All figures in Canadian dollars unless otherwise noted.

Highlights1:

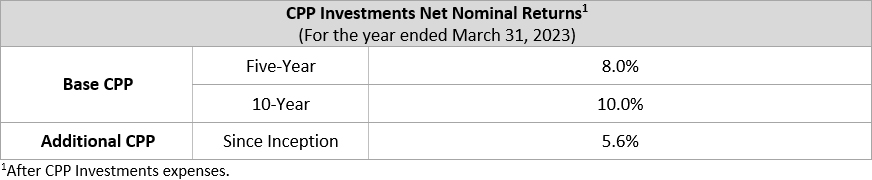

- Fiscal 2023 net return of 1.3%

- 10-year net return of 10.0%

- Net assets increase by $31 billion for fiscal year

- One-year dollar value-added of $2 billion or 1.3% above the Reference Portfolios

- Compounded dollar value-added of $47 billion since inception of active management

TORONTO, ON (May 24, 2023): Canada Pension Plan Investment Board (CPP Investments) ended its fiscal year on March 31, 2023, with net assets of $570 billion, compared to $539 billion at the end of fiscal 2022.

The $31 billion increase in net assets consisted of $8 billion in net income and $23 billion in net transfers from the Canada Pension Plan (CPP). CPP Investments received greater than usual net CPP cash flows in fiscal 2023 due to higher employment rates, an increased limit to the year’s maximum pensionable earnings, an increase to additional CPP contribution inflows, and a lump-sum inflow in the fourth quarter due to forecasting adjustments made by the CPP.

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved a net return of 1.3% for the fiscal year. Since the CPP is designed to serve multiple generations of beneficiaries, evaluating the performance of CPP Investments over extended periods is more suitable than in single years. The Fund returned a 10-year annualized net return of 10.0%. Since its inception in 1999, CPP Investments has contributed $386 billion in cumulative net income to the Fund.

“Our strong long-term return of 10% over 10 years demonstrates that our active management strategy is on track,” said John Graham, President & CEO. “Despite significant declines in global equity and fixed income markets during our fiscal year, our investment portfolio remained resilient, delivering stable returns while outperforming major indexes.”

The positive fiscal-year results reflect returns on investments in infrastructure and certain U.S. dollar-denominated private equity and credit assets, which benefited from foreign exchange. External investment managers employing quantitative, equity, and fixed income trading strategies also contributed positively to results. Our performance was partially offset by significant declines in both equities and fixed income across major markets as high inflation and rising interest rates weighed heavily on both asset classes. The Canadian dollar depreciated against the U.S. dollar and other major currencies during the year, influenced by the impact of evolving monetary and fiscal policies across global economies. This had a positive impact on investment returns with a foreign currency gain of $25 billion.

Performance of the Base and Additional CPP Accounts

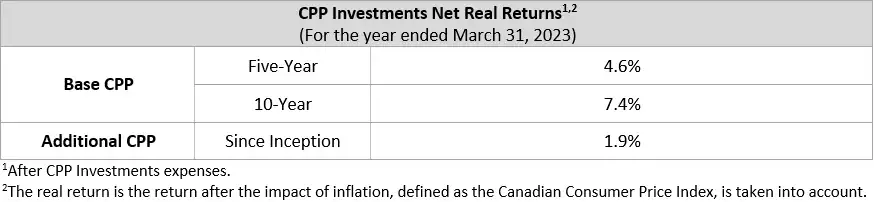

The base CPP account ended the fiscal year on March 31, 2023, with net assets of $546 billion, compared to $527 billion at the end of fiscal 2022. The $20 billion increase in net assets consisted of $8 billion in net income and $12 billion in net transfers from the CPP. The base CPP account achieved a 1.4% net return for the fiscal year and a five-year annualized net return of 8.0%.

The additional CPP account ended the fiscal year on March 31, 2023, with net assets of $24 billion, compared to $13 billion at the end of fiscal 2022. The $11 billion increase in net assets consisted of $331 million in net income and $11 billion in net transfers from the CPP. The additional CPP account achieved a 0.3% net return for the fiscal year and an annualized net return of 5.6% since its inception in 2019.

The additional CPP was designed with a different legislative funding target and contribution rate compared to the base CPP. Given the differences in their design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in their net contribution profiles, the assets in the additional CPP account are also expected to grow at a much faster rate than those in the base CPP account.

Long-Term Financial Sustainability

Every three years, the Office of the Chief Actuary of Canada, an independent federal body that provides checks and balances on the future costs of the CPP, evaluates the financial sustainability of the CPP over a long period. In the most recent triennial review published in December 2022, the Chief Actuary reaffirmed that, as at December 31, 2021, both the base and additional CPP continue to be sustainable over the long term at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2021, the base CPP account will earn an average annual rate of return of 3.69% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.27%.

“CPP Investments has a clear mission to help ensure the long-term financial sustainability of the CPP, which includes navigating through periods of volatility. In challenging economic times, it is helpful to reflect on how far we’ve come,” said Graham. “When CPP Investments was first created, it was projected that the Fund would earn $256 billion in investment income and grow to $368 billion at the end of 2022. Since that time, CPP Investments has made many strategic choices that have set the Fund on the path to exceed those projections by more than $200 billion. At $570 billion, this outperformance is due in part to the $386 billion in investment income earned over that period.”

Relative Performance

The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. CPP Investments has established benchmarks of passive, public-market indexes called Reference Portfolios that reflect the targeted level of market risk that we believe is appropriate for each of the base CPP and additional CPP accounts, while also serving as a point of measurement when assessing the Fund’s performance over the long term. CPP Investments’ performance relative to the Reference Portfolios can be measured in percentage or dollar terms, or dollar value-added, after deducting all expenses.

On a relative basis, the Fund’s net return of 1.3% outperformed the aggregated Reference Portfolios’ return of 0.1%. As a result, in fiscal 2023, net dollar value-added for the Fund was $2 billion. Over the five-year and 10-year periods, the Fund delivered an aggregate dollar value-added of $7 billion (or percentage value-added of 0.8%) and a dollar value-added of $18 billion (or 0.8%), respectively.

In investing for the long term, the Fund grows not only through the value added in a single year, but also through the compounding effect of continuous reinvestment of gains (net of losses). We calculate compounded dollar value-added as the total net dollars that CPP Investments has added to the Fund through active management, above the returns of the Reference Portfolios. CPP Investments has generated $47 billion of compounded dollar value-added, after all expenses, since the inception of active management in 2006.

For information on which of our decisions are adding the most value, please refer to page 39 of the CPP Investments Fiscal 2023 Annual Report.

Asset and Geography Mix

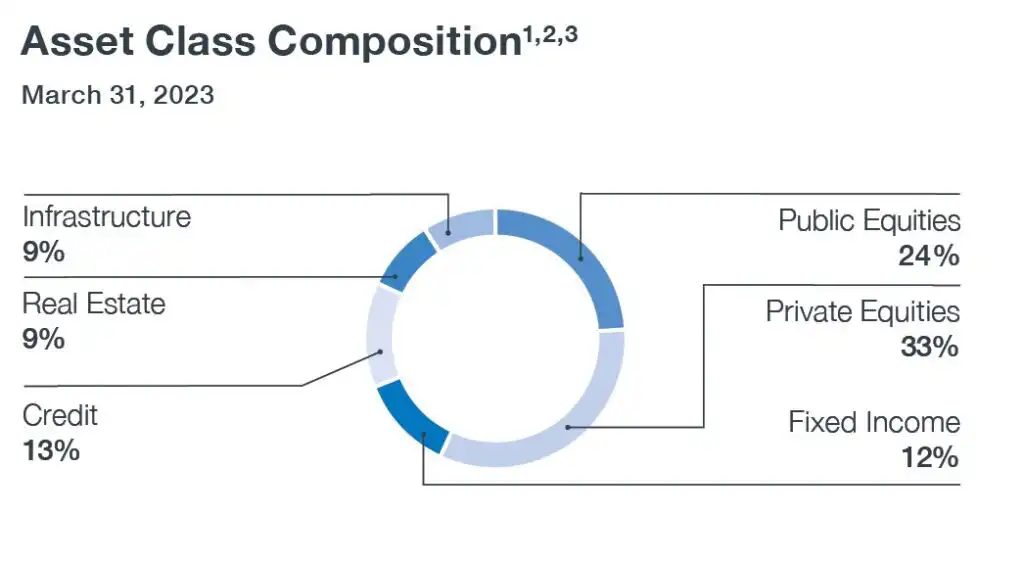

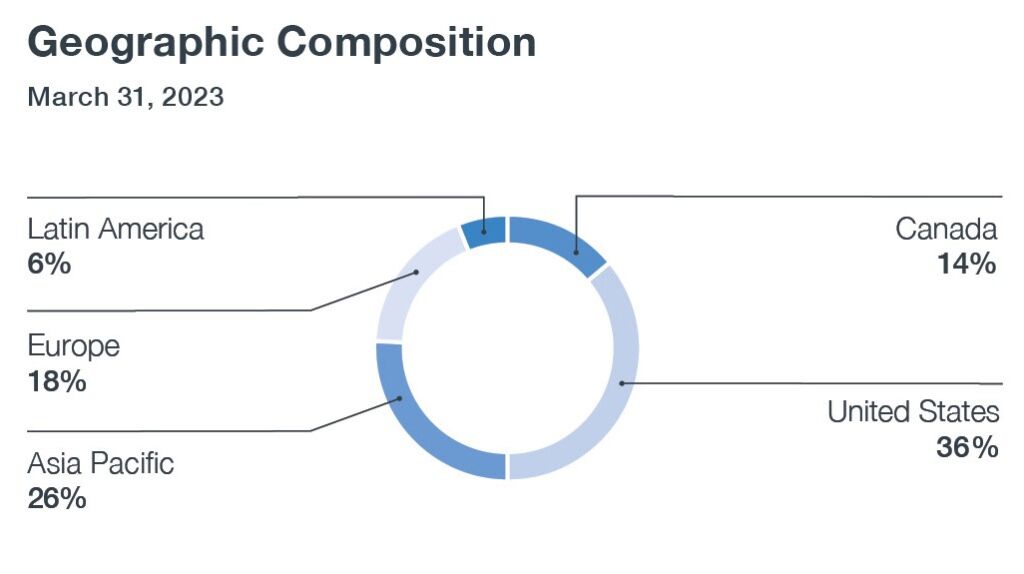

CPP Investments, inclusive of both the base CPP and additional CPP Investment Portfolios, is diversified across asset classes and geographies:

1 Fixed income consists of cash and cash equivalents, money market securities and government bonds, all net of financing liabilities. Public Equities include absolute return strategies and related investment liabilities.

2 As at March 31, 2023, the Real Assets investment department managed $52 billion of real estate, $52 billion of infrastructure and $32 billion of our private equity investments associated with sustainable energies. Collectively, these holdings represented 24% of net assets.

3 Credit consists of public and private credit investments of which $52 billion forms part of the Active Portfolio and $20 billion forms part of the Balancing Portfolio as at March 31, 2023, both managed by the Credit Investments department.

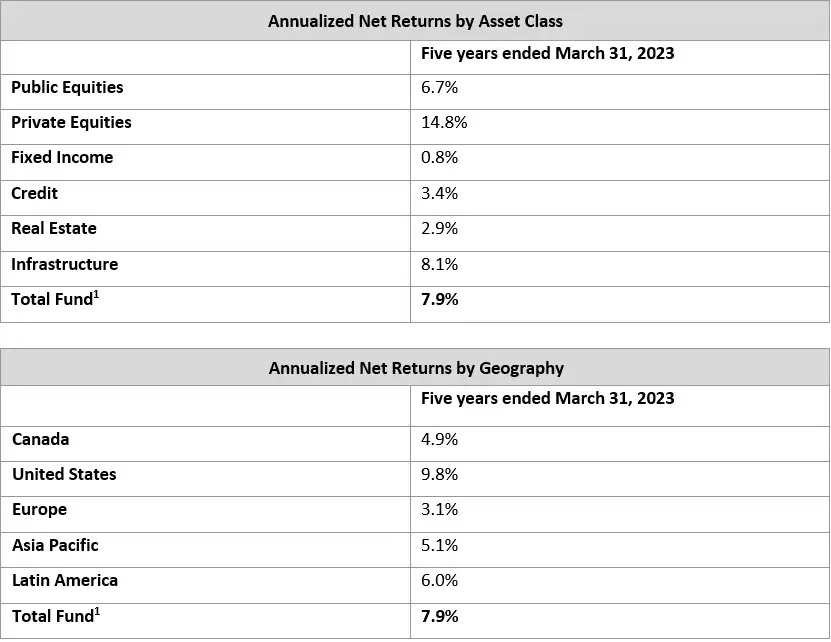

Performance by Asset Class and Geography

Five-year Fund returns by asset class and geography are reported in the tables below. In fiscal 2023, both emerging and developed markets contributed positively to our annual and five-year returns. A more detailed breakdown of performance by investment department is included on page 48 of the Fiscal 2023 Annual Report.

1 The performance of certain investment activities is only reported in the total Fund return and not attributed to an asset class and/or geography return. Activities reported only within total Fund net returns include those from currency management activities, cash equivalents and money market securities investments, and absolute return strategies. For the geography-based presentation, total Fund net returns also include securities, such as swaps, forwards, options and pooled funds, that are without country of exposure classification.

Managing CPP Investments Costs

Discipline in cost management is a main thrust of our public accountability as we continue to build an internationally competitive enterprise that seeks to create enduring value for multiple generations of beneficiaries of the CPP.

Overall, total expenses have increased compared to the previous year. Operating expenses increased by $112 million due to an increase in full-time globally positioned talent, continuous improvements to our technology and data infrastructure, and the development of our investment science capabilities. Our operating expense ratio was 28.6 basis points (bps), which is below the five-year average of 29.0 bps and up marginally from 27.1 bps observed in fiscal 2022.

Management fees increased by $165 million, due to an increase in average assets managed by external fund managers. Performance fees decreased by $621 million driven by fewer realization events in the private equity portfolio given the low transaction activity through the year, partially offset by strong performance of hedge funds.

Transaction-related expenses, which decreased by $151 million, vary from year to year according to the number, size and complexity of our investing activities. Other categories affecting our total cost profile include taxes and expenses associated with various forms of leverage.

Page 27 of the Fiscal 2023 Annual Report provides a discussion of how we manage our costs. For a complete overview of CPP Investments combined expenses, including year-over-year comparisons, refer to page 46.

Operational Highlights for the Year

Leadership announcements

- Announced the following Senior Management Team appointments:

- Maximilian Biagosch as Senior Managing Director & Global Head of Real Assets;

- Kristina Fanjoy as Senior Managing Director & Chief Financial Officer;

- Priti Singh as Senior Managing Director & Global Head of Capital Markets and Factor Investing;

- Kristen Walters as Senior Managing Director & Chief Risk Officer; and

- Jon Webster as Senior Managing Director & Chief Operating Officer.

- Appointed Richard Manley as Chief Sustainability Officer.

Board appointment

- Welcomed Judith Athaide to the Board of Directors. Appointed in November 2022, Ms. Athaide is President and CEO of The Cogent Group Inc., and a corporate director. She previously held a variety of senior commercial and technical roles in the energy industry, as well as academic positions at the Universities of Alberta, Brandon, Calgary and Mount Royal.

Strategic developments

- Achieved our objective for CPP Investments’ operations to be carbon neutral across Scope 1, 2 and 3 (business travel) emissions this fiscal year as part of our commitment to achieve net zero by 2050. Our approach is to pursue opportunities to decarbonize our operations, with carbon credits only being used to compensate for the remaining emissions. Consistent with this, we will continue to monitor and manage the emissions associated with our air travel and office footprint in fiscal 2024, capturing learnings from the hybrid working models used during the COVID-19 pandemic.

- Signed a statement of commitment to the FX Global Code, which represents a set of principles generally recognized as good practice to promote the integrity and effective functioning of the wholesale foreign exchange market. The FX Global Code was developed by a partnership between central banks and market participants from 20 jurisdictions around the globe.

- Created a distinct Risk department, as part of the division of the Chief Financial and Risk Officer role, to further strengthen the governance of the Fund as the organization grows. The Risk department, led by the Chief Risk Officer, develops the organization’s overall risk framework, provides objective oversight and helps ensure risk considerations are incorporated into investment and operational processes.

Public accountability

- Hosted nine in-person public meetings – one in each province that participates in the CPP – along with a national virtual meeting, which provided an accessible forum for more contributors and beneficiaries to ask questions of our senior leaders. These meetings reflect our continued accountability to the CPP’s more than 21 million contributors and beneficiaries.

Investment Highlights for the Year

Active Equities

- Invested C$207 million for a 0.3% stake in London Stock Exchange Group (LSEG) through a private placement with a selling consortium that included CPP Investments. LSEG is a global market infrastructure, data and analytics provider.

- Invested C$401 million for a 2.0% stake in Commerzbank, one of the largest banks in Germany serving retail and small business customers.

- Invested an additional C$309 million in Airbus SE, increasing our ownership stake to 0.5%. Based in Europe, Airbus is a leader in designing, manufacturing, and delivering aerospace products, services, and solutions to customers globally.

- Invested an additional C$459 million in Z Holdings Corporation, a Japanese holding company that owns and manages a portfolio of businesses including Yahoo! Japan, increasing our ownership stake to 2.1%.

- Invested approximately C$113 million for a 1.8% stake in Sendas Distribuidora, the second largest food retailer in Brazil, operating more than 260 cash-and-carry stores across the country.

- Invested C$277 million for a 3.1% stake in Frontier Communications, a broadband and voice services exchange carrier, expanding its fibre-to-the-home network by six million homes, operating across 25 U.S. states.

- Invested C$150 million for a stake of less than 1% in Cheniere Energy, a producer and exporter of liquefied natural gas in the U.S.

- Invested US$292 million for a 9.3% stake in the Hong Kong-listed shares of China Tourism Group Duty Free, a leading duty-free operator in China.

- Exited Orpea SA, a France-based company that operates retirement homes, outpatient and rehabilitation clinics, and psychiatric care. Net proceeds from the sale were €26.1 million. Our original investment was made in 2013.

Credit Investments

- Committed US$350 million to Blackstone Credit’s BGreen III fund, an energy transition-focused private credit fund that targets global opportunities in a variety of sub-sectors including renewable power generation and storage, energy efficiency services, and critical energy infrastructure.

- Invested US$148 million in the senior secured notes of Auna S.A.A., a leading health care service provider in Mexico, Colombia and Peru.

- Invested R$200 million (C$52 million) in the debt facility of Rio Energy alongside Lumina Capital Management. Rio Energy is an independent renewable energy company in Brazil.

- Invested US$200 million in an asset-purchasing vehicle with Gordon Brothers to acquire asset-backed loans originated by the company. Headquartered in Boston, U.S., Gordon Brothers is a global advisory, restructuring and investment firm.

- Committed INR 18.5 billion (C$310 million) to the first close of the Kotak Infrastructure Investment Fund, which will provide senior and secured financing to operating infrastructure projects in India.

- Invested US$75 million in a mezzanine loan backed by a sponsor-owned, Grade-A office and retail property in Shanghai, China.

- Invested US$115 million in the second-lien term loan of HCP Global Ltd. (HCP) to support Carlyle’s acquisition of the company. HCP is a global premium cosmetics and skincare packaging manufacturer serving most of the top cosmetic companies worldwide.

- Closed a C$230 million investment in the term loans of Legal Search, a provider of property- and corporate-related search services in Australia, the U.K., and the U.S.

Private Equity

- Entered into a definitive agreement alongside Silver Lake to acquire Qualtrics, a U.S.-headquartered leader in the experience management software category in an all-cash transaction that values Qualtrics at approximately US$12.5 billion.

- Committed US$400 million to Carlyle Asia Partners VI, L.P., which focuses on control buyouts and minority investments in mid-to-large companies across Asia.

- Committed US$150 million to GTCR XIV/C, L.P., which is focused primarily on mid-market buyouts in North America in the health care, financial services, technology, media & telecommunications, and business & consumer services sectors.

- Invested in Hexagon Bio’s US$77 million Series B funding round. The U.S.-based biopharmaceutical company has an interdisciplinary drug discovery platform to identify novel therapeutic molecules with an initial focus on oncology and infectious diseases.

- Invested US$180 million for a 9.8% stake in Tricor Group, a leading Asia-focused provider of business and corporate services based in Hong Kong, alongside BPEA EQT.

- Committed US$400 million to Clayton, Dubilier & Rice Fund XII. Clayton, Dubilier & Rice is one of the world’s oldest private equity firms and focuses on upper middle market and large value-oriented buyouts, as well as build-ups in North America and Western Europe.

- Acquired a significant minority stake in Universal Investment Group, a leading third-party management company and fund administration service provider serving both institutional investors and asset managers across European fund markets.

- Invested US$334 million to acquire a 19.3% stake in D1, the market leader in Latin America’s expanding discount food retail space.

- Committed US$1 billion to Blackstone Capital Partners IX, the flagship fund of Blackstone, which focuses on large-scale, control buyouts in North America, Europe and Asia.

- Committed US$79 million across Radical Ventures III and Opportunities I, after previously committing to Fund II as an anchor investor. Radical Ventures is an early-stage manager based in Toronto, Canada, focusing on artificial intelligence opportunities in Canada and the U.S.

- Committed €400 million to EQT X, which will pursue investments in high-quality companies operating in attractive sub-sectors within health care, technology, media & telecommunications, services, and industrial technology. Headquartered in Sweden, EQT is a global alternative asset manager operating across private capital and real assets.

Real Assets

- Agreed to acquire an additional 29.5% stake in ReNew Energy Global (ReNew) through two transactions totalling C$925 million, bringing our total economic stake to 51.9% with C$1.8 billion of invested capital. ReNew is one of the largest renewable energy independent power producers in India.

- Launched Floen, a 50%/50% partnership with Votorantim S.A. focused on investing in the energy transition in Brazil.

- Agreed to purchase 49% of Aera Energy from international asset management group IKAV. Aera Energy is one of California’s largest oil and gas producers and accounts for nearly 25% of the state’s production.

- Committed additional capital to our Indian toll roads portfolio company IndInfravit Trust through two transactions, in which we now own 49.9%. We committed up to C$700 million to help fund the acquisition of five operating road concessions and invested C$86 million for the secondary acquisition of an additional 6.1% stake in IndInfravit.

- Allocated an additional C$322 million in equity to the Japanese Data Centre Development venture with Mitsui & Co. Ltd., for a total allocation of C$730 million since the venture was established in 2021. The venture is focused on hyper-scale data centre developments in Japan.

- Committed US$205 million to IndoSpace Logistics Park IV, a real estate vehicle managed by India-based real estate company IndoSpace.

- Awarded an 80,418-acre floating offshore wind lease off the central coast of California for US$150 million, through Golden State Wind, our 50%/50% joint venture with Ocean Winds.

- Invested R$2.5 billion (C$639 million) for a stake of approximately 9.5% in V.Tal, the largest neutral fibre-to-the-home network provider in Brazil.

- Increased our equity allocation by C$755 million to the second tranche of the Tricon Multifamily joint venture, for a total allocation of C$1.5 billion. Alongside Canada-based Tricon Residential, the joint venture will develop more than 2,000 Class-A purpose-built rental units in the Greater Toronto Area.

- Allocated €475 million to a new joint venture focused on the European hospitality sector with Hamilton – Pyramid Europe, a leading hotel operator and co-investment partner forming part of the Pyramid Global Hospitality group of companies, which committed €25 million. The first asset acquired as part of this new partnership was the W Rome hotel for €172 million.

- Increased our commitment to BAI Communications, a U.K.-headquartered global communications infrastructure provider, alongside partners Manulife and AIMCo to support BAI’s ongoing growth strategy, including the acquisition of ZenFi Networks. We have committed approximately C$3 billion to BAI since 2009 and hold an 86% ownership stake.

- Expanded our strategic partnership with Octopus Energy to support its global expansion and renewables strategy with a total financial commitment of US$525 million since our partnership was established in 2021. Octopus Energy is a global clean energy technology pioneer based in the U.K.

- Sold our minority interests in five regional malls across the U.S., including two in St. Louis, Missouri and three in Southern California. Net proceeds from the sales were C$379 million. The original investments were made between 2012 and 2014.

- Exited the investment in Crowne Plaza Times Square, a mixed-use hotel property in New York City. Net proceeds from the investment were nil. Our original investment was made in 2010.

- Agreed to sell our 33.33% indirect stake in Skyway Concession Company LLC, which manages, operates and maintains the Chicago Skyway toll road. Net proceeds from the sale were US$1 billion. We initially acquired our stake in 2016.

- Sold six logistics warehouses in Western China in the Goodman China Logistics Partnership (GCLP). Net proceeds from the sale were approximately C$340 million. GCLP was established with Goodman Group in 2009 to own and develop logistics assets in mainland China and we have an 80% ownership interest in GCLP.

Transaction Highlights Following the Year-End

- Invested US$20 million in PT Samator Indo Gas Tbk, the largest industrial gas company in Indonesia, alongside CVC Capital.

- Invested US$40 million in the acquisition and merger of two leading Australian frozen food producers, Patties Foods and Vesco Foods, alongside PAG. We own a 16.3% stake in the combined company.

- Sold our 50% interest in Kumho Asiana Tower, a prime-grade office building in Seoul, South Korea. Net proceeds from the sale were C$181 million. Our original investment was made in 2018.

- Committed US$160 million to Multiples Private Equity Fund IV, which targets mid-market growth opportunities in India.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 21 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At March 31, 2023, the Fund totalled $570 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

Disclaimer

Certain statements included in this press release constitute “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable United States safe harbors. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United States securities laws. Forward-looking information and statements include all information and statements regarding CPP Investments’ intentions, plans, expectations, beliefs, objectives, future performance, and strategy, as well as any other information or statements that relate to future events or circumstances and which do not directly and exclusively relate to historical facts. Forward-looking information and statements often but not always use words such as “trend,” “potential,” “opportunity,” “believe,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions. The forward-looking information and statements are not historical facts but reflect CPP Investments’ current expectations regarding future results or events. The forward-looking information and statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, including available investment income, intended acquisitions, regulatory and other approvals and general investment conditions. Although CPP Investments believes that the assumptions inherent in the forward-looking information and statements are reasonable, such statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. CPP Investments does not undertake to publicly update such statements to reflect new information, future events, and changes in circumstances or for any other reason. The information contained on CPP Investments’ website, LinkedIn, Facebook and Twitter are not a part of this press release. CPP INVESTMENTS, INVESTISSEMENTS RPC, Canada Pension Plan Investment Board, L’OFFICE D’INVESTISSEMENT DU RPC, CPPIB and other names, phrases, logos, icons, graphics, images, designs or other content used throughout the press release may be trade names, registered trademarks, unregistered trademarks, or other intellectual property of Canada Pension Plan Investment Board, and are used by Canada Pension Plan Investment Board and/or its affiliates under license. All rights reserved.

1 Certain figures may not add up due to rounding.

Article Contacts

For More Information:

Frank Switzer

Public Affairs & Communications

Tel: +1 416 523 8039

fswitzer@cppib.com