All figures in Canadian dollars unless otherwise noted.

Highlights1:

- Net income of $59.8 billion, one of the highest levels in our history

- Net annual return of 9.3% in fiscal 2025

- Net annual return of 14.2% in calendar 2024

- 10-year net return of 8.3%

- Cumulative net income of $492.1 billion since inception in 1999

TORONTO, ON (May 21, 2025): Canada Pension Plan Investment Board (CPP Investments) ended its fiscal year on March 31, 2025, with net assets of $714.4 billion, compared to $632.3 billion at the end of fiscal 2024. The $82.1 billion increase in net assets consisted of $59.8 billion in net income and $22.3 billion in net transfers from the Canada Pension Plan (CPP).

The Fund, which consists of the base CPP and additional CPP accounts, generated a net return of 9.3% for the fiscal year. Since the CPP is designed to serve multiple generations of beneficiaries, evaluating the performance of CPP Investments over extended periods is more suitable than in single years. The Fund returned a 10-year annualized net return of 8.3%. Since CPP Investments first started investing the Fund in 1999, it has contributed $492.1 billion in cumulative net income, which is approximately 70% of its value today, with the balance attributed to net contributions.

“The Fund’s performance during the fiscal year was strong, with all investment departments contributing to one of the highest levels of annual net income in our history — despite market headwinds in the final quarter,” said John Graham, President & CEO. “The Fund remains on solid financial footing and is well-positioned to deliver long-term value for current and future generations of Canadians.”

On a calendar-year basis, the Fund delivered a 14.2% net return, reflecting strong global equity market growth during that period, compared to a lower return environment in the last quarter of the fiscal year.

The multi-strategy platform employed by CPP Investments continues to deliver value. Strong returns across multiple assets classes were instrumental in driving the Fund’s fiscal year results. Public equities, especially in the U.S. and China, delivered gains despite geopolitical and trade-related headwinds in the fourth quarter. Investments in private equities and infrastructure contributed positively to returns, as did credit, which benefited from tightening credit spreads. The strengthening of other currencies against the Canadian dollar was a significant contributor to gains across our asset classes for the year.

“Our portfolio – diversified across sectors, themes, asset types and geographic markets – is built for the long term. And while we’re not immune to short-term market shifts, our strategy is designed to remain resilient despite periodic fluctuations,” added Graham. “Our investment strategy continues to deliver, earning $492.1 billion in cumulative net income since we started investing the Fund more than 25 years ago. By investing today in high-quality opportunities – from technology to infrastructure – we’re positioning the Fund to deliver steady returns over the long term.”

“In times of uncertainty, Canadians can take comfort in knowing that the CPP is designed to support them in retirement,” added Graham. “At CPP Investments, our team is working diligently to help ensure the Fund remains financially strong for generations to come. In fact, in 2024, approximately six million Canadians received their CPP benefits.”

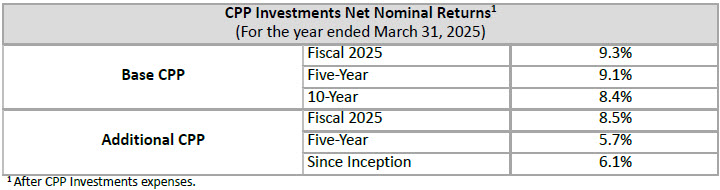

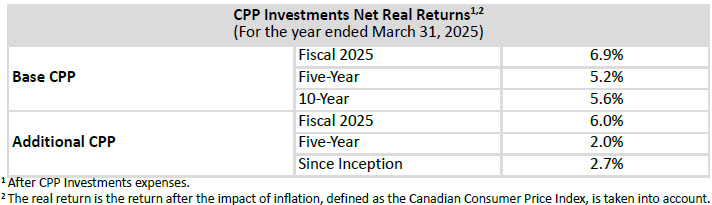

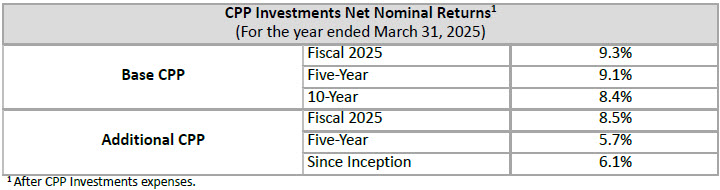

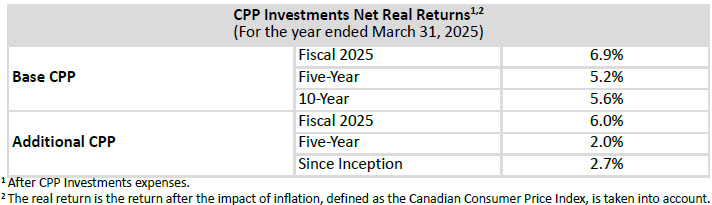

Performance of the Base and Additional CPP Accounts

The base CPP account ended the fiscal year on March 31, 2025, with net assets of $655.8 billion, compared to $593.8 billion at the end of fiscal 2024. The $62.0 billion increase in net assets consisted of $55.8 billion in net income and $6.2 billion in net transfers from the base CPP. The base CPP account’s net return for the fiscal year was 9.3% and the 10-year annualized net return was 8.4%.

The additional CPP account ended the fiscal year on March 31, 2025, with net assets of $58.6 billion, compared to $38.5 billion at the end of fiscal 2024. The $20.1 billion increase in net assets consisted of $4.0 billion in net income and $16.1 billion in net transfers from the additional CPP. The additional CPP account’s net return for the fiscal year was 8.5% and the annualized net return since inception was 6.1%.

The additional CPP was designed with a different legislative funding profile and contribution rate compared to the base CPP. Given the differences in its design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in its net contribution profile, the additional CPP account’s assets are also expected to grow at a much faster rate than those in the base CPP account.

Long-Term Financial Sustainability

Every three years, the Office of the Chief Actuary of Canada, an independent federal body that provides checks and balances on the future costs of the CPP, evaluates the financial sustainability of the CPP over a long period. In the most recent triennial review published in December 2022, the Chief Actuary reaffirmed that, as at December 31, 2021, both the base and additional CPP continue to be financially sustainable over the long term at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2021, the base CPP account will earn an average annual rate of return of 3.69% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.27%.

Relative Performance

The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. CPP Investments was created to invest and help grow the Fund, maximizing returns without undue risk of loss.

In fiscal 2025, the benchmark portfolios replaced the market risk targets (previously known as the reference portfolios) as our benchmark against which relative performance is measured. The benchmark portfolios provide target allocations for our active and balancing investment strategies. We construct the benchmark portfolios by aggregating the public market index benchmarks that serve as passive, investible alternatives for each individual investment strategy.

Prior to the introduction of the benchmark portfolios, the market risk targets served as both our performance benchmark and a representation of our targeted level of market risk. Over time, however, the market risk targets became less aligned with the targeted exposures of our investment portfolios. During the first era of active management, the composition of the reference portfolio matched that of the base CPP investment portfolio. Over time, the development and growth of a multi-strategy platform made the reference portfolio significantly less diversified than a sophisticated global portfolio that is representative of CPP Investments’ statutory mandate, rendering it an inadequate measure of performance today. The benchmark portfolios better reflect our diversified investment approach and long-term strategy, offering performance benchmarking that is more relevant and accurate today as an alternative passive strategy to the investment portfolios compared to the earlier era.

CPP Investments’ performance relative to the benchmark portfolios is measured in percentage terms, after deducting all costs, known as value added.

On a relative basis, the Fund’s 10-year return outperformed the aggregated benchmark portfolios, generating 1.4% in value added. This amounts to billions of dollars that are attributable to active management (after costs). The benchmark portfolios’ fiscal 2025 return of 10.9% exceeded the Fund’s net return of 9.3% by 1.6%.

The benchmark portfolios’ outperformance in fiscal 2025 was primarily due to strong double-digit returns from levered global public equity indexes. While the Fund’s diversified asset mix helps reduce the impact of sharp equity market declines, it can also limit participation in equity market rallies, such as those reflected in the benchmark portfolios’ public market indexes.

For information on which of our decisions we believe are adding the most value, please refer to page 39 of the CPP Investments Fiscal 2025 Annual Report.

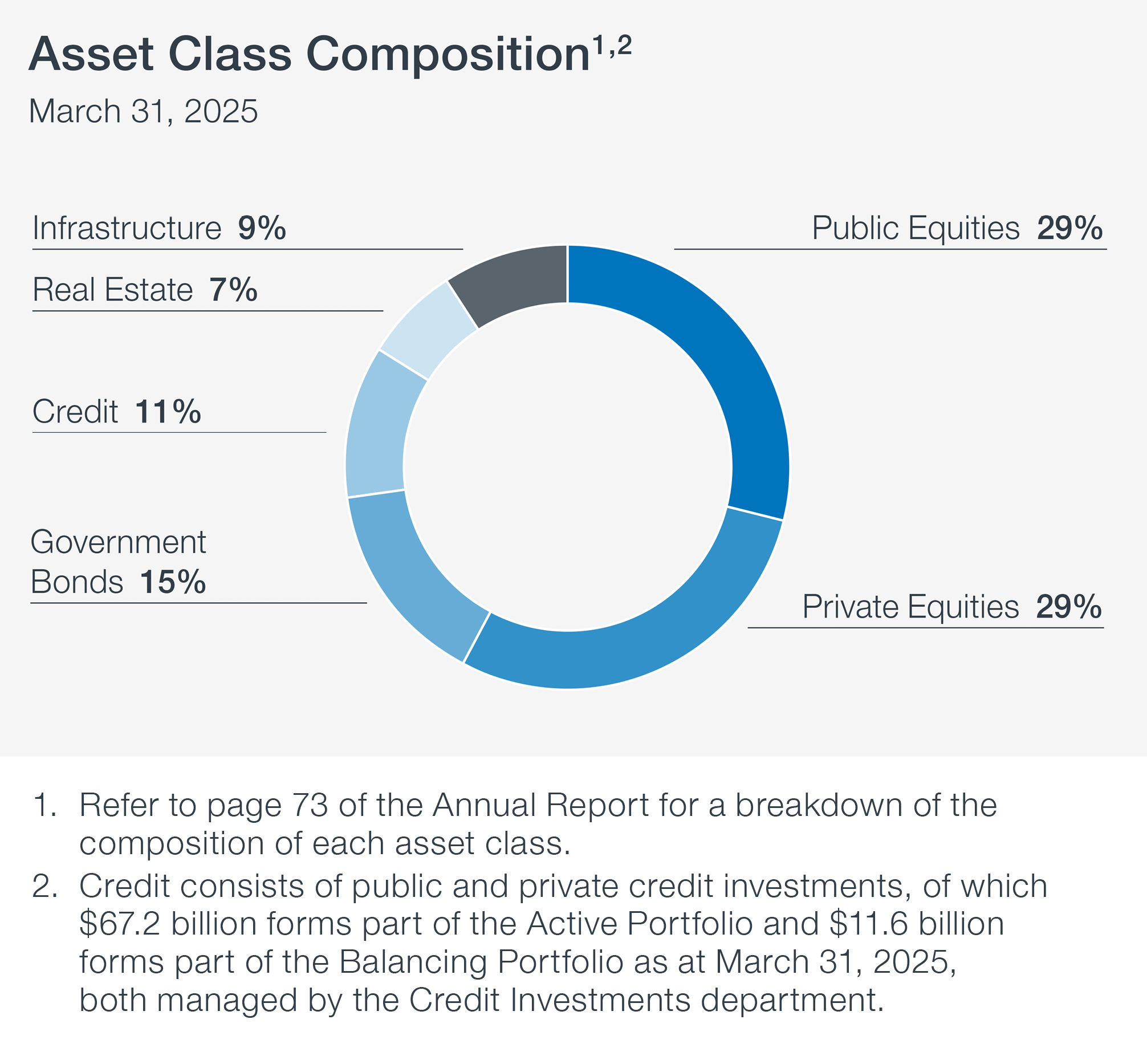

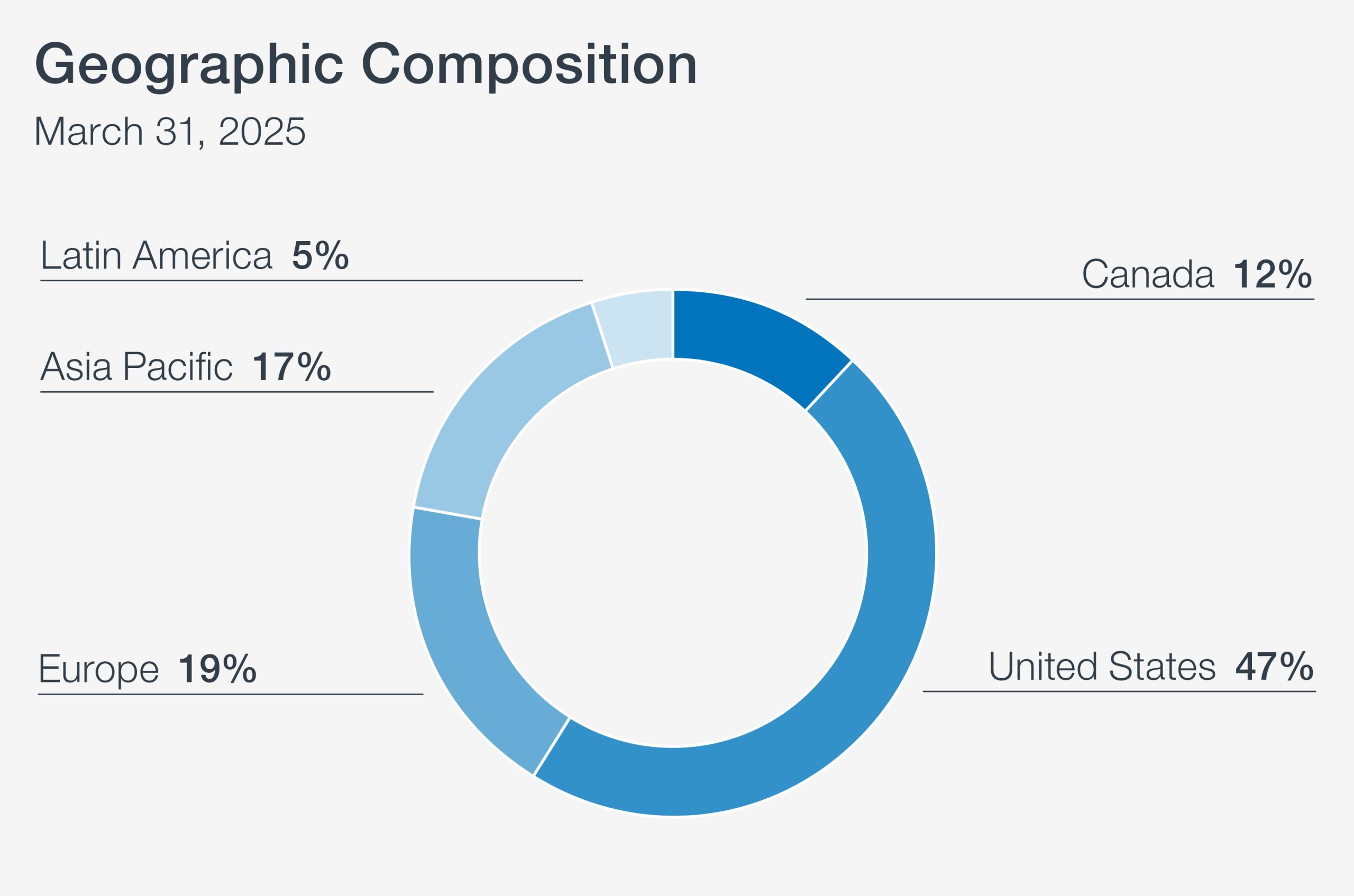

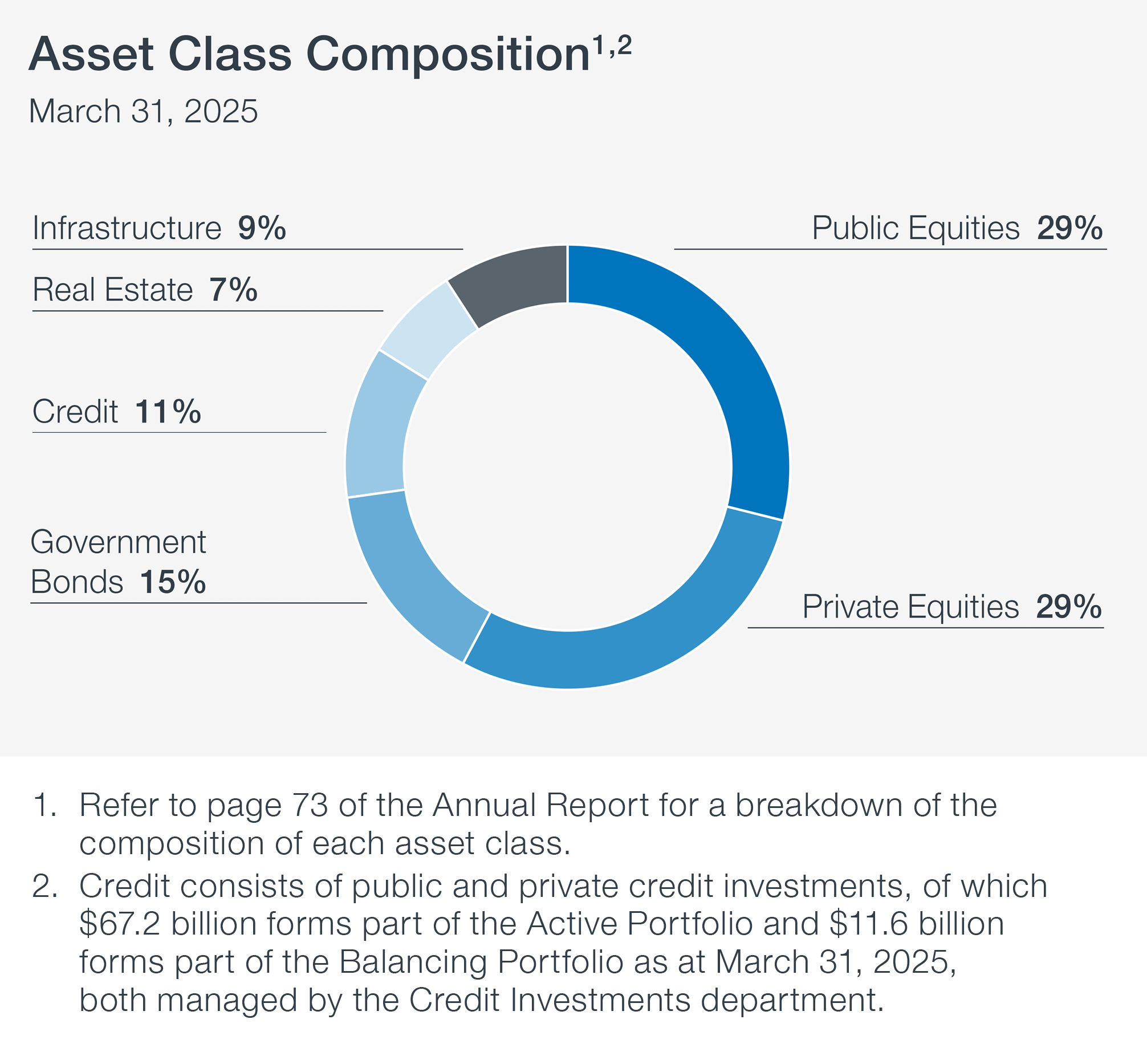

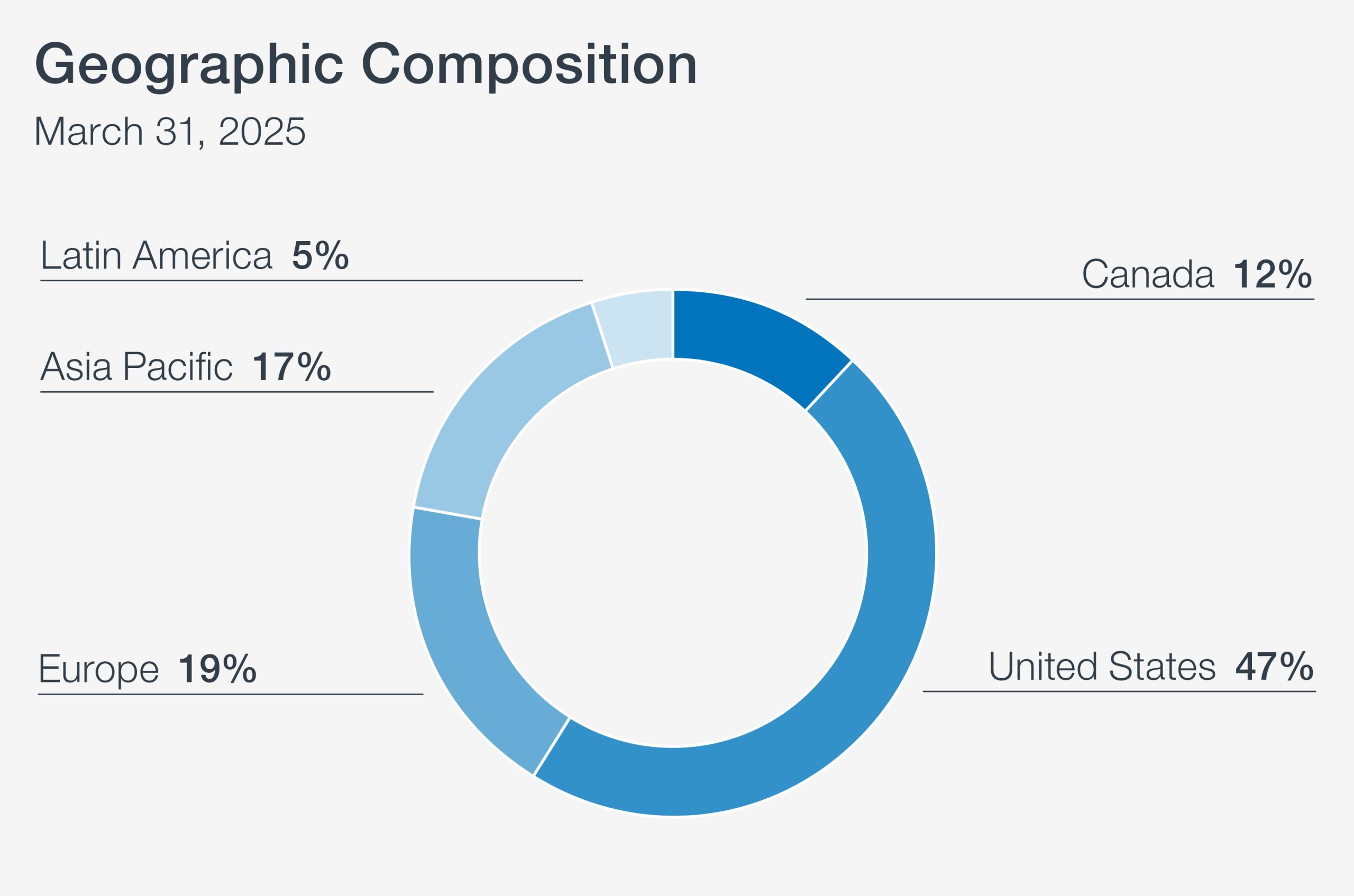

Asset Class and Geography Composition

CPP Investments, inclusive of both the base CPP and additional CPP investment portfolios, is diversified across asset classes and geographic markets.

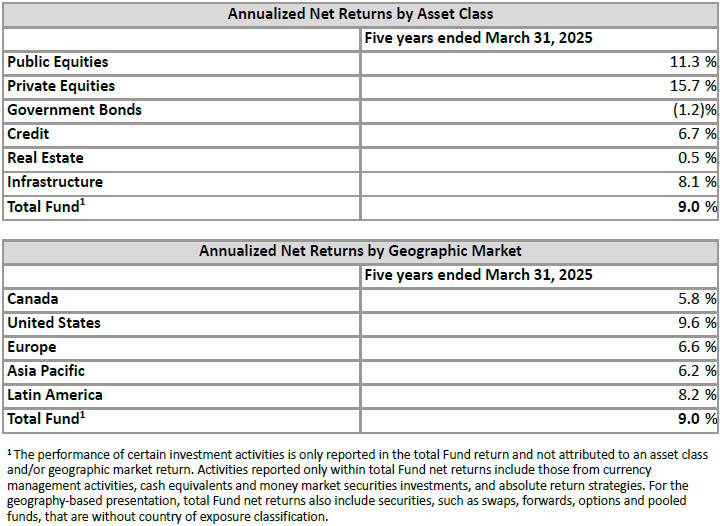

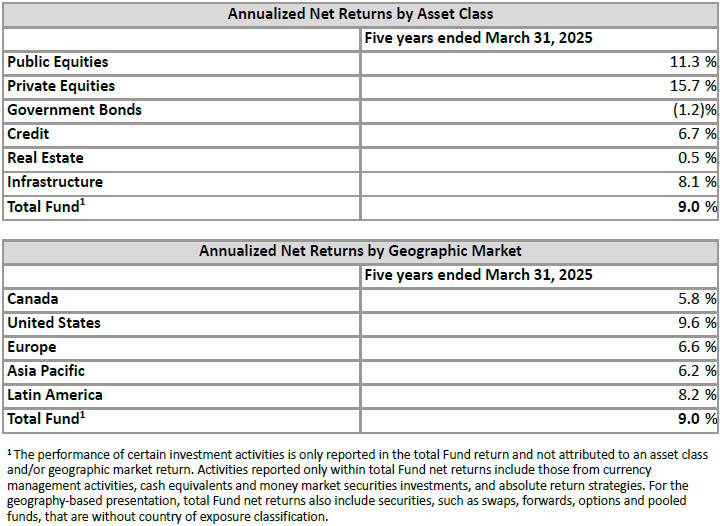

Performance by Asset Class and Geographic Markets

Five-year Fund returns by asset class and geographic markets are reported in the tables below. A more detailed breakdown of performance by investment department is included on page 50 of the Fiscal 2025 Annual Report.

Managing CPP Investments Costs

Discipline in cost management is a main thrust of our public accountability as we operate an internationally competitive enterprise that exists to create enduring value for multiple generations of beneficiaries of the CPP.

To generate $59.8 billion of net income, CPP Investments directly and indirectly incurred $1,756 million of operating expenses, $1,760 million in investment management fees and $2,223 million in performance fees paid to external managers, as well as $730 million of transaction-related costs.

Operating expenses increased by $139 million due to inflationary pressure impacting salaries and employee benefits, incentive compensation aligned with Fund performance, foreign exchange impact, and expenditures related to technology and software licenses. Our operating expense ratio continues to decline and is 26.1 basis points (bps), which is below the five-year average of 27.7 bps and below the 27.5 bps in fiscal 2024. Management fees increased by $311 million, driven by growth in externally managed assets. Performance fees increased by $156 million reflecting the positive performance delivered by our external managers.

Transaction-related costs, which increased by $303 million, vary from year to year according to the activity level, size and complexity of our investing activities. In fiscal 2025, we announced more than 100 transactions of C$100 million or more. Major infrastructure, sustainable energy, and private equity transactions in the U.S. and Europe drove the year-over-year increase. Other categories affecting our total cost profile include taxes and expenses associated with various forms of leverage.

Page 28 of the Fiscal 2025 Annual Report provides a discussion of how we manage our costs. For a complete overview of CPP Investments combined expenses, including year-over-year comparisons, refer to page 47.

Operational Highlights for the Year

Corporate developments

- Ranked one of the world’s top-performing public pension funds by Global SWF when measuring annualized returns between calendar years 2015 and 2024 (Global SWF Data Platform, May 2025).

- Ranked second among 75 pension funds across 15 countries in the 2024 Global Pension Transparency Benchmark developed by Top1000funds.com and CEM Benchmarking. The Global Pension Transparency Benchmark focuses on the transparency and quality of public disclosures relating to the completeness, clarity, information value and comparability of disclosures.

- Completed a strategic review of our operational footprint resulting in the planned closure of our San Francisco office by the end of the calendar year. This decision was the result of a thorough analysis of business activities that best serve our global operations. The San Francisco office was established in January 2019 in pursuit of valuable investment opportunities and deep relationships within the technology ecosystem. We continue to pursue these objectives globally.

Leadership announcements

- Announced the following Senior Management Team appointments:

- Caitlin Gubbels as Senior Managing Director & Global Head of Private Equity;

- Priti Singh as Senior Managing Director & Chief Risk Officer; and

- Heather Tobin as Senior Managing Director & Global Head of Capital Markets and Factor Investing.

- John Graham was appointed the Chair of FCLTGlobal’s board of directors. FCLTGlobal is a non-profit organization, whose members are leading companies and investors worldwide, that develops actionable research and tools to build a long-term sustainable global economy. John has been a member of FCLTGlobal’s board since 2021. CPP Investments is the co-founder of FCLTGlobal having led the joint initiative that created FCLTGlobal in 2016.

Public accountability

- Hosted in-person public meetings in Calgary, Edmonton, Ottawa, Regina, Winnipeg, Halifax, St. John’s, Charlottetown, Fredericton and Vancouver as well as a national virtual meeting. Public meetings are held every two years across Canada, reflecting our continued accountability to the more than 22 million CPP contributors and beneficiaries by providing an accessible forum to ask questions of our senior leaders.

Debt issuance

- Announced the addition of Cedar Leaf Capital, Canada’s first majority Indigenous-owned investment dealer, to our Canadian Dollar syndicate in the bond market.

Transaction Highlights for the Year

Active Equities

- Invested approximately C$160 million for a 2.1% stake in Quebecor Inc., a Canadian leader in telecommunications, entertainment, news media and culture.

- Invested C$113 million in Teck Resources, a leading Canadian resource company with a portfolio of world-class copper and zinc operations across North and South America, resulting in a less than 1% stake.

- Invested an additional C$50 million in WSP Global through a private placement to support its acquisition of POWER Engineers, Incorporated. We have been invested in WSP Global, a Canadian-headquartered leading global professional services firm, since 2011 and we hold a 10.3% stake.

- Invested C$178 million in Sabesp, Brazil’s largest sanitation company and one of the largest in the world, serving the São Paulo state, and representing a 1.3% ownership interest in the company.

- Invested an additional C$463 million in Asahi Group Holdings, a Japanese beverage holding company, resulting in a total ownership stake of 1.8%.

- Invested C$133 million for a 0.5% stake in First Solar, a leading photovoltaic solar technology and manufacturing company headquartered in the U.S.

- Invested €600 million through a private placement for a 1.3% interest in the public shares of Denmark-based DSV A/S to support the funding of DSV’s acquisition of Schenker AG. This acquisition enhances the company’s position as a world leading player within the global transport and logistics industry.

- Exited our approximate 6% stake in Delhivery, India’s largest integrated third-party logistics service provider. Net proceeds from the sale were C$298 million. Our initial investment in the company was made in 2019.

- Realized a partial interest of our stake in Viking Holdings for net proceeds of C$2 billion through the company’s initial public offering as well as through subsequent follow-on offerings. Viking Holdings is a global cruise operator and travel company. Our initial investment in the company was made in 2016 and we continue to own approximately 13% of shares outstanding.

Credit Investments

- Invested US$59 million in Spirit Airline’s refinanced Super Class B Enhanced Equipment Trust Certificates. Spirit Airlines is a U.S.-based airline that operates flights throughout the U.S., Caribbean, and Latin America.

- Completed a US$475 million secured term loan and working capital facility to finance a Sixth Street consortium’s acquisition of Select Portfolio Servicing (SPS) from UBS. Founded in 1989, SPS is the leading servicer of non-agency mortgages in the U.S.

- Committed KRW 473.1 billion (C$479 million) in a separately managed account by TPG Angelo Gordon, targeting real estate credit opportunities in South Korea.

- Completed a US$250 million anchor investment in the Antares Private Credit Fund, which holds Antares-originated loans to private companies in the U.S.

- Invested SEK 1.2 billion (C$150 million) in the holding company facilities of Open Infra, a fibre-to-the-home developer, owner and operator across Sweden and Germany.

- Committed approximately C$90 million to a mezzanine forward-flow agreement with HomeTree, a U.K. whole-market energy player. The loan will support HomeTree’s expansion of its solar systems and heat pumps financing business.

- Committed to invest up to £75 million in a mezzanine loan facility supporting ThinCats, an alternative lender to mid-sized businesses in the U.K.

- Invested US$250 million in a loan facility to support CoreWeave, Inc. to purchase contracted Nvidia Graphics Processing Units (GPU) servers for cloud computing. Based in the U.S., CoreWeave provides cloud infrastructure at scale to support artificial intelligence and machine learning workstreams and is one of the largest purchasers of Nvidia GPUs.

- Committed C$185 million in an Indian Rupee-denominated debt facility to Enfinity Global to build 1.2-gigawatts of solar and wind power plants in India. Based in the U.S., Enfinity Global is a renewable energy and sustainable services company with a large portfolio of solar, onshore wind and battery storage assets across the U.S., Europe, and Asia, in various stages of development.

Private Equity

- Invested US$100 million for an approximate 14% stake alongside PAG in the combined company of Manjushree Technopack and Pravesha, creating a diversified market-leading rigid plastic packaging player in India.

- Committed US$200 million to Stone Point Trident X, managed by Stone Point Capital, a U.S.-based private equity firm focused on financial services and related industries.

- Invested US$80 million in Kestra Holdings, which offers industry-leading wealth management platforms for independent wealth management professionals across the U.S., alongside Stone Point Capital.

- Committed US$300 million to Blackstone Capital Partners Asia III, managed by Blackstone Capital Partners Asia, a leading private equity manager focused on control buyout investments in the Asia Pacific Region.

- Completed C$105 million in follow-on investments to FNZ, a global wealth technology platform, as well as an additional US$58 million follow-on subsequent to fiscal year end.

- Invested JPY 11.5 billion (C$105 million) for a 7% stake in Alinamin Pharmaceutical, a Japan-based developer and manufacturer of over-the-counter drug and health supplement products, alongside MBK Partners.

- Committed approximately €460 million for a significant minority stake in Regnology, alongside a new investment made from Nordic Capital XI in addition to its current ownership. Headquartered in Germany, Regnology is a global software provider with a focus on regulatory reporting solutions for financial institutions.

- Invested US$180 million alongside Advent in the take-private of Nuvei, a global payments provider based in Montreal, Canada.

- Invested approximately US$1 billion for a significant minority interest in Novolex to support its combination with Pactiv Evergreen Inc., creating a leading manufacturer in food, beverage and specialty packaging products across North America.

- Completed the acquisition of Keywords Studios, a leading technology services provider to the global video gaming industry, alongside EQT and Temasek. We invested approximately US$515 million for an approximate 24% stake in the company.

- Co-invested US$100 million in Jersey Mike’s, a leading franchisor of fast casual submarine sandwich shops with approximately 3,000 stores across 50 U.S. states and in Canada, alongside Blackstone.

- Completed a disposal and reinvestment of our stake in Nord Anglia Education, generating net proceeds of US$2 billion. We have been invested in Nord Anglia, a leading international school organization, since 2017. Our current ownership stake is 15%.

- Committed US$75 million to Radical Growth I, managed by Radical Ventures, a Canadian-headquartered AI-focused venture and growth manager with offices in Toronto, San Francisco and London, as well as an additional US$75 million to Radical Fund IV subsequent to the fiscal year end. The total commitment now stands at approximately US$280 million across various fundraising cycles since the initial investment in 2019.

- Committed approximately €550 million to acquire an approximate 20% stake in team.blue, a leading webhosting services provider and digital enabler for entrepreneurs and small- and medium-sized businesses across Europe.

- Committed US$450 million to Ontic, a provider of specialized parts and repair services for established aerospace technologies. Ontic is headquartered in the U.K.

Real Assets

- Completed a follow-on investment of INR 20.8 billion (C$346 million) in the units of National Highways Infra Trust (NHIT), an Infrastructure Investment Trust sponsored by the National Highways Authority of India. Since our initial investment in 2021, we have invested INR 57.6 billion (C$960 million) to date.

- Committed €500 million to EQT Infrastructure VI, which will invest in value-add infrastructure opportunities across U.S., Europe and selectively Asia.

- Signed a new 50:50 joint venture agreement with Cyrela Brazil Realty, the largest residential real estate developer in Brazil, with an investment target of R$1.7 billion (C$400 million) to develop residential condominiums in São Paulo, Brazil.

- Signed a joint venture agreement with Equinix, Inc., a digital infrastructure company, and GIC with the intent to jointly raise more than US$15 billion in capital. We have made an initial equity allocation of up to US$2.4 billion and will control a 37.5% equity interest. The joint venture will develop state-of-the-art Equinix xScale data centres in the U.S. to serve the unique core workload deployment needs of the world’s largest cloud service providers, including hyperscalers, which are key players in the AI ecosystem.

- Completed a follow-on commitment of up to R$2.2 billion (C$532 million) to Brazilian water and sanitation company, Iguá Saneamento, to support its business growth related to its new major concession contract in the Brazilian state of Sergipe. We currently own a 66.5% stake in the company.

- Acquired a 12% interest in AirTrunk, the leading Asia-Pacific data centre operator, in partnership with Blackstone, in a transaction that values the business at an implied enterprise value of over A$24 billion (C$22 billion), including capital expenditures for committed projects.

- Committed €500 million to Blackstone Real Estate Partners Europe VII, which invests in under-managed, well-located real estate assets across Europe.

- Entered into a definitive agreement to jointly acquire ALLETE, Inc. alongside Global Infrastructure Partners for US$6.2 billion, including the assumption of debt. Headquartered in Duluth, Minnesota, ALLETE is focused on addressing the clean-energy transition by expanding renewables, reducing carbon, enhancing grid resiliency, and driving innovation. Upon closing, our ownership stake in ALLETE will be 40%.

- Entered into agreements related to our ownership in 407 Express Toll Route (407 ETR), a 108-km toll highway spanning the Greater Toronto Area in Canada. Net proceeds from the applicable transactions are expected to be approximately C$2.39 billion for a net 5.81% sold after closing. We continue to hold a significant interest in 407 ETR.

- Signed an agreement to sell our entire 15.75% stake in U.S. power producer Calpine Corporation to Constellation Energy as part of Constellation’s acquisition of Calpine. As at signing, net proceeds are expected to be approximately US$700 million in cash and US$1.9 billion in Constellation stock. Our original investment in the company was made in 2018.

Transaction Highlights Following the Year-End

- Invested in the loan facilities of Waste Services Group, a waste management solution provider in Australia.

- Invested approximately €275 million in IFS, acquiring shares from EQT alongside other investors. Headquartered in Sweden, IFS is a leading global provider of cloud enterprise software and industrial AI applications.

- Committed to invest in a new wireless network infrastructure subsidiary of Rogers Communications Inc. through a Blackstone-led acquisition of a non-controlling interest in the business unit, subject to closing.

- Completed the sale of a diversified portfolio of 25 limited partnership fund interests in North American and European buyout funds to Ares Management Private Equity Secondaries funds and CVC Secondary Partners for net proceeds of approximately C$1.2 billion. The portfolio of interests represents various primary commitments and secondary purchases made in funds over 10 years old.

- Committed A$150 million (C$135 million) to Pacific Equity Partners PE Fund VII, which focuses on upper mid-market buyout opportunities in Australia and New Zealand.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Canada Pension Plan Fund in the best interests of the more than 22 million contributors and beneficiaries. In order to build diversified portfolios of assets, we make investments around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At March 31, 2025, the Fund totalled $714.4 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Instagram or on X @CPPInvestments.

Disclaimer

Certain statements included in this press release constitute “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable United States safe harbors. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United States securities laws. Forward-looking information and statements include all information and statements regarding CPP Investments’ intentions, plans, expectations, beliefs, objectives, future performance, and strategy, as well as any other information or statements that relate to future events or circumstances and which do not directly and exclusively relate to historical facts. Forward-looking information and statements often but not always use words such as “trend,” “potential,” “opportunity,” “believe,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions. The forward-looking information and statements are not historical facts but reflect CPP Investments’ current expectations regarding future results or events. The forward-looking information and statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, including available investment income, intended acquisitions, regulatory and other approvals and general investment conditions. Although CPP Investments believes that the assumptions inherent in the forward-looking information and statements are reasonable, such statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. CPP Investments does not undertake to publicly update such statements to reflect new information, future events, and changes in circumstances or for any other reason. The information contained on CPP Investments’ website, LinkedIn, Facebook and Twitter are not a part of this press release. CPP INVESTMENTS, INVESTISSEMENTS RPC, Canada Pension Plan Investment Board, L’OFFICE D’INVESTISSEMENT DU RPC, CPPIB and other names, phrases, logos, icons, graphics, images, designs or other content used throughout the press release may be trade names, registered trademarks, unregistered trademarks, or other intellectual property of Canada Pension Plan Investment Board, and are used by Canada Pension Plan Investment Board and/or its affiliates under license. All rights reserved.

1 Certain figures in the news release may not add up due to rounding.