realize any net proceeds from the investment. Along with our co-sponsor, we continue to be majority investors in Mytheresa, a high-growth, online ultra-luxury fashion retailer. Our ownership interest was initially acquired in 2013.

- Sold 10,000,000 shares in the capital of Battle North Gold Corporation, a Canadian gold mine developer, through the open markets for net proceeds of approximately C$19 million.

Transaction Highlights Following the Quarter:

- Entered into an agreement to invest an additional C$50 million, through a private placement of common shares, in Premium Brands Holdings Corporation, a specialty food manufacturing and differentiated food distribution businesses, to support its joint acquisition of Clearwater Seafoods Incorporated with a Mi’kmaq First Nations coalition.

- Invested an additional US$350 million in Viking Holdings Ltd, the parent company of Viking Cruises, alongside our co-investor TPG Capital. Viking Cruises is a leading provider of worldwide river and ocean cruises and this investment will support its continued development. The transaction is subject to customary closing conditions, including regulatory approvals.

- Invested in a combination of secondary offerings and market purchases of Avantor Inc., a leading global provider of products and services to customers in the biopharma, healthcare, education and government, and advanced technologies and applied materials industries, holding total ownership in the company at 2.0% with a combined investment of US$285 million.

- Allocated an additional £300 million of equity to investment vehicles in the United Kingdom targeting the logistics sector, alongside Goodman Group and APG Asset Management N.V. The expansion follows the success of the Goodman U.K. Partnership established in 2015.

- Exited our 18% ownership stake in Advanced Disposal Services Inc., a solid waste services company in the U.S., through its acquisition by Waste Management Inc. Net proceeds from the sale were US$502 million. Our ownership stake was originally acquired in 2016.

- Converted and sold our convertible debt position in Bloom Energy, a manufacturer of solid oxide fuel cells in the U.S. Net proceeds from the sales and an April 2020 partial repayment from the company were approximately US$452 million. Our position was initially acquired in 2015, followed by two further investments in 2016 and 2017.

- Sold our 50% interest in Phase One of Nova, an office-led mixed-used development in London Victoria, U.K. Net proceeds from the sale are expected to be approximately C$720 million. Our ownership interest was initially acquired in 2012.

- Invested €200 million in Embracer Group, a Sweden-listed developer and publisher active in the global video game industry, for a 3% stake.

About Canada Pension Plan Investment Board

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 20 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At September 30, 2020, the Fund totalled $456.7 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

Disclaimer

Certain statements included in this press release constitute “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable United States safe harbors. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United States securities laws. Forward-looking information and statements include all information and statements regarding CPP Investments’ intentions, plans, expectations, beliefs, objectives, future performance, and strategy, as well as any other information or statements that relate to future events or circumstances and which do not directly and exclusively relate to historical facts. Forward-looking information and statements often but not always use words such as “trend,” “potential,” “opportunity,” “believe,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions. The forward-looking information and statements are not historical facts but reflect CPP Investments’ current expectations regarding future results or events. The forward-looking information and statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, including available investment income, intended acquisitions, regulatory and other approvals and general investment conditions. Although CPP Investments believes that the assumptions inherent in the forward-looking information and statements are reasonable, such statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. CPP Investments does not undertake to publicly update such statements to reflect new information, future events, and changes in circumstances or for any other reason. The information contained on CPP Investments’ website, LinkedIn, Facebook and Twitter are not a part of this press release. CPP INVESTMENTS, INVESTISSEMENTS RPC, Canada Pension Plan Investment Board, L’OFFICE D’INVESTISSEMENT DU RPC, CPPIB and other names, phrases, logos, icons, graphics, images, designs or other content used throughout the press release may be trade names, registered trademarks, unregistered trademarks, or other intellectual property of Canada Pension Plan Investment Board, and are used by Canada Pension Plan Investment Board and/or its affiliates under license. All rights reserved.

Media Contacts

Darryl Konynenbelt

Director, Media Relations

T: +1 416 972 8389

dkonynenbelt@cppib.com