Strong annual growth despite difficult fourth quarter

Highlights:

- Net return of 6.8%

- Five-year net return of 10.0%

- 10-year net return of 10.8%

- Net assets increase by $42 billion for fiscal year

- One-year dollar value-added of $10 billion or 2.1% above the Reference Portfolios

TORONTO, ON (May 19, 2022): Canada Pension Plan Investment Board (CPP Investments) ended its fiscal year on March 31, 2022, with net assets of $539 billion, compared to $497 billion at the end of fiscal 2021. The $42 billion increase in net assets consisted of $34 billion in net income and $8 billion in net transfers from the Canada Pension Plan (CPP).

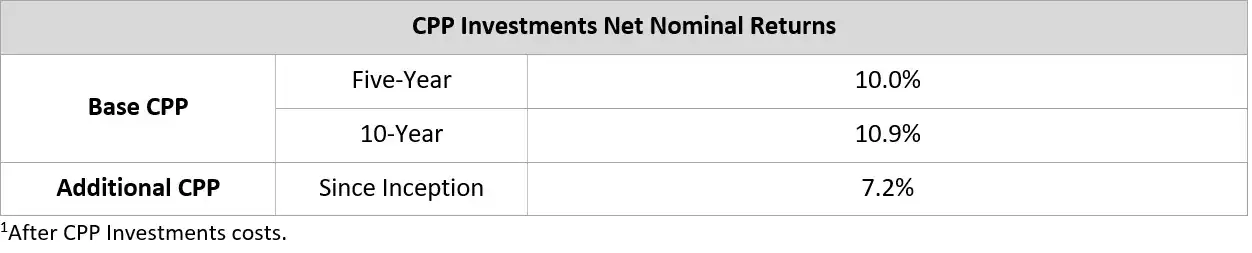

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved a net return of 6.8% for the fiscal year, and five-year and 10-year annualized net returns of 10.0% and 10.8%, respectively.

In managing the Fund in the best interests of contributors and beneficiaries, CPP Investments continues to build a portfolio designed to achieve a maximum rate of return, without undue risk of loss, while considering the factors that may affect the funding of the CPP and its ability to pay current benefits. Since the CPP is designed to serve multiple generations of beneficiaries, evaluating the performance of CPP Investments over extended periods is more suitable than single years.

In the five-year period up to and including fiscal 2022, CPP Investments has contributed $199 billion in cumulative net income to the Fund. Since its inception in 1999, CPP Investments has contributed $378 billion to the Fund on a net basis.

“CPP Investments delivered solid returns in fiscal 2022 despite turbulent market conditions in the wake of Russia’s war on Ukraine, supply chain disruptions caused by the pandemic and rising inflation,” said John Graham, President & CEO. “Our 10-year performance of nearly 11%, the same as it stood at the end of the last fiscal year, demonstrates the enduring growth of the Fund over the long haul on the one hand, with steady resilience during uncertain times, on the other.”

Private equity, infrastructure, real estate and credit investments were the predominant contributors to the Fund’s overall performance in fiscal 2022. The volatility affecting public equities during the final quarter, at levels not seen since the outset of the pandemic, muted returns achieved through the first nine months of the fiscal year. Bond prices also declined in the fourth quarter at a pace unseen in more than 40 years. For reference, CPP Investments’ calendar-year return for 2021 was 13.8%.

“We move forward from a position of strength, focusing on our sound diversification strategy and a disciplined outlook beyond current events. Our confidence is grounded in the robust CPP Investments platform, designed for resiliency, with mature programs at scale, market breadth and local presence, amply supported by an admired global brand. Our purpose-driven people are dedicated – with a demonstrable track record of investment performance and operational excellence – to helping current and future beneficiaries achieve retirement security,” added Graham.

The appreciation of the Canadian dollar against the U.S. dollar and other major currencies during the year, influenced by rising commodity prices and the impact of evolving monetary and fiscal policies across global economies, negatively impacted investment returns with a foreign currency loss of $4 billion.

“Looking ahead, we confront uncertain business and investment conditions with higher inflation expectations, potentially worsening supply chain interruptions, tepid global economic growth estimates and international reactions to the war in Europe, all against the backdrop of a persistent global pandemic and climate change,” concluded Graham.

Performance of the Base and Additional CPP Accounts

The base CPP account ended the fiscal year on March 31, 2022, with net assets of $527 billion, compared to $491 billion at the end of fiscal 2021. The $36 billion increase in net assets consisted of $34 billion in net income and $2 billion in net transfers from the CPP. The base CPP account achieved a 6.9% net return for the fiscal year and a five-year annualized net return of 10.0%.

The additional CPP account ended the fiscal year on March 31, 2022, with net assets of $12 billion, compared to $6 billion at the end of fiscal 2021. The more than $6 billion increase in net assets consisted of $147 million in net income and $6 billion in net transfers from CPP. The additional CPP account achieved a 2.8% net return for the fiscal year, and an annualized net return of 7.2% since its inception in 2019.

The additional CPP was designed with a different legislative funding profile and contribution rate compared to the base CPP. Given the differences in their design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. The performance of the additional CPP differs from that of the base CPP. Furthermore, due to the differences in their net contribution profiles, the assets in the additional CPP account are also expected to grow at a much faster rate than those in the base CPP account.

Fund Five- and 10-Year Returns1

(for the year ended March 31, 2022)

Long-Term Sustainability

Every three years, the Office of the Chief Actuary of Canada (OCA) conducts an independent review on the sustainability of the CPP over the next 75 years. In the most recent triennial review published in December 2019, the Chief Actuary reaffirmed that, as at December 31, 2018, both the base and additional CPP continue to be sustainable over the 75-year projection period at the legislated contribution rates.

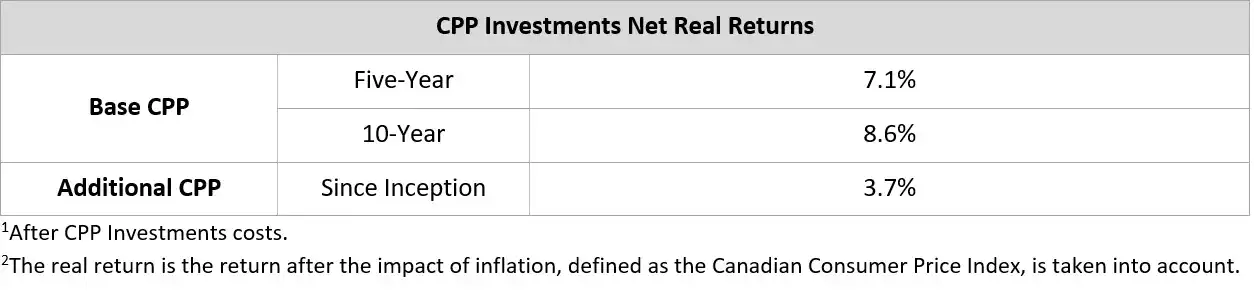

The Chief Actuary’s projections assume that, over the 75 years following 2018, the base CPP account will earn an average annual rate of return of 3.95% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.38%.

Fund Five- and 10-Year Real Returns1, 2

(for the year ended March 31, 2022)

Our Key Sources of Returns

Contributions made to the CPP not needed to pay current benefits are transferred to CPP Investments. To help the CPP remain sustainable, we seek to grow assets by achieving returns commensurate with prudent levels of risk. Risk appetite is one of the most important decisions made by CPP Investments. Just as excessive risk could adversely affect the safety and soundness of the CPP, so could being too cautious. We represent the minimum required level of market risk as a simple two-asset portfolio of global public equities and Canadian government bonds for both the base CPP and additional CPP. This serves as our starting point against which we evaluate the incremental impact of our biggest investment decisions. Importantly, CPP Investments goes beyond this minimum, pursuant to its legislative objectives, by seeking to achieve a maximum rate of return while taking a prudent level of risk. The decisions we have made in accordance with our legislated mandate are to:

- Target a higher level of market risk than the minimum required as represented by our Reference Portfolios;

- Use leverage to construct a more diversified portfolio at our targeted level of market risk; and

- Pursue investment selection and seek returns above and beyond what can be obtained from investing in a public market index.

These represent our key sources of returns because, depending on the level of market risk we choose to target or how we choose to diversify the Fund, the outcomes of these decisions have the most material impact on the overall performance of the Fund. We evaluate the successive impact of these decisions primarily over a five-year period, in line with the long-term nature of our mandate to maximize returns without undue risk of loss.

Over the last five years, the simple two-asset portfolio representing the minimum level of market risk assumed to maintain plan sustainability generated an annualized net nominal return of 6.1%, resulting from the strong performance of global public equities. Targeting a higher level of market risk, pursuant to our legislative objectives, helped add an incremental annualized return of 3.1%, driven by the higher level of global public equity content in our Reference Portfolios for both the base and additional CPP.

Our decision to use leverage to further diversify the Fund incrementally detracted an estimated annualized return of 1.9% from the Fund over the last five years. The Fund’s more diversified portfolio did not keep pace with the returns of the Reference Portfolios, which are more heavily weighted in global public equities. While our decision to diversify into a broader range of asset classes may have detracted value relative to the Reference Portfolios over the past five years, we continue to believe diversification will add value over a longer-term period and provide resiliency during market downturns.

Our decision to pursue investment selection added an annualized 2.7% of additional value over the past five years. The value gained or lost through investment selection is measured against comparable risk-adjusted passive public market benchmarks to enable an objective evaluation of the contributions of each active strategy to Fund performance.

Overall, the Fund’s performance relative to the Reference Portfolios can be measured in both percentage terms or dollar terms, which we refer to as percentage value-added and dollar value-added, respectively. On a relative basis, the Fund delivered a percentage value-added of 2.1% or a dollar value-added of $10 billion this fiscal year. Over the past five years, the Fund generated an overall net value-added of 0.8% or $10 billion.

While not all key sources of return may yield positive results in every period, we believe our comparative advantages support our ability to generate value with a long-term focus. Our investment performance to date supports our belief that pursuing additional sources of returns can increase returns over the long term. Seeking to maximize returns without undue risk of loss from all sources collectively allows us to do our part in contributing to the long-term sustainability of the CPP.

For further information on our Key Sources of Returns, please refer to page 20 of the CPP Investments Fiscal 2022 Annual Report.

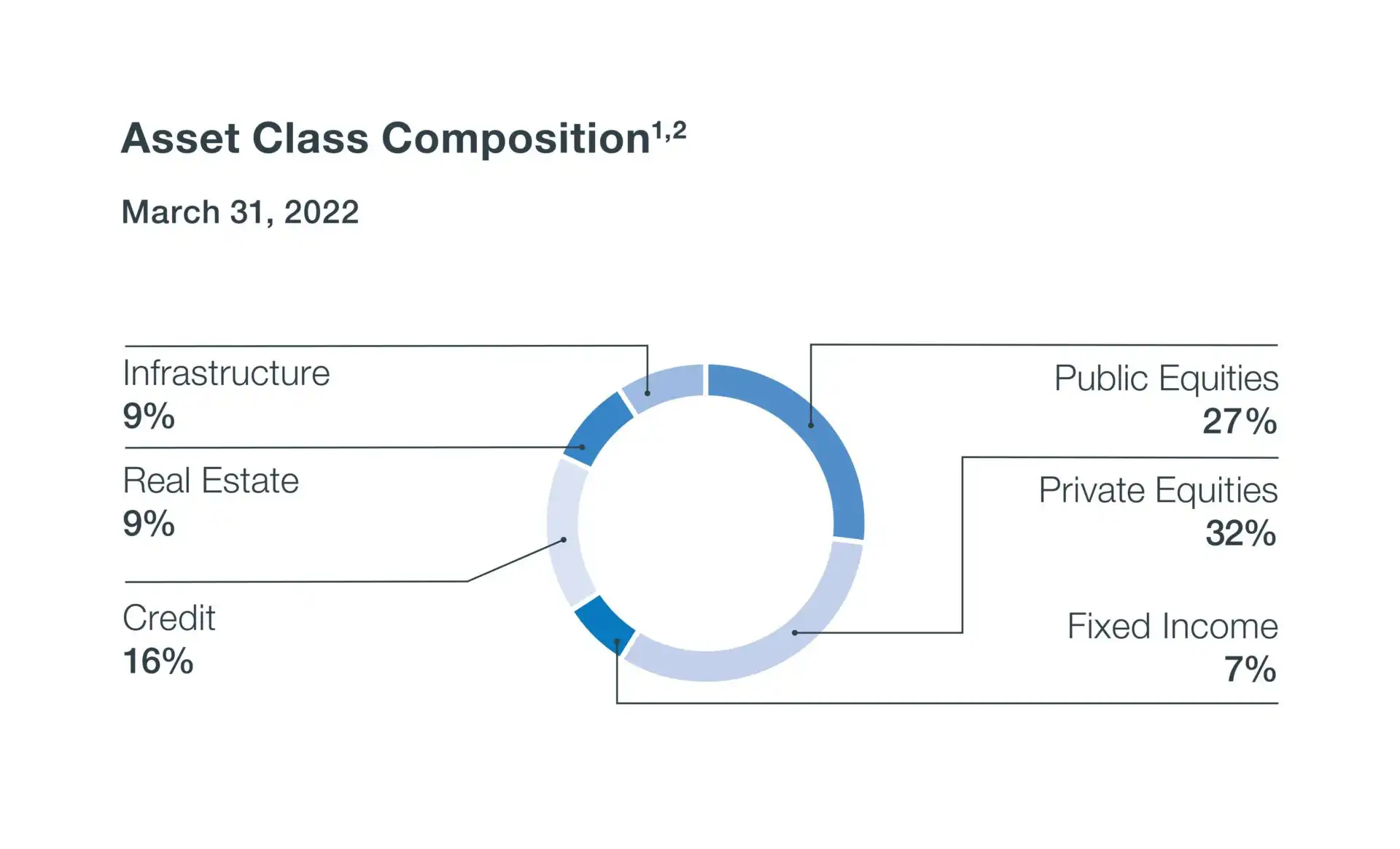

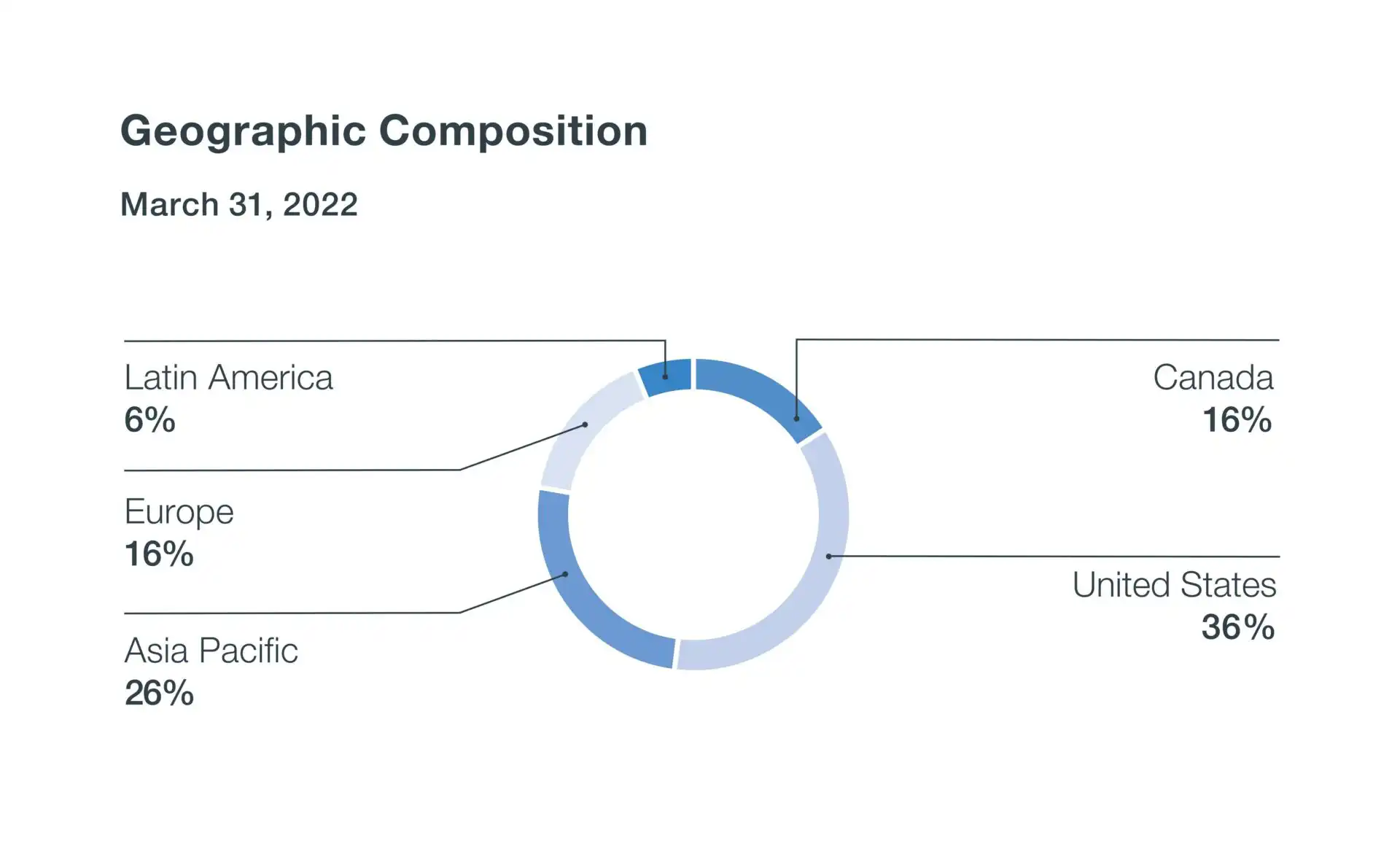

Asset and Geography Mix

CPP Investments, inclusive of both the base CPP and additional CPP Investment Portfolios, is diversified across asset classes and geographies:

1Fixed income consists of cash and cash equivalents, money market securities and government bonds, net of debt financing liabilities. Public Equities include absolute return strategies and related investment liabilities.

1Fixed income consists of cash and cash equivalents, money market securities and government bonds, net of debt financing liabilities. Public Equities include absolute return strategies and related investment liabilities.

2As at March 31, 2022, $49 billion of real estate, $48 billion of infrastructure and $26 billion of our private equity investments associated with sustainable energies, which collectively represented 23% of net assets, are managed by the Real Assets investment department.

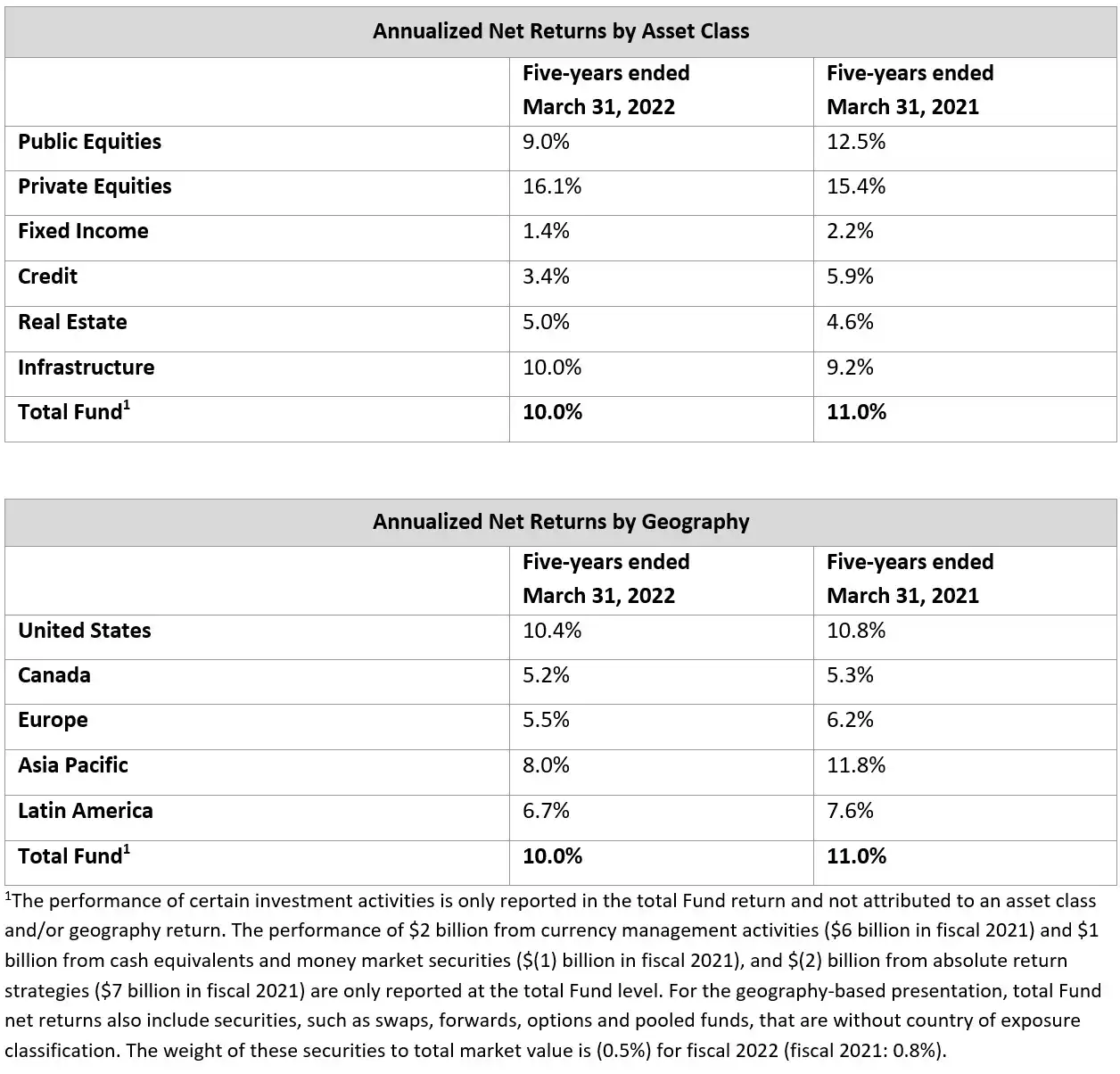

Performance by Asset Class and Geography

Five-year Fund returns by asset class and geography are reported in the tables below. A more detailed breakdown of performance by investment department is included on page 54 of the Fiscal 2022 Annual Report.

Managing CPP Investments Costs

We treat cost management as a tenet of our public accountability as we seek to build an internationally competitive investment platform to maximize long-term returns. While total costs are down compared to the previous year, operating expenses increased by $106 million due to an increase in full-time globally positioned talent, higher incentive compensation, in line with better year-over-year long-term Fund performance, and continued investments in building our technology and data infrastructure. Our operating expense ratio of 27.1 basis points (bps) declined from 29.3 bps the previous year and is also below our five-year average of 29.1 bps. Management fees decreased by $125 million, due to the recognition of management fees last fiscal year which were subject to deferred payment arrangements. Performance fees increased by $98 million driven by strong realizations in our private equity portfolio. Transaction-related expenses, which increased by $172 million, vary from year to year according to the number, size and complexity of our investing activities. Other categories affecting our total cost profile include taxes and expenses associated with various forms of leverage. Page 33 of the Fiscal 2022 Annual Report provides a discussion of how we manage our costs. For a complete overview of the CPP Investments combined cost profile, including year-over-year comparisons, refer to page 52.

Operational Highlights for the Year

Executive announcements

- Announced the following Senior Management Team appointments:

- Maximilian Biagosch as Senior Managing Director, Head of Europe & Direct Private Equity;

- Suyi Kim as Senior Managing Director & Global Head of Private Equity;

- Deborah Orida as our first Chief Sustainability Officer. Ms. Orida also continues to serve as our Senior Managing Director & Head of Real Assets;

- Agus Tandiono as Senior Managing Director, Head of Asia Pacific & Active Equities Asia; and

- Subsequent to the fiscal year end, Priti Singh was appointed Senior Managing Director & Global Head of Capital Markets and Factor Investing, effective May 2, 2022.

Board appointments

- We welcomed the appointment of Barry Perry to the Board of Directors. Appointed in August 2021, Mr. Perry was formerly President and CEO at Fortis Inc., and is a widely respected executive with deep experience in the utilities sector.

- We welcomed the appointment of Dean Connor to the Board of Directors. Appointed in August 2021, Mr. Connor served for a decade as President and CEO of Sun Life Financial and has been recognized in Canada and internationally as an outstanding business leader.

Strategic developments

- Announced that our portfolio and operations commit to be net zero of greenhouse gas emissions across all scopes by 2050. Our commitment includes: continuing to invest and exert our influence in the whole economy transition as active investors, rather than through blanket divestment; achieving carbon neutrality for our internal operations by the end of fiscal 2023; expanding our investments in green and transition assets from $67 billion to at least $130 billion by 2030; and building on our new decarbonization investment approach.

- Updated our Proxy Voting Principles and Guidelines to elevate expectations for board diversity and annual director elections among portfolio companies. The changes extend the 30% threshold for board gender diversity to new countries and signal future ambitions for emerging markets. We will also consider voting against all directors up for election where the board is classified and there are oversight failures related to climate change, board gender diversity or deficient corporate governance.

- Created Sustainable Energies, which combines the organization’s expertise in renewables, conventional energy and new technology and service solutions into a single investment group, positioning us as a leading global energy investor.

- In fiscal 2022, CPP Investments continued its leadership role in the global transition to the new reference rates through its U.S. Dollar (USD) issuance platform, with a 3-year USD secured overnight financing rate (SOFR) benchmark totalling US$1.4 billion – the largest 3-year SOFR benchmark by any sovereign, supranational or agency issuer to date. Debt issuance gives CPP Investments flexibility to fund investments that may not match our contribution cycle. Net proceeds from the issuances will be used by CPP Investments for general corporate purposes.

- With our continued commitment to sustainable investing, CPP Investments grew its green bond presence in the Australian-dollar market with a benchmark 7-year green bond valued at A$750 million. The total issuance of green bonds since inception of the program is now C$6.2 billion. Green bonds enable CPP Investments to invest further in eligible assets such as renewables, water and green real estate projects, and to diversify the investor base.

Investment Highlights for the Year

Active Equities

- Invested an additional US$50 million in the US$1.6 billion Series H funding of Databricks, a data, analytics and AI company based in San Francisco, bringing our stake to 0.3%. We previously invested US$65 million in the company’s US$1 billion Series G funding in February 2021.

- Invested US$350 million in Advanced Drainage Systems, a leading provider of water management solutions for use in the construction and agriculture marketplace, increasing our ownership stake in the company to 4.6%.

- Invested C$200 million as an anchor investor in the IPO of Volvo Cars, a front-runner in the global shift to electric vehicles, representing a 0.9% ownership stake.

- Invested US$25 million for a 0.75% ownership stake in ITM Power, a U.K.-based manufacturer of electrolyzer systems based on proton exchange membrane technology that generates green hydrogen for energy storage, transport, renewable heat and industrial sectors.

- Invested an additional €362 million in a rights offering by Cellnex Telecom S.A., a leading mobile-tower owner and operator based in Spain, holding total ownership in the company of approximately 5.2%.

- Invested US$800 million in The Flipkart Group, one of India’s leading digital commerce entities, which includes group companies Flipkart, Myntra, Flipkart Wholesale, Flipkart Health+ and Cleartrip. The group is also a majority shareholder in PhonePe, a leading digital payments and financial services app in India.

- Invested US$150 million in the National Stock Exchange of India, the leading equity and derivatives exchange in India.

Credit Investments

- Committed US$150 million to Cypress Creek Renewables’ US$450 million debt facility to refinance existing debt and fund the growth of the company’s robust solar and storage project pipeline. Cypress Creek Renewables is one of the largest independent vertically integrated solar and storage developers in the U.S.

- Committed US$220 million in a senior secured financing facility for the development of utility-scale solar projects in the U.S. through a partnership with HPS Investment Partners, a leading global investment firm.

- Closed on a US$421 million whole loan to Spear Street Capital, a U.S.-based owner and operator of office properties in Canada, the U.S. and Europe, for the redevelopment of an existing office complex into a life science development in Watertown, Massachusetts.

- Committed to provide up to US$500 million in financing to Prodigy Finance, a provider of postgraduate student loans for international students attending top schools.

- Invested US$325 million in the unitranche loan for Straive, a business process outsourcing company focused on the education, data and publishing verticals, with operations primarily in India and the Philippines.

- Committed C$112 million to an investment in the first lien term loan of BAPE Hong Kong Limited, a Hong Kong-based streetwear apparel company that designs, sources and retails the BAPE and AAPE brands.

Private Equity

- Supported the combination of Inmarsat, a leading provider of mobile satellite services, with global communications company Viasat, as part of a four-party consortium in a transaction valued at approximately US$4 billion. The consortium will hold a 37.5% ownership in the combined entity, and we will hold 9.4%. Our initial stake in Inmarsat was acquired in 2019.

- Committed to an investment in FNZ, the global wealth management platform, alongside Motive Partners, in one of the largest-ever primary equity raises in the wealth management sector. The fundraising values FNZ at over US$20 billion and CPP Investments committed a total of US$1.1 billion. Subsequent to our fiscal year end, US$200 million was syndicated to other investors.

- Entered into a definitive agreement to acquire all outstanding common shares of McAfee, a global leader in online protection for consumers, alongside an investor group comprising Advent, Permira, Crosspoint Capital, GIC and ADIA, in an all-cash transaction valued at approximately US$14 billion on an enterprise value basis.

- Invested US$23 million alongside Genesis Capital for an approximate 3.5% stake in Bluepha, a leading synthetic biology company in China engaged in the development and production of PHA, a type of biodegradable plastic.

- Committed C$303 million to BGH Capital Fund II. BGH Capital is an Australia- and New Zealand-focused private equity manager active in the mid-to-large cap buyout space.

- Committed US$325 million to Anchor Equity Partners Fund IV, a Korean mid-market private equity firm focused on control-oriented consolidation investments and significant minority growth-stage opportunities.

- Invested US$120 million into Eruditus, an Indian Education Technology company that partners with top-tier universities worldwide to deliver online courses and other programs to a global learner base, resulting in a 3.8% stake in the company.

- Committed US$600 million to the Baring Asia Private Equity Fund VIII, L.P. Baring Private Equity Asia is a pan-Asian private equity investment firm focusing on control buyouts and minority growth investments.

Real Assets

- Formed a US$979 million joint venture with Lennar Multifamily Communities, a leader in apartment development and management, to develop Class-A multifamily residential communities across high-growth metropolitan areas in the U.S. We hold a 96% stake in the joint venture.

- Invested more than US$3 billion to acquire a 100% ownership interest in Ports America, North America’s largest independent marine terminal operator with diversified operations, including 70 locations in 33 ports on each of the United States’ three coasts.

- Invested US$10 million in Project Canary’s Series B institutional fundraising. Project Canary is a Denver-based emissions tracking business that provides real-time methane emissions monitoring and independent ESG certification for oil and gas well sites.

- Formed a US$1.1 billion joint venture with Bridge Industrial, a vertically integrated real estate operating company and investment manager, to develop industrial properties in several core markets across the United States. We own a 95% stake in the joint venture.

- Committed US$20 million to a partnership with Conservation International, an organization that works to protect the critical benefits that nature provides to people, to invest in nature-based climate solutions.

- Announced a C$340 million investment in partnership with Votorantim S.A. to support the asset consolidation and public listing of several Brazilian energy assets through two independent transactions to create Auren, one of Brazil’s largest energy producers and traders. We own an approximate 32% equity interest in Auren.

- Committed to an investment of C$380 million in Brazilian water and wastewater company Iguá Saneamento S.A., in which we hold a 46.7% aggregate equity stake, to support the privatization of water and sewage services from CEDAE, Rio de Janeiro’s state water and sanitation utility.

- Announced a strategic partnership with U.K.-based Octopus Energy Group (Octopus), a global clean energy technology pioneer, including a US$300 million investment for a 6% stake to support Octopus’ global expansion and to support its Kraken technology platform to deploy smart energy across the full energy supply chain, increasing Octopus Energy Group’s valuation to approximately US$5 billion.

- Formed two joint ventures with Greystar Real Estate Partners, a global leader in the investment, development and management of high-quality real estate. Allocated an initial US$1.2 billion in equity to form a joint venture to pursue life science development opportunities in target markets in the United States, starting with the acquisition of 74M, a project located in Somerville, Massachusetts, where we will own a 90% stake. Also formed a joint venture to develop and acquire purpose-built single-family rental communities in the United States, allocating approximately US$840 million in equity, where we own a 95% stake.

- Invested in three GLP vehicles. GLP is a global investment manager and business builder in logistics, real estate, infrastructure, finance and related technologies. We committed US$210 million for a 39.6% interest in the GLP Brazil Development Partners II fund to develop nine logistics parks in São Paulo submarkets experiencing high demand for modern logistics facilities. We committed €900 million of equity to GLP Continental Europe Development Partners I (GLP CDP I), representing a 45% share to develop modern logistics assets, expanding GLP CPD I into a truly pan-European vehicle. We committed C$1.3 billion to the newly established GLP Japan Development Partners IV, our fourth modern logistics partnership in Japan with GLP.

- Established two new joint ventures, with a 50% ownership stake in each, alongside Lendlease, an international real estate group. Formed a joint venture dedicated to the development of a new office-led neighbourhood at International Quarter London, initially committing to developing the Turing Building with an allocation of £215 million. We also formed a joint venture in a dedicated Italian real estate alternative investment fund pursuing the development of Phase 1 of the Milano Innovation District, investing approximately €200 million of equity.

- Established a new joint venture with Round Hill Capital, a global real estate investor, developer and manager, to invest in the purpose-built student accommodation sector across continental Europe. Our initial equity allocation will be €475 million for a 95% interest.

- Committed C$2.1 billion to BAI Communications (BAI), a global communications infrastructure provider, to support BAI’s global growth strategy, including the acquisition of Mobilitie, one of the largest privately held wireless telecommunications infrastructure companies in the U.S. We have been a majority shareholder in BAI since 2009 with an approximate 86% ownership stake.

- Entered into a joint venture with CSI Properties, a Hong Kong listed property developer, to redevelop a mixed-use real estate project comprising residential and commercial spaces in Kowloon, Hong Kong with an equity commitment of C$169 million for a 48% stake.

- Allocated approximately C$400 million in equity to our new Japanese Data Centre Development venture with Mitsui & Co. Ltd., one of Japan’s largest general trading and investment companies, for hyper-scale data centre developments in Japan.

- Entered into two joint ventures with RMZ Corp, one of India’s largest privately-owned real estate owners, investors and developers. Formed a joint venture to develop and hold commercial office space in Chennai and Hyderabad, India, with a US$210 million equity allocation for a 50% ownership interest. Committed C$449 million for an up to 80% stake in a second joint venture to support the development and acquisition of commercial projects across India, starting with StarTech, a 1.37 million-square-foot Grade A office building located in Koramangala, Bangalore.

Disposition highlights for the year

- Sold our 31.6% stake in Puget Holdings for net proceeds of approximately US$2.7 billion. The company’s operating subsidiary, Puget Sound Energy, is the oldest and largest electric and natural gas utility in Washington State, serving approximately 1.2 million electric customers and 900,000 natural gas customers. Our ownership interest was initially acquired in 2007.

- Closed the sale of Royal Bank Plaza in Toronto, Ontario alongside our joint venture partner Oxford Properties, with net proceeds of approximately C$300 million to CPP Investments. The joint venture initially acquired the property in 2005.

- Sold our 85% stake in Buildings 1, 2 and 3 of the Henday Industrial Park in Edmonton, Alberta. Net proceeds from the sale were C$80 million. Our ownership interest in the site was initially acquired in 2014 and we continue to hold a stake in the remaining development site.

- Agreed to sell our 15-18% stake in six Raffles City real estate projects in China. Net proceeds from the sale will be approximately C$800 million before closing adjustments. Our initial investment in the first Raffles City China development, majority owned and managed by CapitaLand, was made in 2008.

- Sold our 40% interest in Avalon North Point and Avalon North Point Lofts, two multifamily real estate assets in Cambridge, Massachusetts. Net proceeds from the sale were US$128 million. We acquired Avalon North Point in 2011 and Avalon North Point Lofts in 2012.

- Sold our 2.9% stake in SBI Life Insurance Company in India. Net proceeds from the sale were approximately C$562 million. We initially invested in the company in 2017.

- Sold our stake in Velvet Energy, a privately held light-oil Montney producer with operations in north-west Alberta. Net proceeds from the sale were C$183 million. We initially invested in Velvet Energy in 2017.

- Exited our 37% interest in AMP Capital Retail Trust (ACRT) alongside other ACRT unitholders at a transaction value of C$2 billion. AMP Capital (rebranded to Collimate Capital) is an Australia-based global investment manager and we initially invested in ACRT in 2012.

Transaction highlights following the quarter

- Committed to an investment of US$25 million in Hydrostor, a long-duration energy storage solution provider, to support the Toronto-based company’s development and operation of storage facilities globally.

- Announced a new joint venture with TATA Realty and Infrastructure Limited to develop and own commercial office space across India. The total aggregate equity value of the joint venture will be C$866 million, with CPP Investments’ equity commitment at C$438 million.

- Closed a US$375 million capital investment in The Amherst Group, a vertically integrated real estate platform in the single-family residential industry, to support a share buyback and loan repayment.

- Invested US$425 million for a 13.8% stake in VerSe Innovation Private Limited, one of the fastest growing local language artificial intelligence-driven content platforms in India.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the 21 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At March 31, 2022, the Fund totalled $539 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

Disclaimer

Certain statements included in this press release constitute “forward-looking information” within the meaning of Canadian securities laws and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and other applicable United States safe harbors. All such forward-looking statements are made and disclosed in reliance upon the safe harbor provisions of applicable United States securities laws. Forward-looking information and statements include all information and statements regarding CPP Investments’ intentions, plans, expectations, beliefs, objectives, future performance, and strategy, as well as any other information or statements that relate to future events or circumstances and which do not directly and exclusively relate to historical facts. Forward-looking information and statements often but not always use words such as “trend,” “potential,” “opportunity,” “believe,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions. The forward-looking information and statements are not historical facts but reflect CPP Investments’ current expectations regarding future results or events. The forward-looking information and statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, including available investment income, intended acquisitions, regulatory and other approvals and general investment conditions. Although CPP Investments believes that the assumptions inherent in the forward-looking information and statements are reasonable, such statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. CPP Investments does not undertake to publicly update such statements to reflect new information, future events, and changes in circumstances or for any other reason. The information contained on CPP Investments’ website, LinkedIn, Facebook and Twitter are not a part of this press release. CPP INVESTMENTS, INVESTISSEMENTS RPC, Canada Pension Plan Investment Board, L’OFFICE D’INVESTISSEMENT DU RPC, CPPIB and other names, phrases, logos, icons, graphics, images, designs or other content used throughout the press release may be trade names, registered trademarks, unregistered trademarks, or other intellectual property of Canada Pension Plan Investment Board, and are used by Canada Pension Plan Investment Board and/or its affiliates under license. All rights reserved.

All figures in Canadian dollars unless otherwise noted.

Article Contacts

Frank Switzer

Managing Director, Investor Relations

fswitzer@cppib.com

Tel: +1 416 523 8039