Fiscal 2022 Annual Report

CPP Investments continues to deliver strong long-term Fund returns, helping to maintain the sustainability of the Canada Pension Plan for generations.

Browse report

Our widely diversified portfolio and active investment approach have built a resilient Fund for today’s retirees and for decades to come.

We invite our stakeholders to read our 2022 Annual Report for more information on our performance.

President’s Message

During periods of uncertainty we know that having a reliable income during retirement is especially important. We take our responsibility to our contributors and beneficiaries very seriously. Your CPP Fund is strong and resilient, and the future value of your benefits remains solid.

John Graham

President & CEO

Sustainability of the CPP

The most recent triennial report by the Chief Actuary of Canada indicated that the CPP is sustainable over a 75-year projection period.

Projections of the Fund, being the combined assets of the base and additional CPP accounts, are based on the nominal projections from the 30th Actuarial Report on the Canada Pension Plan as at December 31, 2018.

1 Represents actual total assets, net of all liabilities, as at March 31, 2022

President's Message

Read what our President & CEO John Graham has to say about fiscal 2022

Learn more2022 Annual Report

President’s Message

President’s Message

During periods of uncertainty we know that having a reliable income during retirement is especially important. We take our responsibility to our contributors and beneficiaries very seriously. Your CPP Fund is strong and resilient, and the future value of your benefits remains solid.

John Graham

President & CEO

Dear fellow contributors and beneficiaries,

The last 12 months have continued to be a period of stress and anxiety for many Canadians. The ongoing impact of the pandemic combined with the impact of geopolitical unrest has touched us all. I am deeply troubled by the tragedy that is unfolding in Ukraine, and the violence strikes especially close to home for many Canadians who have family and friends suffering in the region.

During periods of uncertainty we know that having a reliable income during retirement is especially important. We take our responsibility to our contributors and beneficiaries very seriously. Your CPP Fund is strong and resilient, and the future value of your benefits remains solid.

Capital markets are naturally subject to volatility in the short term, which is why our focus is, and always will be, on long-term performance. Since our establishment, Canadians have trusted us to manage their retirement fund with prudence and foresight. We are confident that we have built an organization worthy of this trust, and that the growth and profitability of the CPP Fund is evidence we are on the right track. A decade ago, the Fund managed assets of $162 billion. Today, that number is $539 billion. At the same time, we know that trust is never a given; it must be earned every day by our actions, investment choices and conduct as a corporate citizen.

Earning and maintaining trust is a key priority for me. At CPP Investments, we are driven by our purpose: to help sustain your retirement benefits as well as those of future generations.

To fulfil our mandate, we have developed many strengths: a global ecosystem of employees, partners and technology that allows us to identify, pursue and secure investment opportunities seamlessly; a universally admired and respected business reputation that helps us recruit top talent; our size and market presence, which gains access to attractive global opportunities of any magnitude; and a long-term outlook that affords us the patience to manage through times of market uncertainty and volatility.

Our performance

Fiscal 2022 continued to present some of the market challenges experienced in the previous year, including global supply chain disruptions and thickening borders as countries sought to bolster their local economies through protectionist trade measures. In the autumn of 2021, inflation rates jumped in Canada and the United States, our country’s largest trading partner, and in many other countries, ending three decades of low and stable inflation. This has raised prices across the board for consumers and unsettled capital markets and businesses with the prospect of rising interest rates and higher borrowing costs.

The outbreak of war in Europe at the end of February triggered a massive round of sanctions against Russia by Western allies. This decisive action had spillover effects on the global economy and its supply chains, with energy costs in particular spiralling upwards. Despite these challenges, the CPP Fund continued its solid performance. Our annual net income (after all costs) was $34 billion, and the CPP Fund grew to $539 billion, well on track to reaching the trillion-dollar mark by fiscal 2033. Our 10-year annualized net return was 10.8%.

This year, we advanced our long-term strategy to deliver a well-balanced portfolio through our active management approach. Our investments in Private Equity continued to drive growth in the Fund with additional contributions from our investments in Real Assets and Credit Investments, despite volatility in public markets which impacted our equity investments.

Our strategy

The financial markets in which we operate remain highly competitive. We expect boundaries between our asset classes and functions will blur. To continually enhance our ability to compete, we are focused on leveraging our global enterprise in such a way that the whole of our organization can be more than the sum of its parts. Let me highlight three notable achievements that demonstrate how we are doing so.

Building a modern investment organization

First, we believe that we must evolve with financial markets and be vigilant about maintaining our competitiveness. To do so, we aim to compete in the marketplace as one Fund. We bring our unique combination of advantages, capabilities and departments together to help generate value over the long term. How we think, act, invest and compete will drive our degree of competitiveness in the global investment market. Two appointments to our Senior Management Team made last December reflect our emphasis on integrating local insights and expertise into our global knowledge base: Maximilian Biagosch is now Senior Managing Director, Head of Europe & Direct Private Equity; and Agus Tandiono is Senior Managing Director, Head of Asia Pacific & Active Equities Asia.

We also reorganized internally to align our investment departments more closely, and to foster collaboration. This helps us showcase our best expertise as we compete for investment opportunities. One example being the creation of our Sustainable Energies Group (SEG), a new investment group that combines the organization’s expertise in renewables, conventional energy, and new technology and service solutions. SEG generates compelling investment opportunities for the Fund, positioning CPP Investments as a leading global energy investor.

This year, Poul Winslow, one of our long-serving colleagues on the Senior Management Team, announced his decision to retire in May 2022. Poul played an important role in building out our investment strategies as part of our active management strategy, growth and success, and we thank him for his valuable contribution to CPP Investments. In April 2022, I was very pleased to appoint Priti Singh to succeed Poul as the new Senior Managing Director and Global Head of Capital Markets & Factor Investing. Priti’s deep investment expertise and success in building our External Portfolio Management investment strategy, as well as commitment to important cultural initiatives, ideally positions her to add value to the Senior Management Team.

Tackling the global challenge of climate change

Second, we announced our commitment to net zero by 2050 for both our portfolio and operations emissions. CPP Investments has been at the forefront of embedding environmental, social and governance (ESG) factors into our investments for more than a decade. We recognize that the risks and opportunities brought about by climate change are a leading factor influencing the long-term financial sustainability of the world’s leading retirement security plans.

One of the organization’s beliefs is that accounting for ESG factors and earning healthy profits are mutually reinforcing objectives. Companies and investors alike are under pressure to move faster to a net-zero global economy; in other words, to reduce human-related greenhouse gas (GHG) emissions to as close to zero as possible by 2050.

We have a track record of using our considerable influence as an asset owner and voting shareholder to encourage the companies we invest in to adopt tangible and measurable strategies to address climate change. As mentioned in the Chairperson’s Report, our net-zero commitment is a result of rigorous analysis, contemplation, and a deep pragmatism toward the data and information available today. We worked closely with our Board, taking time to develop an approach to net zero suited to our unique organization, informed by our decade-plus experience of incorporating climate change into our investing strategy.

This fiscal year, I was delighted to appoint Deborah Orida as CPP Investments’ first Chief Sustainability Officer, leading us as we continue to place ESG factors ‘front and centre’ in our investment decisions. In an inaugural message published last November, Deborah wrote, “Leadership in sustainability is an investment imperative.” Her new role is just one step among many that we are taking to deliver on our net-zero commitment. Another step – and a nod towards leadership by example – is our commitment to achieve carbon neutrality for our internal operations by the end of fiscal 2023.

This annual report and our website provide in-depth information on how we’ve augmented our Policy on Sustainable Investing, launched a new set of Climate Change Principles, and taken further measures on climate change. We recognize that managing climate change is an iterative process; the path to net zero will not be linear, but we will continue to take action and report on our progress. I’ll be working closely with our Chief Sustainability Officer, Chief Investment Officer (Edwin Cass) and our Board, to ensure our entire organization stays on track to deliver on our net-zero commitment.

Enhancing our culture to drive performance

Third, at CPP Investments our 2,052 employees are inspired by our public purpose. This was never more clearly demonstrated than over the past two years, when we made a rapid transition to remote work while maintaining the Fund’s vital systems and infrastructure. Our guiding principles of integrity, partnership and high performance drive our culture. Our focus is on building a diverse, equitable and inclusive workforce. It is diverse representation that leads to better decisions and business outcomes, helping to drive our performance. As such, we aim to continue increasing our organization’s diversity – a key part of our strategy to be a successful high-performing global organization.

In closing

I join our Chairperson, Heather Munroe-Blum, in commending our employees for their tireless efforts through difficult times, all the while taking care of their own families and communities. Thanks to their unwavering commitment, millions of Canadians have more reason to look confidently towards the future.

I also want to thank Heather, her Board colleagues and my Senior Management Team for the tremendous support and wise counsel they have given me since I became CEO. It is a privilege to work with them, and every one of our employees, on your behalf.

I know that all of us remain concerned about recent world events, from geopolitical upheaval to climate change. We expect the next few years will continue with volatility, uncertainty and change. Even as we remain confident in our capabilities, the Fund will not be immune, potentially affecting growth rates. I can assure you that I will work diligently to continue to grow the Fund to help provide retirement benefits for you, your children and your grandchildren.

Sincerely,

John Graham

President & CEO

2022 Annual Report

Chairperson’s Report

Chairperson's Report

For almost 25 years, CPP Investments has successfully balanced present-day realities with our multi-generational obligations. The knowledge and experience we have acquired in the process are amongst our most valuable assets as we continue to fulfil our promise to Canadians.

Dr. Heather Munroe-Blum, Chairperson

Dear fellow Canada Pension Plan contributors and beneficiaries,

As this fiscal 2022 annual report is published, the harshest impacts of the pandemic have stabilized in some parts of the world while others continue to grapple with new waves of the COVID-19 virus. Amidst this ongoing challenge, we now face a grave new obstacle to global health, peace and security. The invasion of Ukraine by Russia has upended decades of relative détente among the world’s superpowers and created new global risks – the world now faces a crossroads in international relations, and uncertainty in the nature and timing of the path forward and the ultimate journey.

Nonetheless, I hope this report finds you and your loved ones managing well.

It is precisely during such unprecedented disruption that the long-term strategy guiding CPP Investments continues to prove itself. The CPP Fund is performing well, delivering strong returns to benefit present and future generations of retirees. Our 10-year annualized net return of 10.8% is a noteworthy achievement given the challenges of these past several years.

Oversight of the long-term investment strategy

Climate change is a major risk and mitigating it is a responsibility shared by all. The steady convergence of evidence, opinion, commitments and action among governments, corporations and civil society concerning the need to transition the global economy to a low-carbon future, identified broadly as “net zero by 2050,” has added impetus to our collective responsibility to act.

For over a decade, CPP Investments has led in incorporating climate change into its investment decisions. When the time came this past year to determine the organization’s position on net zero, the Board engaged closely with Management, guiding, challenging and collaborating as appropriate. In February 2022, with full Board support, CPP Investments released its comprehensive investment approach to reach net zero.

During the year, the Board also monitored progress towards the organization’s 2025 Strategy approved by the Board in 2018. A hallmark of CPP Investments’ forward thinking, the strategy was designed to help ensure that the organization is both well-positioned to manage for today, but also to manage a Fund expected to grow to a trillion dollars over the near term. We conclude that the execution of this strategy remains firmly on track.

A Special Examination, as required for CPP Investments every six years in accordance with the CPPIB Act, was conducted over the past year to assess our systems and practices. Deloitte LLP acted as the independent examiner and I am pleased to report that the examiners provided a clean opinion, with no significant deficiencies noted.

Succession planning

A key element of Board oversight is ensuring that we have the right leaders at the right time. For close to a quarter century, the CEOs appointed by our successive Boards have driven leading management and evolved enterprise strategy fit for each era. At the same time they have spearheaded the execution of that strategy with a focus on strong performance. Their cumulative efforts have transformed CPP Investments into a powerhouse among global institutional investors and pension funds, managing $539 billion in assets today.

During the height of the pandemic in February 2021, the Board finalized its choice of John Graham as President and CEO. He was well-prepared to hit the ground running. John was selected for his important experience and strengths: dedication to our public purpose, deep investment experience, strong strategic sensibilities, a highly collaborative work style, a talent for building teams and a clear approach to achieving operational excellence now and in the coming era. John’s “One Fund” approach optimizes the organization’s critical pool of skills and the knowledge acquired by our talented employees in local markets and globally, and across investment disciplines. This gives proof to the maxim that the whole is greater than the sum of its parts. With strong accountability built in, this strategy provides an important edge as we compete in an intensely competitive context, for prized assets that maximize our returns over the long term.

Engagement with business activities

The Risk Committee of the Board oversaw the implementation of the new Risk Policy which came into effect in fiscal 2022 and incorporated pandemic-related risks. The Investment Strategy Committee of the Board (formerly the Investment Committee) made good progress on its updated mandate during the year, working closely with our CEO and our Chief Investment Officer on the Fund’s investment strategy and portfolio construction, including ongoing investment performance reviews of both.

In October, CPP Investments appointed its first-ever Chief Sustainability Officer, Deborah Orida, who took on this role in addition to her role as Senior Managing Director & Global Head of Real Assets. With sustainability at the core of our investing, it follows that our Chief Sustainability Officer must be deeply involved in our investing activities. This appointment is critical as the organization navigates the ongoing challenges and opportunities brought by climate change.

Every year, the Board meets with employees in our global offices, as well as with local investment partners. These meetings are integral to carrying out our governance responsibilities. Each of CPP Investments’ nine offices on five continents operates within a highly diverse ecosystem. It is essential that the Board experience first-hand the regional issues, business environments and key relationships within these markets. Owing to continued pandemic restrictions in fiscal 2022, we again conducted these sessions virtually, this time with our newest office in San Francisco.

The Board’s oversight activities also include the annual review of the operating budget. In fiscal 2022, the operating expense ratio of 27.1 basis points declined from 29.3 the previous year and below our five-year average of 29.1.

Board of Directors renewal

In August 2021, two new Directors were welcomed to the Board: Barry Perry, formerly President and CEO at Fortis Inc., and a widely respected executive with deep experience in the utilities sector; and Dean Connor, who served a decade as President and CEO of Sun Life Financial and has been recognized in Canada and internationally as an outstanding business leader. Barry and Dean are already making a positive mark as they replace Karen Sheriff and Jo Mark Zurel, who each contributed with great distinction throughout their three terms on the Board.

Sylvia Chrominska and Chuck Magro were reappointed for a second term on the Board. However, Mr. Magro subsequently assumed a new executive role out of the country and resigned from the Board as of March 31, 2022. The Board has recommended a candidate to replace Mr. Magro. We have also recommended Mark Evans for reappointment to a second three-year term.

The Board continues to work closely with the federal-provincial Nominating Committee and the stewards, to ensure there is a prudent rhythm of Director appointments and reappointments.

In closing

Our people delivered solid results this past fiscal year as they have throughout the pandemic. Like employees everywhere, they had to suddenly transition to working from home, with many juggling childcare, eldercare and other responsibilities in addition to the isolation, health concerns and anxieties we have all faced since COVID-19 first appeared some 2 ½ years ago. Many are still facing these challenges. Now add to that the war in Europe that emerged with stunning speed, creating new global risks and uncertainty. There is no moment for complacency, however, we as a Board hold high confidence in our organization’s experienced, dedicated leadership; our fine employees across the firm; and our strategy and culture.

In this light, the performance of employees and Management deserves high commendation in advancing the reputation and success of CPP Investments. Their dedication and skill continue to serve the best interests of 21 million CPP contributors and beneficiaries.

I take this opportunity also, to thank our dedicated, talented Board of Directors for their steadfast commitment to CPP Investments.

As a global investor managing a $539 billion fund, CPP Investments has an intensely forward-looking perspective given our mission to create enduring value for generations of Canadians. While maximizing returns, we are ever mindful of managing current risks, and we remain firmly fixed on addressing long-term challenges arising from climate change, technology disruption, the evolution of stakeholder capitalism, war and other tectonic shifts in the global economy.

For almost 25 years, CPP Investments has successfully balanced present-day realities with our multi-generational obligations. The knowledge and experience we have acquired in the process are amongst our most valuable assets as we continue to fulfil our promise to Canadians.

Heather Munroe-Blum OC, OQ, PhD, FRSC

Chairperson

President’s Message

Read what our President & CEO John Graham has to say about fiscal 2022

Learn more2022 Annual Report

Fund Sustainability

CPP Investments has a critical mission: to help support a strong foundation for Canadians’ financial security in retirement.

Our defining purpose is to manage Canada Pension Plan (CPP) funds in the best interests of contributors and beneficiaries. Our experienced professionals invest globally to maximize returns without undue risk of loss, with consideration of the factors that may affect funding of the CPP. We take a disciplined, long-term approach to managing the Fund.

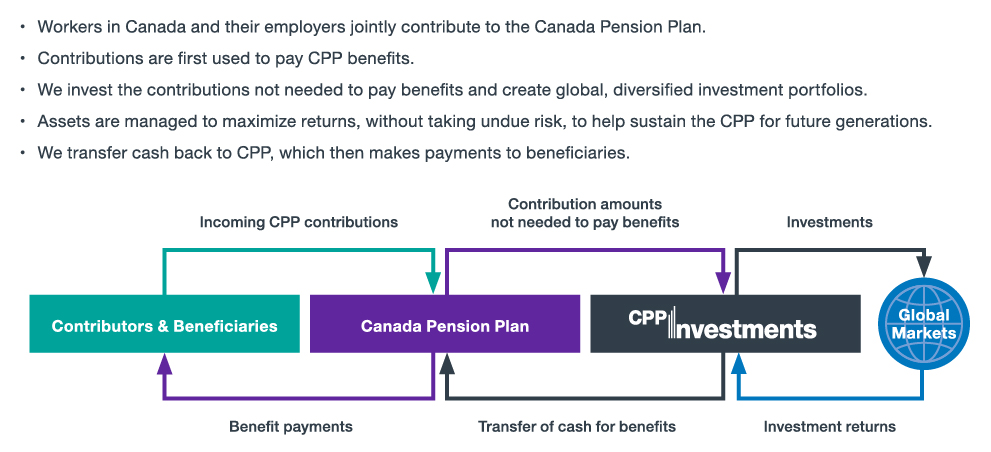

How we support the Canada Pension Plan:

The CPP is designed to provide a stable source of retirement income to Canadians today and across multiple generations.

The Office of the Chief Actuary monitors the long-term sustainability of each part of the Plan. Every three years, the Chief Actuary reports on the financial state of the base CPP and additional CPP over the next 75 years.

The most recent report, released in December 2019, reconfirmed that both parts of the CPP are sustainable at the legislated contribution rates as of December 31, 2018.

The chart below illustrates the combined projections of assets from the Chief Actuary’s 30th Report, which considers future changes in demographics, the economy and investment environments. The Fund has two sources of growth: net contributions from CPP participants and net income earned from investments.

By 2050, the total Fund is projected to reach $3 trillion ($1.6 trillion when value is adjusted for expected inflation).

Sustainability of the CPP

The most recent triennial report by the Chief Actuary of Canada indicated that the CPP is sustainable over a 75-year projection period.

Projections of the Fund, being the combined assets of the base and additional CPP accounts, are based on the nominal projections from the 30th Actuarial Report on the Canada Pension Plan as at December 31, 2018.

1 Represents actual total assets as at March 31, 2022

The Journey to Net Zero

Fund Sustainability Highlights

75+ Years

of CPP sustainability

21 Million

Contributors and beneficiaries

$329 Billion

10-year net income

10.8%

10-year return (net nominal)

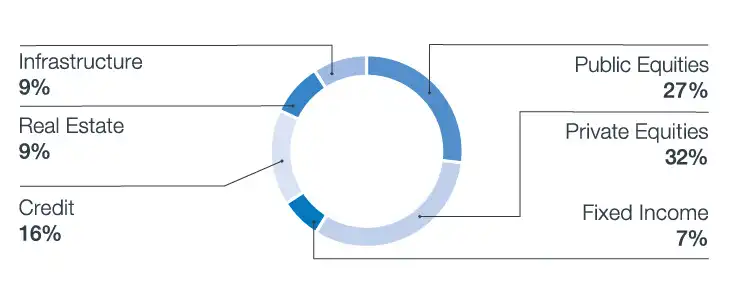

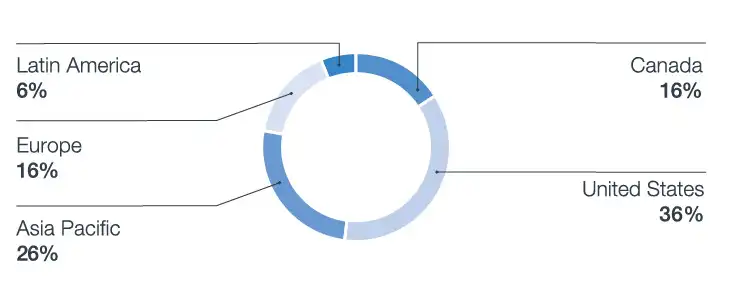

Asset Mix1, 2

As at March 31, 2022

Global Diversification by Region

As at March 31, 2022

1Fixed income consists of cash and cash equivalents, money market securities and government bonds, net of debt financing liabilities. Public Equities include absolute return strategies and related investment liabilities.

2As at March 31, 2022, $49 billion of real estate, $48 billion of infrastructure and $26 billion of our private equity investments associated with sustainable energies, which collectively represented 23% of net assets, are managed by the Real Assets investment department.

2022 Annual Report

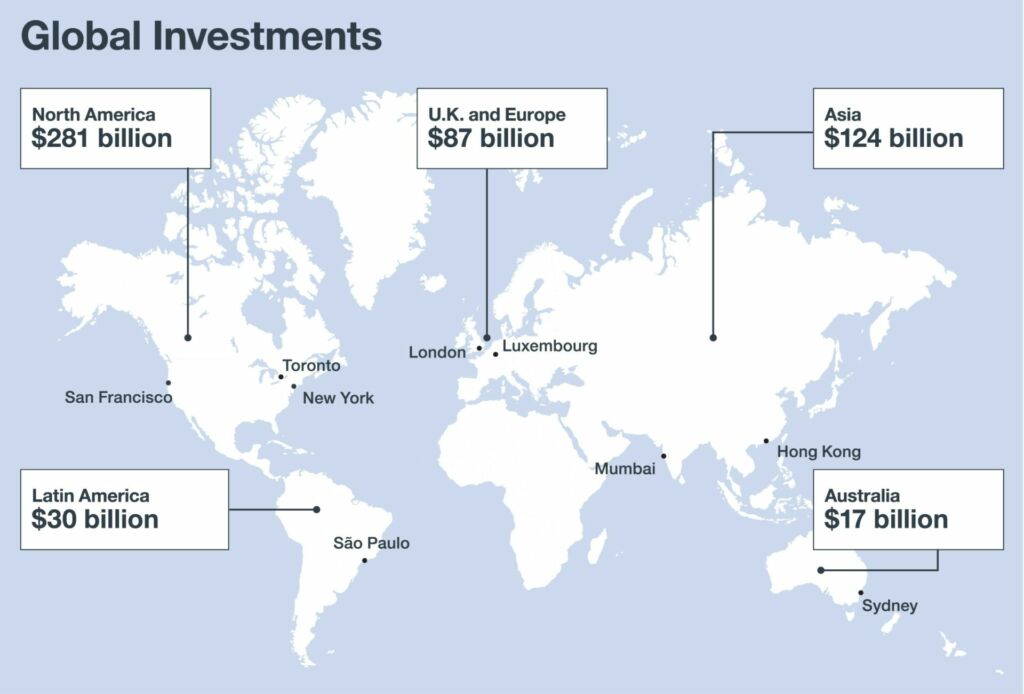

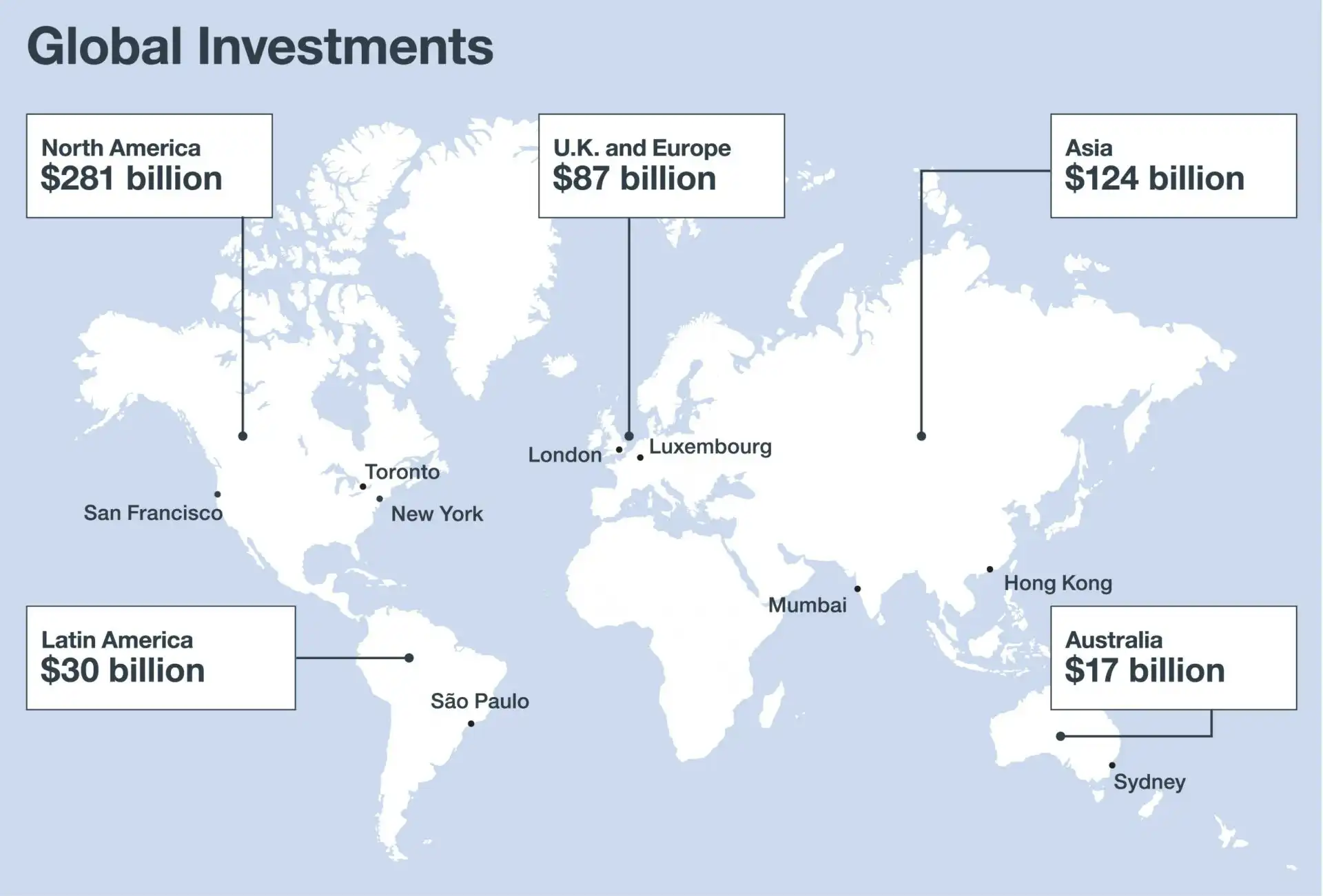

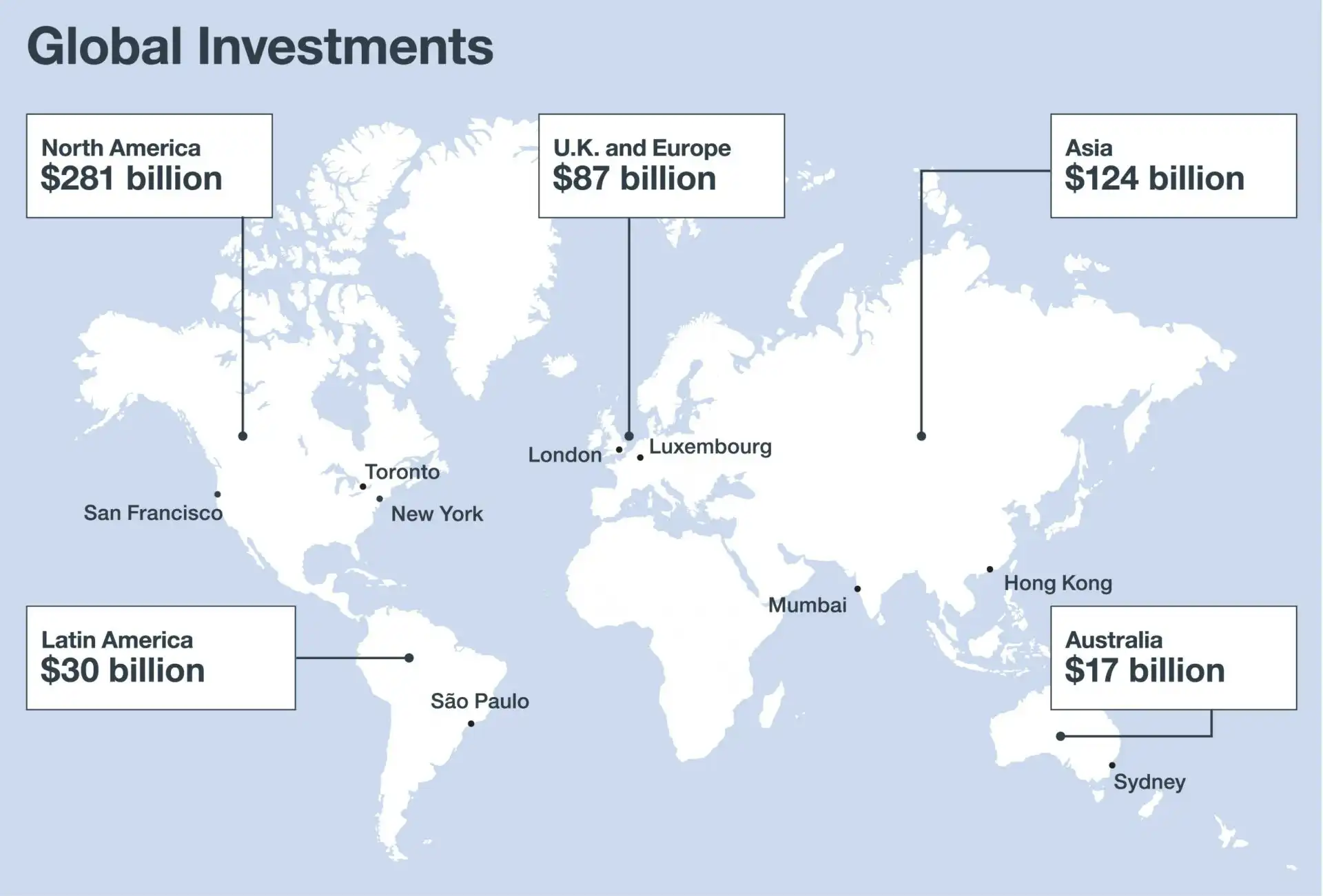

Global Investment Highlights

We search globally for the best possible investment opportunities.

Our Fund is designed to capture global growth while also demonstrating resilience during periods of market uncertainty. Our team of professionals collaborate across nine global offices to apply their deep expertise and local knowledge to source investment opportunities, engage with world-class partners and build value in our existing assets.

Untether AI

US$35 million

Invested in Untether, a developer of high-performance AI chips optimized for edge and cloud AI inference.

Bridge Industrial

US$1.05 billion

Formed a joint venture to develop industrial properties in several core markets across the United States.

Laronde

US$35 million

Investment will advance the development of the company’s eRNA platform and a broad range of programs across a number of therapeutic categories.

Auren Energia S.A.

C$340 million

Consolidated several Brazilian energy assets to create a new entity in which we hold a 32% ownership share.

Round Hill Capital

€475 million

Made an initial equity allocation to a €1 billion joint venture with the U.K.-based global investor for investment in purpose-built student accommodation across continental Europe.

BGH Capital

C$303 million

Invested in an Australia- and New Zealand-focused private equity manager active in the mid-to-large cap buyout space.

Octopus Energy Group

US$300 million

Formed a long-term strategic partnership to drive the green energy company’s technology development and help it expand more rapidly internationally.

Morrisons

£1.2 billion

Committed to provide subordinated notes to support Clayton Dubilier & Rice’s acquisition of the U.K. supermarket group, Morrisons.

CeramTec

€800 million

Acquired an ~50% co-control stake in CeramTec, the high-performance ceramics specialist and global MedTech business.

National Highways Infra Trust

C$257 million

Acquired 25% of the units in an infrastructure investment trust sponsored by the National Highways Authority of India.

Flipkart Group

US$800 million

Invested in one of India’s leading digital commerce companies.

Mitsui & Co., Ltd.

C$400 million

Established a data centre joint venture with one of Japan’s largest general trading and investment companies.