All figures in Canadian dollars unless otherwise noted.

Second-Quarter Highlights:

- $19.8 billion in net income generated for the Fund

- Record 10-year annualized net return of 11.6%

- Strong gains from private equity programs

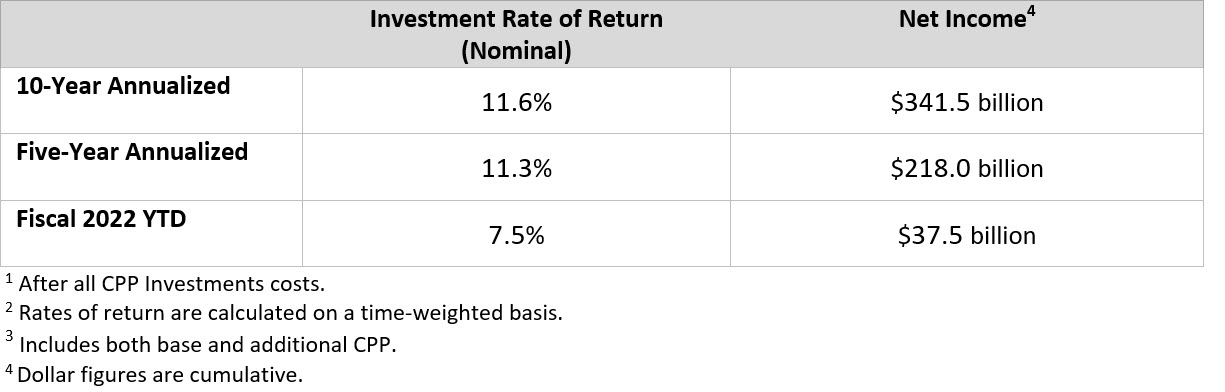

TORONTO, ON (November 12, 2021): Canada Pension Plan Investment Board (CPP Investments) ended its second quarter of fiscal 2022 on September 30, 2021, with net assets of $541.5 billion, compared to $519.6 billion at the end of the previous quarter.

The $21.9 billion increase in net assets for the quarter consisted of $19.8 billion in net income after all CPP Investments costs and $2.1 billion in net Canada Pension Plan (CPP) contributions.

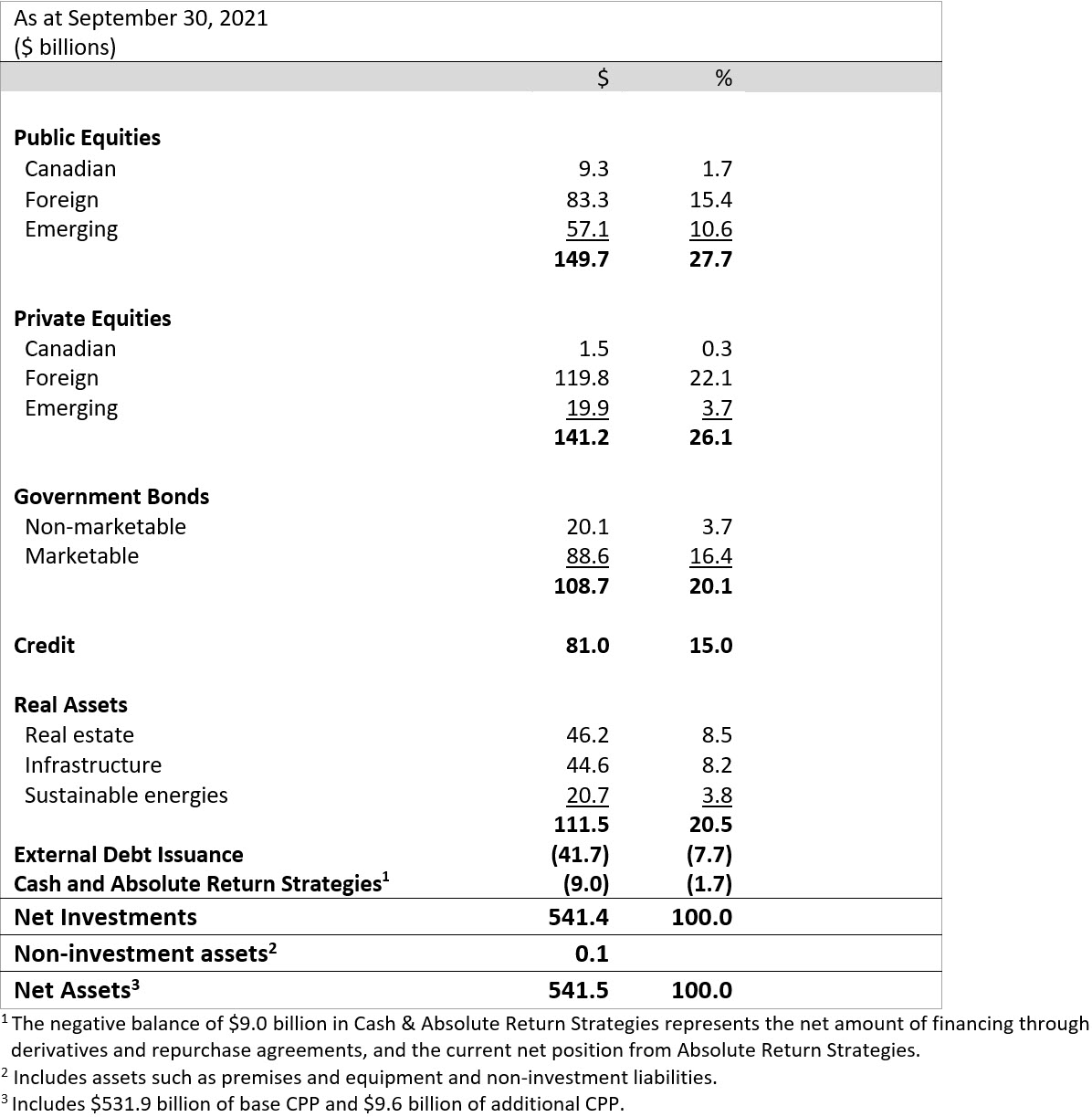

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved 10-year and five-year annualized net nominal returns of 11.6% and 11.3%, respectively. For the quarter, the Fund returned 3.8%, net of all CPP Investments costs.

For the six-month fiscal year-to-date period, the Fund increased by $44.3 billion consisting of $37.5 billion in net income after all CPP Investments costs, plus $6.8 billion in net CPP contributions. For the period, the Fund returned 7.5%, net of all CPP Investments costs.

“CPP Investments delivered strong results this quarter to achieve a record 10-year annualized net return of 11.6%, reflecting the benefits of diversification and investment selection,” said John Graham, President & Chief Executive Officer. “As we emerge from the impact of the global pandemic, our teams continue to execute across the organization to deliver sustainable long-term growth for the Fund.”

The Fund’s quarterly results were driven by an increase in the value of all private equity programs, contributions from real assets and credit investments and gains from foreign exchange as the Fund benefitted from a rebound in the U.S. dollar against the Canadian dollar. Public equity active programs were flat.

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, taking into account the factors that may affect the funding of the CPP and the CPP’s ability to meet its financial obligations. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance compared to quarterly or annual cycles.

Fund 10- and Five-Year Returns1, 2, 3

(For the period ending September 30, 2021)

Performance of the Base and Additional CPP Accounts

The base CPP account ended its second quarter of fiscal 2022 on September 30, 2021, with net assets of $531.9 billion, compared to $511.5 billion at the end of the previous quarter. The $20.4 billion increase in assets consisted of $19.6 billion in net income after all costs and $0.8 billion in net base CPP contributions. The base CPP account achieved a 3.8% net return for the quarter.

The additional CPP account ended its second quarter of fiscal 2022 on September 30, 2021, with net assets of $9.6 billion, compared to $8.1 billion at the end of the previous quarter. The $1.5 billion increase in assets consisted of $193 million in net income after all costs and $1.3 billion in net additional CPP contributions. The additional CPP account achieved a 2.3% net return for the quarter.

The additional CPP, which began in 2019, differs in contributions, investment profile and risk targets from the base CPP because of the way each part is designed and funded. As such, we expect the investment performance of each part to be different.

Long-Term Sustainability

Every three years, the Office of the Chief Actuary of Canada conducts an independent review of the sustainability of the CPP over the next 75 years. In the most recent triennial review published in December 2019, the Chief Actuary reaffirmed that, as at December 31, 2018, both the base and additional CPP continue to be sustainable over the 75-year projection period at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2018, the base CPP account will earn an average annual rate of return of 3.95% above the rate of Canadian consumer price inflation, after all costs. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.38%.

The Fund, combining both the base CPP and additional CPP accounts, achieved 10-year and five-year annualized net real returns of 9.7% and 9.0%, respectively.

Diversified Asset Mix

Operational Highlights:

Executive announcement

- Alain Carrier, Senior Managing Director and Head of International, left the organization to become CEO of a global private equity firm. Geoffrey Rubin, Senior Managing Director and Chief Investment Strategist, has assumed oversight for international operations on an interim basis.

Corporate development

- Appointed Deborah Orida as our first Chief Sustainability Officer (CSO), responsible for our enterprise-wide approach to ESG initiatives, with a focus on climate change. As CSO, Ms. Orida will lead the execution of a roadmap for the organization to prudently navigate the Fund’s sustainability efforts as the world economy transitions to address climate change. Ms. Orida will maintain her role as Senior Managing Director and Global Head of Real Assets.

Second-Quarter Investment Highlights:

Active Equities

- Invested US$300 million in Sinch to support the company’s US$1.9 billion acquisition of Pathwire, a leading cloud-based email delivery platform, bringing our ownership in Sinch to 2%.

- Committed US$50 million in Planet Labs, an earth observation and data insights company, through participation in the expanded private investment in public equity (PIPE) transaction in dMY Technology Group, Inc. IV.

- Made a follow-on investment of US$50 million in the $1.6 billion Series H funding of Databricks, a data, analytics and AI company based in San Francisco. We previously invested US$65 million in the company’s $1 billion Series G funding in February 2021.

- Invested US$350 million in Advanced Drainage Systems, a leading provider of water management solutions for use in the construction and agriculture marketplace, increasing our ownership stake in the company to 4.6%.

- Invested C$198 million in Jazz Pharmaceuticals, a biopharmaceutical company that develops, in-licenses and commercializes drugs for the treatment of neurological disorders and oncology.

Credit Investments

- Committed to provide up to US$500 million in financing to Prodigy Finance, a provider of postgraduate student loans for international students attending top schools.

- Committed US$300 million to Blackstone Life Sciences Yield, which will invest in royalty streams on FDA-approved products and structured credit opportunities with biotechnology, pharmaceutical and MedTech partners.

- Committed C$115 million to the financing of a portfolio of late-stage construction toll-roads owned by Dilip Buildcon Limited, a publicly traded developer and operator of infrastructure assets in India.

- Completed a US$100 million investment in the debt financing for OTG Management, an airport concessions operator with locations across 10 airports in North America.

- Committed HK$700 million (C$112 million) to an investment in the first lien term loan of Brooklyn, a Hong Kong-based streetwear apparel company that designs, sources and retails the BAPE and AAPE brands.

- Committed US$325 million to Angelo Gordon’s Essential Housing Fund II, a fund designed to provide off-balance sheet financing for homebuilders to enable them to assemble development-ready land. Angelo Gordon is a U.S. credit and real estate investor.

Private Equity

- Committed US$200 million to Clearlake Capital Partners VII. Clearlake is an investment firm operating integrated businesses across private equity, credit and other related strategies.

- Committed US$325 million to Anchor Equity Partners Fund IV, a Korean mid-market PE firm focused on control-oriented consolidation investments and significant minority growth stage opportunities.

- Committed US$600 million to the Baring Asia Private Equity Fund VIII, L.P. Baring Private Equity Asia is a pan-Asian private equity investment firm focusing on control buyouts and minority growth investments.

- Committed US$350 million to Carlyle Partners Fund VIII. Carlyle Partners is a U.S.-based private equity manager focused on buyout and growth equity opportunities.

- Committed US$100 million to Kainos Capital Partners Fund III, L.P. Kainos is a lower middle-market manager focused on investing in the food and consumer staples industries.

- Invested US$120 million into Eruditus, an Indian Ed-Tech company that partners with top-tier universities worldwide to deliver online short courses and other programs to a global learner base, resulting in a 3.8% stake in the company.

- Invested US$35 million in Laronde’s $440 million Series B financing to advance the development of its eRNA platform and a broad range of programs across a number of therapeutic categories.

- Agreed to jointly acquire CeramTec, a leading global MedTech business specializing in critical high-performance ceramic components, alongside BC Partners. Our capital contribution in CeramTec will be approximately €800 million for a 50% stake in the company.

- Invested US$15 million in QCraft’s US$100+ million Series A+ funding round. QCraft is an autonomous vehicle company.

- Invested INR 5,950 million (C$98 million) for a 24% stake in the carve-out Zenex Animal Health India Private Limited, the animal health division of Cadila Healthcare that manufactures and sells animal health products for livestock and poultry.

Real Assets

- Entered into a joint venture with CSI Properties in Hong Kong to redevelop a mixed-use real estate project comprising residential and commercial spaces in Kowloon, Hong Kong with an equity commitment of C$169 million.

Asset Dispositions:

- Sold our 2.3% stake in SBI Life Insurance Company in India. Net proceeds from the sale were approximately C$463 million. We initially invested in the company in 2017.

- Sold our stake in Velvet Energy, a privately held light-oil Montney producer with operations in north-west Alberta. Net proceeds from the sale were C$183 million. We initially invested in Velvet Energy in 2017.

Transaction Highlights Following the Quarter:

- Committed €50 million to Summa Equity III. Summa Equity is a Nordic-based private equity manager with a mandate to invest in companies that address global challenges.

- Entered a new joint venture with Round Hill Capital for investment in the purpose-built student accommodation sector across continental Europe. Our initial equity allocation will be €475 million.

- Committed JPY 110 billion (C$1.3 billion) to the newly established GLP Japan Development Partners IV, our fourth modern logistics partnership in Japan with GLP.

- Announced a BRL 1.5 billion (C$340 million) investment to support the asset consolidation and public listing of several Brazilian energy assets through two independent transactions to create one of Brazil’s largest energy producers and traders, in partnership with Votorantim S.A.

- Provided over €200 million in financing to RFR, an experienced real estate owner and operator working across the United States and Germany.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 20 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At September 30, 2021, the Fund totalled $541.5 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

Disclaimer

Certain statements included in this press release constitute “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable United States safe harbors. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United States securities laws. Forward-looking information and statements include all information and statements regarding CPP Investments’ intentions, plans, expectations, beliefs, objectives, future performance, and strategy, as well as any other information or statements that relate to future events or circumstances and which do not directly and exclusively relate to historical facts. Forward-looking information and statements often but not always use words such as “trend,” “potential,” “opportunity,” “believe,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions. The forward-looking information and statements are not historical facts but reflect CPP Investments’ current expectations regarding future results or events. The forward-looking information and statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, including available investment income, intended acquisitions, regulatory and other approvals and general investment conditions. Although CPP Investments believes that the assumptions inherent in the forward-looking information and statements are reasonable, such statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. CPP Investments does not undertake to publicly update such statements to reflect new information, future events, and changes in circumstances or for any other reason. The information contained on CPP Investments’ website, LinkedIn, Facebook and Twitter are not a part of this press release. CPP INVESTMENTS, INVESTISSEMENTS RPC, Canada Pension Plan Investment Board, L’OFFICE D’INVESTISSEMENT DU RPC, CPPIB and other names, phrases, logos, icons, graphics, images, designs or other content used throughout the press release may be trade names, registered trademarks, unregistered trademarks, or other intellectual property of Canada Pension Plan Investment Board, and are used by Canada Pension Plan Investment Board and/or its affiliates under license. All rights reserved.

Article Contacts

For More Information:

Frank Switzer

Managing Director, Investor Relations

fswitzer@cppib.com

T: +1 (416) 523-8039